That Smells Expensive

A Spotlight On...'Everyday Auras' and the Economics of India's Fragrance Boom

Hey folks👋

A warm welcome to the 324 new Tigerfeathers subscribers who’ve joined since our last piece, about the story of India’s trailblazing inflatable-theatre company - PictureTime.

If you’re looking to…inflate your understanding of the Indian tech ecosystem (or whatever), start here👇

This edition of Tigerfeathers is presented by…Zoho One

If you’ve been reading this newsletter for the past five years, you will be familiar with India’s grand experiments with public digital infrastructure, and how the likes of Aadhaar, UPI and Account Aggregators have supercharged economic activity on the Subcontinent.

But while the public rails have been paved and polished, the private ones have lagged behind. Most businesses still have to wrestle with a jungle-gym of fragmented tools, siloed data, disparate teams, and clunky handoffs.

That’s where Zoho One comes in.

Built as an end-to-end operating system for modern businesses, Zoho One brings together 50+ integrated apps - from CRM and payroll to analytics and support - into a single, unified suite. It’s the quietly-humming infrastructure powering 60,000+ businesses in India and beyond.

Whether you’re a five-person team scaling up or a 500-person company with a sprawling global business, Zoho One offers the kind of coherence most businesses don’t realise they need — until things break. If you’re looking to level up your software stack, learn more about ‘The Zoho One Ethos’ here:

And if you're interested in partnering with us on a future edition of Tigerfeathers, hit us up on Twitter/LinkedIn or by replying to this email. With that, let’s get to it.

Friends, you might recall that in early July we officially got the ball rolling on The Tigefeathers Spotlight Series. For the uninitiated, this is our programme to feature the sharpest guest writing from and on India.

Aside from being able to learn from people within the Tigerfeathers community, our intent when we announced this series last year was to curate stories that “illuminate some aspect of Indian tech, business, history or culture”. Basically we want to read things that we could never write.

Our first contributors are in various stages of drafting their Spotlight pieces (with topics that couldn’t be more different from each other). Case in point, for our inaugural edition, we were graced with the wit and wisdom of Raas Partners’ founder Paavan Gami. Paavan used his time at the podium to unpack the upcoming public listing of Urban Company, one of Indian tech’s true pioneers.

For Edition #2, we are switching settings (and scents) to learn about the Internet-propelled renaissance of one of India’s most cherished cosmetic traditions. But first…

Into The Spotlight

This week we’re going to hear from Harnidh Kaur.

Harnidh is the head of WTFund, India’s first non-dilutive grant programme and early-stage fund backing under‑25 founders in their quest to build category‑defining startups. WTFund is part of the extended WTF universe seeded by Zerodha co-founder Nikhil Kamath, which planted itself at the centre of Indian pop-tech discourse with the launch of the WTF Podcast in 2023.

Before stepping into venture, she spent her time knee-deep in brand playbooks and Go-To-Market strategies at Swiggy and Virtualness, and has since become a distinctive voice in the cacophony of Indian tech: part operator, part cultural commentator and part (as she describes herself) “chaos muppet”.

From her vantage point at WTFund, Harnidh thinks India’s startup future will be built by ambitious, audacious, culturally-fluent Gen Z founders. WTF is building a home for these next-gen disruptors, backing them with capital and community while sharpening their storytelling chops. Their first two cohorts have unearthed an ecletic mix of companies tackling everything from DNA data storage, virtual workstations, AI plush toys, hydrogen storage, industrial robotics, and, of course, Hot Girl Matcha.

Dovetailing with her role as an investor, Harnidh also writes an eponymous newsletter read by thousands of founders, operators, and curious onlookers, on everything from tech trends to job postings to career advice. Her debut book, The Girls Club, launches globally in 2026 as “part career manifesto and part survival guide for ambitious women navigating power and identity at work”.

So what’s on the menu this week?

For her Tigerfeathers debut, she’s turned her attention to the frenzy of activity taking place in a previously sleepy corner of our consumer landscape, namely the Indian perfume and fragrance market.

If, like us, your first reaction is to wonder what the big deal about perfumes is, Harnidh makes the case that studying the activity in India’s fragrance economy is the most insightful way of understanding the behaviours, rituals and tastes of The New Indian Consumer™️ - i.e. the new Indian rules of aspiration and identity.

Moreover, as we learned, there’s an apparent cultural arbitrage underway in India’s burgeoning fragrance market. A fresh class of brand-builders is leveraging the country’s centuries-old perfumery heritage, sophisticated supply chains, new-age platforms and shifting consumer psychology to create novel product categories that were non-existent even just a half-decade ago.

Her piece takes us down Kannauj's forgotten distilleries to Instagram's fragrance discovery subculture, unpacking what it takes to build a consumer brand that ‘smells expensive, feels inevitable, and actually scales’. This is part cultural teardown, part investor brief, part homage to an emerging wave that's beginning to turn the heads of local investors and entrepreneurs alike.

If consumer brands are your thing; if you’re looking for a business case to launch your own perfume company; if you’re interested in solving the riddle of Gen Z’s buying preferences; if phrases like ‘scent hauls’, ‘moodboard mindsets’ and ‘everyday auras’ get your juices flowing, there’s a good chance you’ll enjoy today’s piece.

With that said, lets get on with it.

I. That Smells Expensive

I didn’t realise India’s scent game had changed until I caught a whiff of Samantha Ruth Prabhu.

Not her, personally, but the perfume she’d just launched. It was called Rose Oud. It showed up on Instagram. It was priced at ₹999. And it smelled like rose and mystery and self-reflection and the kind of heartbreak you don’t want to talk about (yet).

And then, like every VC who thinks she’s just buying a product but ends up chasing a thesis, I fell headfirst into a very fragrant rabbit hole.

That bottle opened up a door to something bigger. India, a country historically drenched in attar and deoderant (i.e. deo), was quietly undergoing a scent revolution. But this wasn’t just about how we smell, it was about how we signal. Something had changed.

Perfume has always been a strange category in India. Not because we don’t care about scent, we really do. Mogra, sandalwood, mitti attar after the first rain, our cultural imagination is soaked in smell. But for decades, fragrance sat on the fringes of Indian consumer behaviour. It was either too functional (deo = not stinking) or too ornamental (French imports = weddings, gifts, prestige). There was no real middle. No intimacy. No fun.

Over the past 18 months, I’d started seeing perfume everywhere - not on hoardings or airport duty-free, but in carts and DMs and birthday wishlists. Blinkit added a perfume tab. Influencers began posting ‘scent hauls’. Instagram was littered with discovery kits. Founders were launching fragrances with more fanfare than fintech. And most of them, crucially, were priced between ₹900 and ₹3,000.

‘Massmium’.

That’s what I call this zone. The mass-premium overlap. Too expensive to be casual, too affordable to be luxury. It’s the regret price point: high enough to sting if you hate it, low enough to justify as self-care. And yet, this is where India's fragrance game is exploding, leading the charge as India’s ₹2500 cr organised perfume sector looks set to grow at a CAGR of 12-13% cent over the next five years

A few years ago, India’s fragrance market looked like this:

Fogg and Engage at the bottom

Calvin Klein and Davidoff Blue in the middle (usually airport bought, often gifted)

And a smattering of uber-luxe international niche brands (like Tom Ford and Dior) at the top, available mostly via grey markets

Today, among others, we’ve got newer entrants like:

Dear Diary, priced like a dinner date

Secret Alchemist, co-founded by Samantha Ruth Prabhu

SOL by Zaeden, built entirely on the back of music fandom

Fraganote, Eze, House of EM5, La French, and more

And they’re all targeting a new class of Indian consumers, ones who want to smell good, feel something, and spend responsibly doing it. Ones who don’t want to wear Dior to work but are done with mall musk. Ones who are treating perfume like therapy, like intimacy, like individuality.

Massmium perfume isn’t an FMCG product. It’s a personality layer, much like sneakers, t-shirts, handbags, or sunglasses.

I spoke to some of our interns buying ₹999 perfume on Blinkit as a ‘promotion gift to self.’ College students are splitting discovery kits. Moms are experimenting with neroli and amber instead of the usual florals. It’s scent-as-transformation. As a (soft) power move.

Increasingly, these buyers aren’t interested in spraying scents but curating personas. They’re seeking a sense of belonging to something larger than themselves. In discerning-yet-nouveau categories like this, the product becomes both a mirror and a membership card: it reflects who you believe you are, and connects you to an aesthetic, a tribe, a moodboard you want to inhabit.

For the consumer, it’s not just “this smells good on me.” It’s “this is part of my story now.” And that emotional anchoring makes these categories disproportionately sticky.

From an investor lens, that makes it compelling. You have a product category with:

Low unit weight, high margin potential

Embedded gifting behaviour

Room for subscription or ritualisation

Emotional virality (“this is me”, "you HAVE to smell this")

Plus, and this part really matters, you can build brands here. Real ones. Because this category rewards story, identity, positioning. You don’t have to invent a new molecule. You just have to invent a reason people want to wear yours.

As someone who invests in early-stage consumer brands, this felt like a puzzle worth unpacking. Because this wasn’t just a vibe shift; it was a supply chain shift. A storytelling shift. A gender shift. A distribution shift. A psychological shift.

And underneath that surface, a whole lot of opportunity.

This essay is a deep dive into India’s emerging massmium perfume economy. You’ll find:

How consumer behaviour is evolving

Who’s building and why now

What differentiates winners from losers

What makes scent such a potent canvas for new-age identity

We’ll go from Kannauj to Korean actives, from Instagram strategy to genderless scent theory, from ₹99 samplers to ₹999 regrets. I’ll tell you what’s exciting, what’s overhyped, and where I think India’s next big consumer brand could emerge.

II. What Changed: The Market Forces Behind the Boom

The Big Cultural Reframe: From ‘Occasion’ to ‘Everyday Aura’

For a long time, Indian fragrance was a box to check. Weddings? Wear something French. Gifting? Maybe Davidoff Cool Water. Hot date? A splash of CK One if you’re fancy, Axe if you’re 18.

Perfume was ornamental, not emotional. It didn’t belong to your day. It lived on your dresser, next to the things you used once a month. And crucially — those ‘once-a-month’ moments were culturally programmed, often triggered via Santoor bars, talc tins, or mogra garlands. These created an unspoken scent calendar: sandalwood for pooja, rose after bath, fresh jasmine when guests arrived…but not perfume for daily self-expression.

According to a Brickwork Ratings report, India’s per capita fragrance spending clocks in at around $12.30, compared to $45–60 in the U.S. and Europe, evidence that scent in India has historically been treated as a rarity, not a routine. What’s changed: our lifestyles, and along with them the number of ‘scented moments per day’ has exploded. From 3–4 traditional occasions a month to 15–20 micro-moments like morning walks, Zooms, date nights, commute playlists when applying oud or citrus no longer feels curated, it feels necessary.

This is less about buying more perfume, and more about what perfume means. It’s gone from finishing touch to ritual. A mood. A tool.

Much of this is a 2020 phenomenon. During the pandemic years, India saw a rise in self-care behaviour. Not the spa-kind, but the survival-kind. You needed ways to mark time, regulate emotion, draw boundaries in a world that had collapsed into your screen. For a lot of younger consumers, scent became one of those tools. A spray before settling into your Zoom-office. A different scent after your evening walk. Something fresh when you needed to think, something warm when you were having a bad day. Fragrance became invisible punctuation in a formless day - literally, aromatherapy. And it stuck.

By 2023, this behavioural shift had hardened into consumer preference. Indian buyers, especially urban millennials and Gen Z, weren’t thinking of perfume as a luxury anymore. It was part of their get-ready routine. As essential as sunscreen. As expressive as lipstick. As mood-shifting as music.

You see it clearly in social media language. Nobody says "I wear this for parties" anymore. They say: "This is my 9-to-5 scent." "This smells like the end of monsoon." "This one is for when I'm in my villain era."

That shift in vocabulary is telling. It means the role of scent has moved from outward projection to inward curation. It’s not just what you want others to think. It’s how you want to feel.

Which is why newer brands are positioning fragrance less as a seduction tool and more as an emotional cue. The scent isn’t for the world. It’s for your playlist. Your desk. Your date with yourself.

This reframing also opens the door for more gender-expansive scent behaviour. Because once you detach perfume from the male/female binary and attach it to the moodboard, you pry open more room to experiment. A man wearing vetiver because it reminds him of childhood. A woman layering oud with citrus for power meetings. A nonbinary person choosing rose on Tuesday and leather on Friday.

Gen Z, especially, approaches personal care like an Instagram grid. Each product choice is a layer. Hair oil. Sunscreen. Kajal. And now, perfume. Not for longevity. Not for projection. For vibe.

They don’t build routines, they curate aesthetics. Every purchase is a tile on the feed of the self they’re assembling. Products aren’t just functional; they’re signifiers that align you with a tribe, an archetype, a story you want to tell.

And perfume? It’s emotional UX. It’s the filter over the whole grid - the invisible tone that makes the rest of the picture make sense. It’s a shortcut to memory, intimacy, sensuality. It is deeply human, and therefore, deeply buildable.

Infrastructure Catches Up: Platforms, Pipes, and Discovery

A cultural shift alone doesn’t build a category. It creates desire. But that desire needs somewhere to go. What made the Indian fragrance moment inevitable isn’t just consumer appetite, it’s the rise of infrastructure that can finally deliver on it.

Let’s start with the most obvious: platforms.

In 2015, if you wanted to buy a fragrance online in India, you had Nykaa, Shopper’s Stop (if you were fancy), and maybe Lifestyle and a few resellers. Today, you’ve got a few more:

Nykaa (now a category-defining force with 30%+ online beauty market share)

Smytten, where users can trial perfumes for ₹199 and get the money back as credit

Blinkit, which now delivers fragrance discovery kits in 20 minutes

Brand-owned D2C sites with quizzified, mood-based, aesthetic-forward UX

Each of these platforms has fundamentally reshaped the trial-to-loyalty journey. They made perfume discoverable, testable.

Smytten, for instance, pioneered the idea that fragrance could be a low-risk experiment. By offering 2–6ml samplers at trial prices, it shifted perfume from commitment to curiosity. Their internal data suggests fragrance trials see one of the highest conversion rates on the platform, upward of 60% in some cases. That's unheard of in traditional e-commerce.

Blinkit changed something even more visceral: impulse.

When SOL by Zaeden launched on Blinkit, it wasn’t just the celebrity angle that worked. It was the speed. Fragrance, for the first time, entered the Q-commerce loop sitting beside refined oil, energy drinks, and last-minute gifts. This proximity matters. It makes perfume feel normal, not aspirational. You could order one for a night out, and get it faster than your Uber.

That twenty‑minute window changes the entire psychology of fragrance purchasing from one thing into another. Pre‑Blinkit, fragrance was a considered purchase. You’d research, read reviews, maybe visit a store, definitely sleep on it. The friction was built in. Perfume sat next to jewellery and watches in the “think‑about‑it” category. Now it sits next to energy drinks and condoms in the “why‑not” category.

That shift alters buying behaviour. The same neural pathway that makes you order ice cream at 11 PM now works for a ₹1,399 EdP (Eau de Parfum, in case you were wondering). Internal quick‑commerce data suggests fragrance has one of the highest “add‑to‑cart” rates when bundled with other beauty products. A lipstick purchase becomes a perfume purchase in one click. Impulse infrastructure has arrived, and brands that design for legibility and instant recognition will win that moment.

Meanwhile, Nykaa has done the heavy lifting of creating a digital-first prestige context for fragrance. Through content, exclusives, and smart bundling (perfume + lipstick + pouch = ₹999 deal), they’ve positioned perfume as a natural part of beauty.

But beyond platforms, infrastructure also means tools.

Ten years ago, launching a perfume brand required:

In-house scent expertise

Expensive packaging suppliers

Offline distribution

Celebrity endorsement or huge ad spends

Pleading with one of the few reliable bottling companies to take on your project with low Minimum Order Quantities (MOQ); h/t Manan Gandhi for this point, founder of Bombay Perfumery

Today, you can:

Source base fragrances from established suppliers like S.H. Kelkar or IFF India

Customise them via boutique perfumers in Mumbai, Kannauj, or Bengaluru or mid-Sized European fragrances houses (with fine fragrance expertise) who now have better setups in India, for example, CPL Aromas, Eurofragrance, Iberhchem, Parfums Plus

Use low-MOQ packaging vendors

Launch via Instagram drops, with influencer seeding replacing mass media

The cost of experimentation has collapsed. You no longer need ₹2 crores and an agency. You need conviction, a compelling story, and a few thousand loyal followers.

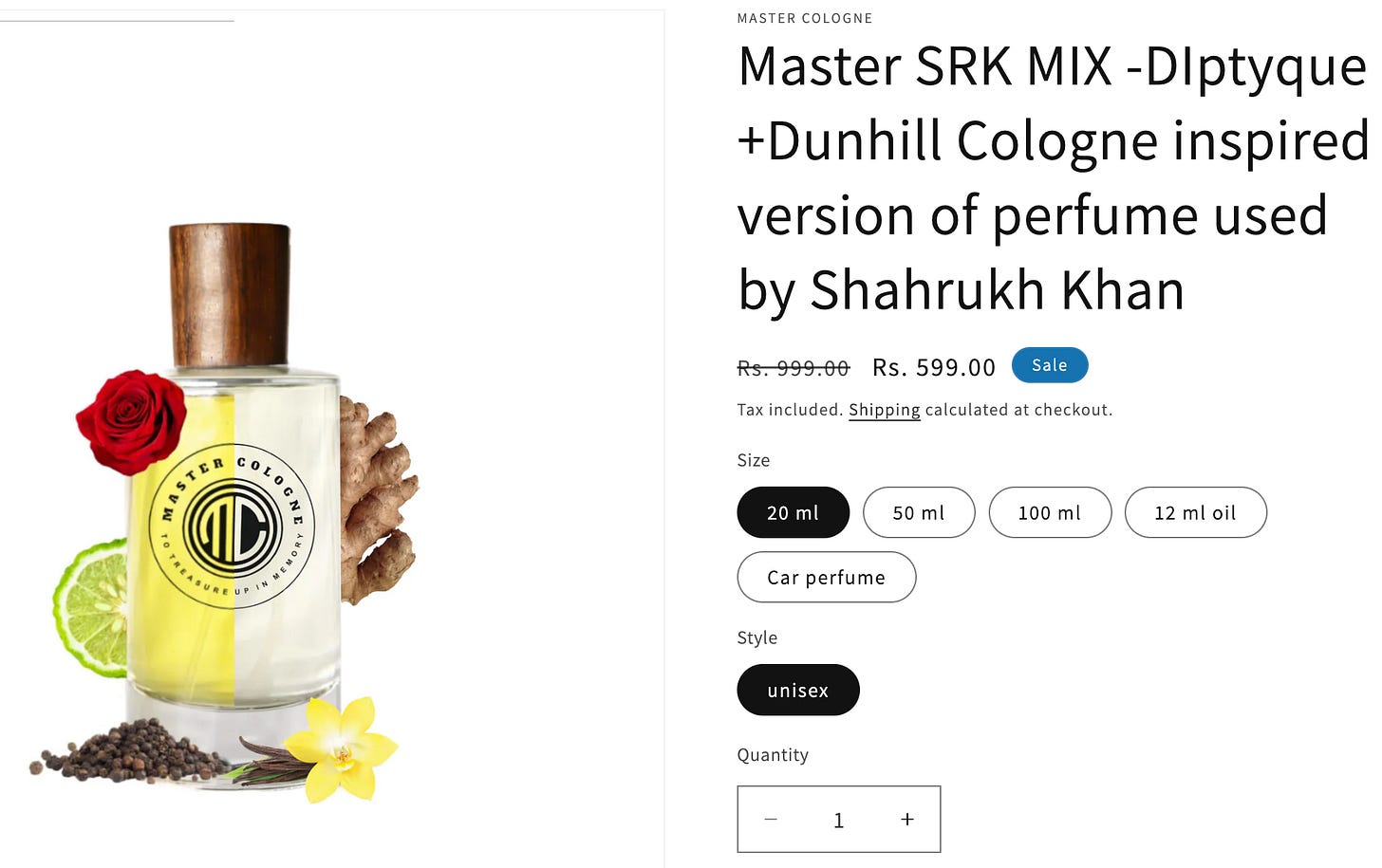

The moodboard mindset isn’t limited to what’s on the shelf, it’s bleeding into how people want to smell. Scroll Instagram and you’ll find perfume mixers selling “SRK’s personal blend” (apparently a three-fragrance cocktail he layers himself), Alia’s “off-duty mix,” or Rihanna’s rumoured signature scent.

These aren’t just sales pitches. They’re identity hacks. Buying a “Shah Rukh mix” is less about the juice and more about proximity, a way to borrow the aura of someone whose brand you want to inhabit. It’s mass intimacy, bottled.

And it’s the next frontier for massmium fragrance: hyper-specific, narrative-led blends that let consumers step into a role, not just a scent.

Discovery, too, has changed shape.

Instagram is now a full-blown fragrance mall. You’ll scroll past:

Flatlays with captions like “my moodboard in scent form”

Reel tutorials on how to layer “cozy + clean” perfumes

UGC of unboxing experiences (with misty sprays in slo-mo)

Reviews that sound like wine tastings: “top notes of white tea, dries down to skin-like warmth”

The language of fragrance has gone from aspirational luxury (Chanel, Tom Ford) to emotional granularity. This isn’t about prestige, it’s now about precision. Perfume now occupies the same space as music playlists and therapy worksheets: tools for tuning yourself.

And because everyone can talk about it, brands no longer need to shout. They just need to give people the words, the samples, and the context, and the community does the rest.

The Funding and Distribution Flywheel

Let’s talk funding first. Pre-2020, very few Indian investors wanted to touch perfume. It felt too premium, too low-frequency, too hard to build brand love without offline presence. Beauty? Sure. Lipstick, skincare, haircare, those had repeat purchase cycles and clearer GTM.

Perfume was a “founder passion” category, perceived as an indulgence rather than a serious enterprise.

It was discarded as a sleepy category, the closed club of beauty and personal care, and a relic of FMCG. That changed when the D2C gold rush hit. Between 2020 and 2023, Indian VCs poured over $3.5 billion into early-stage consumer brands. While much of it went to nutrition, wellness,and skincare, perfume began to sneak in, often as a smart second act.

Think:

Plum expanding into fragrance via sub-brands

Bombay Shaving Company launching perfume as a bundling upsell

The Man Company building an entire masculine identity suite

Suddenly, perfume wasn’t a risk. It was a layer. A retention tool. A higher-margin product to raise AOV and drive brand storytelling.

This layered well with the new investor appetite: category creators with emotional moats. And perfume has the deepest emotional moat of all, memory.

We’ve even started seeing funding rounds for perfume-first brands — a rarity in India until very recently. House of EM5, Naso, and Raahi are three that stand out, each betting on a different wedge into the massmium market.

House of EM5 has doubled down on “affordable luxury”: glass-bottled, high-concentration fragrances that feel aspirational without drifting into ₹8,000 niche territory. This positioning isn’t just a pricing strategy; it’s a trust signal. It tells a new, curious customer: you can take a risk on this, and it will still feel special.

Naso has taken the opposite approach, grounding itself in sustainability and artisanal sourcing. Their pitch is all about conscious luxury: natural ingredients, small-batch production, and an eco-friendly lens that taps into the same sensibility driving clean beauty. In a category where “natural” is often just marketing fluff, Naso’s credibility gives them pricing power and cultural cachet.

Raahi, meanwhile, is playing the heritage card, but doing it digitally. Rooted in Kannauj, India’s centuries-old perfume capital, they’re packaging attar know-how in a way that fits an Instagram carousel. That origin story matters: it telegraphs authenticity in a sea of white-label imports, and for the urban buyer, it’s a romantic shorthand for “real Indian perfumery.”

These early winners are proving two things:

You can build investable, scalable fragrance brands here.

The brand’s wedge, whether it’s price psychology, provenance, sustainability, or storytelling, is as important as the juice in the bottle.

But money only matters if the product moves. And that’s where distribution comes in. Offline retail for luxury fragrance is brutal. You need testers, floor staff, heavy branding, and expensive retail rentals. Which is why legacy perfume brands stagnated: they couldn’t break out of mall counters and Kirana shelves.

What massmium D2C are doing differently is bypass retail altogether. Instead of fighting for shelf space, they are building their own stacks:

Fulfilment partners who can handle tiny bottles

E-comm dashboards optimized for mini-kit bundling

Fragrance quizzes to mimic store sampling

Influencer UGC to replicate sales pitch demos

Add Blinkit and Nykaa into the mix, and you’ve got a powerful loop: instant access, impulse buying, and visible discovery.

More importantly, the AOV math begins to work. At ₹999–₹1,499, you can:

justify your performance marketing spends (i.e. your CAC)

Cross-sell via beauty bundles

Earn margins of 50-65% even with luxury packaging

One more thing: distribution doesn’t just mean logistics. It also means reach. Platforms like Smytten and Nykaa are giving new brands legitimacy. Customers trust platforms. They use filters. They check reviews. And they discover brands in context, alongside things they already love.

What that does is flatten the trust curve. You’re not convincing someone to try perfume. You’re convincing them to try yours, and the platform does half the work.

Taken together, the funding x distribution flywheel isn’t just about scale. It’s about who gets to scale sustainably. Massmium perfume brands don’t need ₹100 crore fundraises. They need ₹2-4 crore to prove PMF, ₹10 crore to scale sampling + bundling, and a strong enough story to keep CAC down.

And if they crack that, they become something we haven’t seen in India yet: an emotionally sticky, financially sound, founder-led perfume house.

Not a category add-on. Not a celebrity vanity project. A brand.

III. Mapping the Massmium Landscape

Let's get surgical about brands that have been around long enough to show their true colors, starting with the ones that have found a formula that works:

Bombay Shaving Company: The Adjacency Play

What They Got Right:

Leveraged existing male grooming audience for fragrance expansion

Priced aggressively at ₹899-₹1,299 to drive trial

Used subscription model to create repeat purchase rhythm

What's Actually Happening: Three years in, BSC's fragrance line accounts for ~15% of revenue but shows the highest margins. Smart bundling (razor + aftershave + perfume) drives AOV up 40%. The scents themselves are competent but unremarkable, think "elevated Axe."

The Reality Check: This isn't artisanal perfumery. It's FMCG with better packaging. And it works because they know their lane: convenient, affordable, masculine-coded scents for men who don't want to think too hard about fragrance.

Verdict: Successful category extension, not fragrance innovation. Proves there's money in being pragmatic rather than precious.

The Man Company: Celebrity Attachment Done Right (Mostly)

The Ayushmann Years (2019-2022): Strong celebrity-product fit. Ayushmann's "everyman sophistication" matched the brand's accessible premium positioning. Fragrance sales grew 200% year-over-year.

Post-Celebrity Reality (2023-2024): Without the celebrity crutch, sales plateaued. The scents were never distinctive enough to stand alone. Customer acquisition costs doubled as they lost the celebrity halo effect.

What This Teaches: Celebrity partnerships work for trial, but if your juice isn't memorable, you're building a house of cards.

Verdict: Classic case of celebrity-dependent growth. When the star moves on, you better have built real brand equity.

Plum's Fragrance Gambit: When Skincare Brands Play Perfumer

The Setup: Plum, known for cruelty-free skincare, launched fragrances in 2022 targeting their existing customer base.

What Looked Smart: Cross-selling to loyal customers, leveraging brand trust, clean beauty positioning

What Actually Happened: Fragrance performed well initially (existing customers willing to try) but showed poor retention. Why? The scents were formulated like skincare, gentle, inoffensive, forgettable.

The Learning: Skincare customers want products that work. Fragrance customers want products that make them feel something. Different emotional contracts.

Verdict: Proves that brand extension isn't automatic. You can't skincare your way into fragrance success.

Forest Essentials: Heritage Done Right

What They Mastered:

Packaging that feels genuinely luxurious (heavy glass, detailed labels, ritual-ready presentation)

Pricing confidence (₹3,000-₹8,000 range without apology)

Authentic Ayurvedic credentials (actual ingredient sourcing, not marketing theater)

Why It Works: Forest Essentials never tried to be affordable. They positioned themselves as luxury from day one and built the experience to match. Their customers buy into the ritual, not just the scent.

The Numbers:

Average customer owns 3+ products

70%+ of sales are repeat customers

International presence in 15+ countries

What Others Miss: You can't fake luxury. The entire experience, from website to unboxing to performance, must be cohesive.

Verdict: Proof that Indian fragrance can command premium pricing, but only with uncompromising execution.

Nykaa's Private Label: Platform Power vs. Product Power

The Strategy: Use platform data to identify gaps, create house brands to fill them

The Execution: Competent dupes at massmium pricing (₹999-₹1,599)

The Results: Decent sales driven by platform placement and bundling, but zero brand heat outside Nykaa's ecosystem

The Reality: When the platform is your primary advantage, you're not building a brand. You're building a SKU.

Verdict: Smart business, forgettable products. Shows the difference between moving units and creating culture.

The Pattern Recognition:

Winners have: Clear customer understanding, cohesive brand experience, products that match their positioning promise

Losers have: Platform dependence, borrowed aesthetics from other categories, pricing that doesn't match performance

The real test isn't launch month metrics. It's whether people actively choose your brand when they have infinite alternatives.

The Ghosts: What Didn’t Work (and What We Learned)

Every wave has its wipeouts. And in India’s fragrance boom, the casualties are deeply instructive.

Let’s start with Belora Cosmetics, which raised $3.57M via Surge (Peak XV’s accelerator) and shut down operations in 2023. While Belora wasn’t a perfume-only brand, its story is crucial to understand because it chased the same demographic, same aesthetic, and same D2C playbook as massmium perfume brands. What went wrong? Classic D2C pitfalls: over-projection of revenue, poor offline conversion, and fragile unit economics. Belora aimed for ₹500 crore revenue within five years but hit only ₹15 crore by FY22, all while struggling to scale its retail operation. It couldn’t cross the bridge from cart curiosity to category ownership.

Then there are the legacy attar houses that couldn’t evolve. In the 1990s, Kannauj had over 700 distilleries. Today, that number has dwindled to 150–200. The reasons are structural: outdated production methods, lack of digital fluency, and an inability to package for modern taste. Many tried D2C pivots but stumbled on basics: poor UI, minimal branding, and no narrative scaffolding. In a world where fragrance must now come with a story, these houses had lineage, but no language.

You also have a graveyard of white-label “Instagram” perfumes. Brands that looked good on-grid but smelled like generic alcohol. The formula? Pretty bottle, punny name, ₹999 price tag, zero retention. They burnt through performance spends to generate that first whiff of virality and collapsed under refund requests and customer apathy. The problem wasn’t awareness. It was experience. Indian consumers are rarely forgiving, but especially not when you promise niche and deliver naphthalene.

And of course, we must talk about celebrity-first failures.

Fragrance globally has been a celebrity playground: think Rihanna’s Fenty scents or Ariana Grande’s perfume empire. But in India, the formula rarely works. Why?

Indian celebrity worship doesn’t translate to sustained product love

Fans love their stars but don’t necessarily want to smell like them

Most celebrity perfumes feel lazy: name slapped on, no story, poor formulation

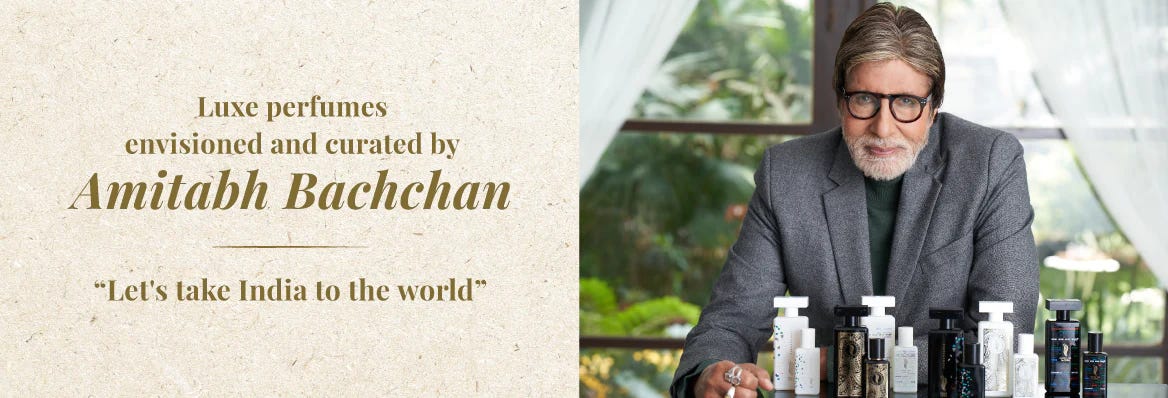

Consider the early 2000s launch of Bachchan's 'Fragrance of a Legend', elegant bottle, high-profile launch, zero follow-up. Or Shah Rukh Khan’s 'SK' perfume, which generated intense press but disappeared from shelves within months.

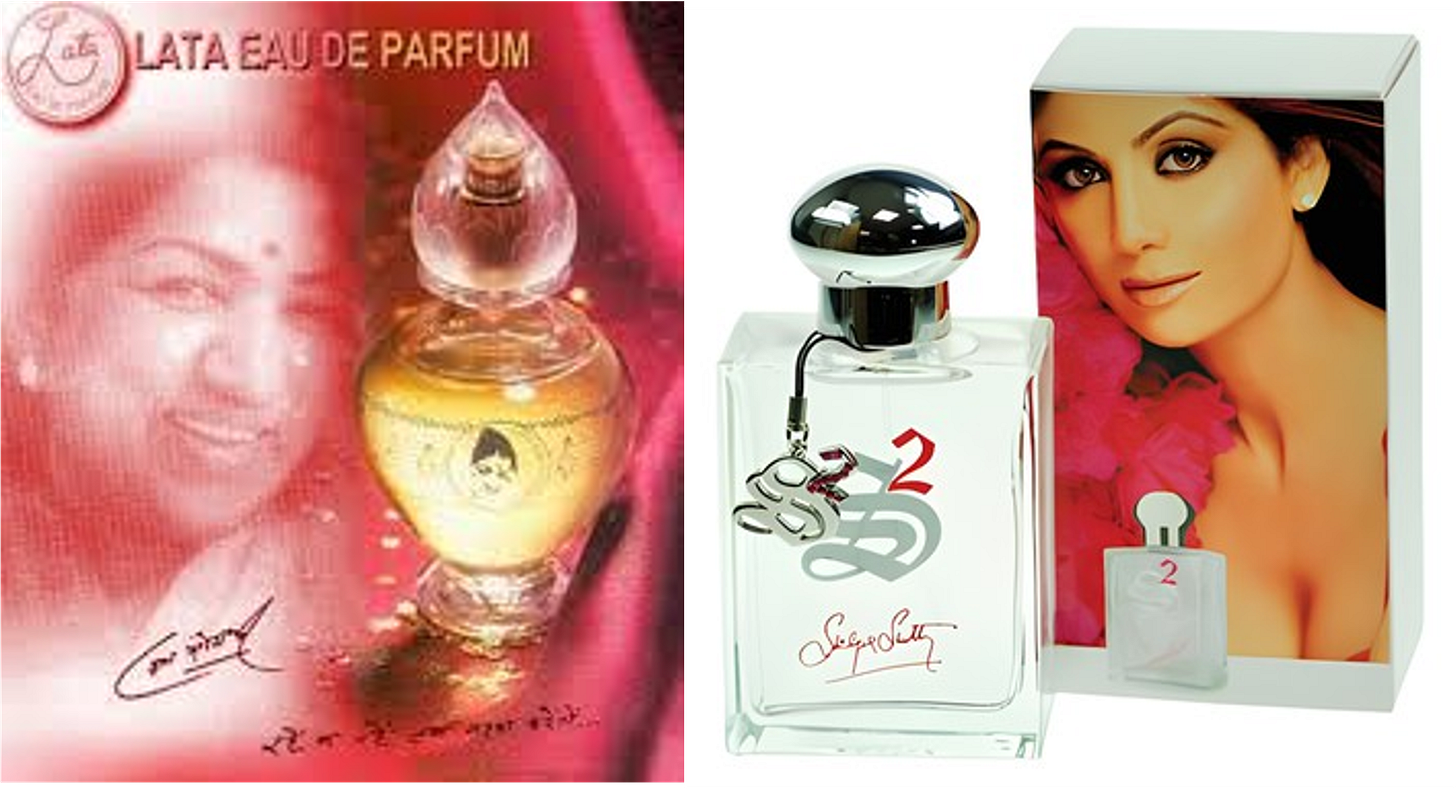

Shilpa Shetty’s S2 perfume, positioned as a women’s empowerment fragrance, couldn’t establish product recall despite early visibility. Even Lata Mangeshkar’s 'Lata Eau de Parfum', launched in the mid-2000s, struggled to connect with modern audiences despite strong nostalgia cues. More recently, cricket-led launches (like MS Dhoni’s 'Seven' range) focused more on mass apparel and body sprays, but failed to develop any fragrance-specific traction.

Even mega-influencers who’ve tried entering the space through limited-edition drops found it difficult to create emotional stickiness, especially in a category as personal and memory-led as scent.

Most of these launches relied on celebrity presence, not participation. They sold access, not identity. And that’s not enough.

What do all these ghosts have in common?

They underestimated how personal fragrance is

They over-indexed on aesthetics, under-invested in product

They believed brand love could be engineered purely through ad spend

Fragrance isn’t a one-night stand. It’s a long-term relationship. The failures show what happens when brands treat it like a fling. If you can’t deliver a memory, a moment, or a transformation, no amount of marketing can save you.

And as the massmium category matures, we’ll see more ghosts. Because the game isn’t about being first. It’s about being felt.

The Middle Class: Legacy Brands, Mass-Market Giants, and the Great Unbundling

Not everyone is playing in the new lane. Some have been here forever. Others are slow-stepping into the massmium zone. And a few are so deeply embedded in India’s fragrance memory that they’re invisible until you really start looking.

Let’s start with the household names: Fogg, Engage, and Layer’r Wottagirl. These brands dominate tier-2 and tier-3 markets, not because they’re the most innovative, but because they’ve nailed availability, price, and scent profile.

They’ve also shaped expectations. Ask any Indian consumer what perfume smells like, and odds are, they’ll describe something that’s 70% inspired by Fogg or Engage. This is important context: most D2C brands are trying to break this scent muscle memory, offering softer, subtler, more layered profiles, while these legacy brands doubled down on strength, throw, and sillage.

The very qualities that made them mass-market hits now work against them in urban metros. Gen Z doesn’t want to smell like the office uncle (apologies to any office uncles reading this). And aspirational middle-class buyers want bottles that sit pretty on a dresser, not inside a deo can.

What we’re seeing now is a slow unbundling of that dominance.

More players are entering the ₹800–₹1,200 range

Brands are choosing glass over aerosol

Fragrance language is moving from “fresh blast” to “morning jasmine with a vetiver trail”

That opens up a wide middle: consumers who aren’t ready to drop ₹5,000 on Jo Malone but also want something more refined than a supermarket aisle pick.

And this is where the hybrid straddlers come in.

Brands like Bombay Shaving Company and The Man Company didn’t start with fragrance. But they’re expanding into it, not as an add-on, but as a category investment. These are brands that understand the grooming market, have repeat customer data, and can cross-sell scent with beard oils, razors, and face wash. Their superpower is integration.

They also understand distribution. BSC is in modern retail, premium outlets, and online. The Man Company has tied up with celebrities (Ayushmann Khurrana) and subscription gifting partners. Their perfumes might not be massmium-first, but they slide into the category through adjacency, and that’s a wedge.

You also have players like Plum, who entered scent after establishing a stronghold in skincare. Their perfumes borrow from their existing tone, clean, playful, and Gen Z-coded, and work because the audience already trusts the brand’s cruelty-free, vegan ethos.

Meanwhile, new entrants like Perfora, known for oral care, have introduced menthol-based mouth spray perfumes, part hygiene, part scent. It’s not a traditional perfume play, but signals how olfactory branding is bleeding into wellness. Similarly, mCaffeine, known for coffee-based skincare, has hinted at future launches in the scent space.

So what’s the takeaway?

The incumbents shaped the market. The hybrids are stretching it. And the middle class of Indian fragrance, that ₹800–₹1,500 zone, is now where the most creative, chaotic, and consequential brand-building is happening.

It’s not niche. It’s not luxury. It’s not supermarket.

It’s the new Indian normal. And it smells… like aspiration.

IV. Inside the Bottle: Ingredients, Sourcing, and the Supply Chain Shift

India’s Natural Advantage: The Forgotten Powerhouse of Smell

India has always been a global supplier. What changed recently is that Indian brands finally started treating that supply dominance not as a commodity, but as an identity.

India produces over 60% of the world’s spice oleoresins and nearly 80% of its mint extracts. From jasmine in Madurai to vetiver (khus) in Tamil Nadu, sandalwood in Mysore, Oudh in Assam, and attar distillation in Kannauj, we are a deeply scented nation, not just culturally, but agriculturally and economically.

For decades, international fragrance houses have quietly sourced Indian essential oils and absolutes, shipping them off to Grasse or Geneva, only to re-import them as luxury French perfumes. Companies like Firmenich, Givaudan, Symrise, and IFF have maintained sourcing relationships in India for decades, but very few Indian consumers know this. The story of what’s inside the bottle has largely been erased.

What’s changing now is a growing confidence among Indian D2C brands to highlight ingredient provenance, not just as a cost arbitrage, but as a brand pillar. Brands like Raahi and Zighrana lean into their Kannauj origins. Others like Root & Soil emphasize cold-pressed distillation techniques. The new positioning isn’t “smells foreign.” It’s “smells local, but luxe.”

India’s geography offers a rare scent trifecta: tropical climate, rich soil chemistry, and centuries of perfumery knowledge passed down informally. It’s a terroir advantage. And in a world increasingly obsessed with traceability, Indian perfumery is finally stepping into its own story.

This advantage also ties into consumer perception. As sustainability and ingredient sourcing become bigger priorities (especially for Gen Z), Indian consumers are beginning to question where their products come from. In that moment of curiosity, Indian brands that can confidently say “from here” have a credibility that international brands don’t.

But here’s the catch: the brand must be willing to do the storytelling work. Without narrative, vetiver is just grass. With narrative, it’s nostalgia, monsoon, and soft masculinity in a bottle.

As brands deepen their scent portfolios, those that lean into this ingredient-level pride and make it part of both identity and performance will have an edge that no TikTok trend can replicate.

D2C Meets Distillation: The Rise of Modern Supply Chains

Once the raw ingredients are grown, distilled, or extracted, how do they become shelf-ready fragrances that can survive Indian heat, logistics, and consumer expectations?

That’s where the real transformation has happened.

Ten years ago, most Indian perfumery relied on two extremes: either ancient attar artisanship or full-blown FMCG manufacturing. Today’s D2C fragrance supply chain, however, is a hybrid machine. It blends small-batch production with scalable backend support, giving brands flexibility without sacrificing consistency.

The key enablers here are formulators and compounders, fragrance development firms like Ultra International, VedaOils, A.G. Industries, and Keva that partner with brands to create custom blends. These aren’t just off-the-shelf fragrance oil vendors. Increasingly, they offer full-stack services: olfactory brief mapping, performance testing, longevity benchmarking, and climate-sensitivity adaptation (very necessary for tropical India).

Some brands are even hiring in-house noses: perfumers who work exclusively with the brand to build proprietary scent IP. Others use AI-based tools for mapping customer preferences to fragrance families, especially in early discovery and sampling stages. For example, Fraganote’s quiz-based onboarding and recommendation engine builds both retention and insight.

On the bottling and packaging side, a quiet revolution has taken place. The era of stock bottles is over. New brands invest in custom bottle molds, high-throw atomizers, and foil-stamped cartons not because it’s pretty, but because packaging affects perception of throw, quality, and even lasting power. A ₹1,399 product must feel like it’s worth twice that.

Logistics also matters more than ever. D2C fragrance brands have to ensure temperature-stable packaging (especially for high-altitude or summer delivery zones), spill-proof safety, and compliance with hazmat handling for alcohol-based sprays. This means working with specialized courier partners and fulfillment platforms that can handle cosmetics-grade freight.

Then comes regulatory compliance. Fragrances in India require labeling adherence under BIS norms, along with safety certificates if they contain allergens or volatile compounds. International expansion brings in another layer: IFRA guidelines, EU labeling norms, and FDA cosmetic rules.

But here’s the kicker: this sophistication is now accessible to 5-person startups. The ecosystem has matured enough that even lean teams can launch with:

Premium-grade oils

Custom glass packaging

Efficient fulfillment

Compliant labels

Because the stack is modular and competition among vendors is fierce, fragrance brands today can stand up a product in 8–12 weeks, iterate quickly, and operate with high LTV-CAC ratio if their storytelling works.

Massmium brands, in particular, rely on this stack to punch above their price. That ₹1,200 scent may use a ₹50 formulation, but smart dilution ratios, high-concentration base oils, and elegant bottling give it the feeling of prestige.

In essence, the backend isn’t just logistics, it’s a branding amplifier. And the brands that treat it like infrastructure, not afterthought, are the ones leading the game.

India’s Invisible Edge (and Global Bottleneck)

For all its momentum, India’s homegrown fragrance wave still carries a contradiction: we’re rich in ingredients, nimble in execution, and culturally attuned but the world doesn’t yet associate us with olfactory excellence.

Why?

Because fragrance prestige has historically been European-coded.

Think: Grasse, Paris, Milan. Indian brands are still shaking off the shadow of “cheap attar” or “deo-first” stereotypes. Even when we make brilliant scents, the global consumer (and even some desi ones, I’m guilty!) still default to French, Arabian, or Korean perfumery when it comes to prestige.

This perception gap is a brand problem, not a supply one. Let’s break it down:

1. Cost and Margin Advantage

India’s domestic sourcing allows for extremely favorable unit economics. A D2C perfume here can achieve a 6–10x markup on COGS and still retail at ₹1,200, a fraction of what an equivalent scent would cost abroad.

But this same cost-efficiency breeds skepticism. Low price = low prestige in many minds. Until Indian brands own their storytelling, global audiences won’t understand why our scents are affordable and exceptional.

2. Ingredient Power vs. Fragrance IP

India exports mint, vetiver, cardamom, and jasmine by the ton. But our scent signatures aren’t globally recognizable. We’re an ingredient superpower but not yet a fragrance authority.

To become one, Indian perfumery needs more than supply chain excellence. It needs distinct, defensible olfactory language profiles that consumers associate with us, not with France or Dubai. That’s how South Korea built a K-beauty scent palette, and how Le Labo built a cult out of “Santal 33.”

Until then, we risk remaining the ghostwriters of global perfumery, never its protagonists.

3. Export Friction and Smell Translation

India’s tropical climate means our scents are bolder, more oil-heavy, and often designed to last through sweat, humidity, and long commutes. But when these same profiles are exported to colder countries, they can feel overpowering.

Exporting Indian perfumes is a formulation problem, not a regulatory one. Fragrance needs recalibration for climate, water chemistry (hard vs. soft), and even cultural associations. A jasmine-forward scent in India evokes freshness. In Europe, it might read as overly sweet or dated.

The future winners will be those who can translate their scent without diluting their identity.

4. The Global Retail Gap

Most Indian fragrance brands aren’t available in Sephora, Boots, or niche perfume boutiques abroad. They also struggle to compete with the sampling culture of Western niche brands: free testers, mini discovery sets, travel sizes. These are not luxuries; they’re table stakes in global fragrance retail.

Massmium brands must design globally shippable formats, partner with online retailers like Scentbird, and rethink their storytelling for an international buyer who hasn’t grown up in an attar-rich culture.

5. Regulatory and Labeling Labyrinths

Selling abroad means navigating a maze of compliance: EU’s REACH and IFRA guidelines, FDA registration in the US, safety testing, ingredient disclosure, and ethical certifications. Many Indian D2C brands are only now beginning to build internal regulatory muscle.

But here’s the good news: those who crack this first will leapfrog others. Because the global market is ready, they just don’t know where to look yet.

In sum: India’s fragrance future isn’t just about creating great scents. We already do that. It’s about building global confidence, infrastructure, and language around what we already do so well.

The ingredients are here. The ambition is here.

Now, the world just needs to smell it.

🎩*Puts Investor Hat On*🎩

V. What Comes Next: Risks, Traps, and the Future of Fragrance in India

The Massmium Ceiling: Price Compression and Product Fatigue

Here’s the smelly truth: ₹900 to ₹2000 is a beautiful place to play, but it’s also a trap.

This price bracket, the sweet spot for India’s D2C fragrance boom, is where most massmium brands live. It’s affordable enough for discovery-led impulse purchases, yet premium enough to feel aspirational. But that very success is creating its own ceiling.

This segment is getting crowded, fast.

Consumers are now swiping past near-identical bottles with matte pastel labels, vague poetic names, and similar note pyramids. Santal, oud, vanilla, and bergamot show up again and again. Every other brand promises “bold yet balanced,” “mood-elevating,” “gender-neutral” freshness. And the algorithm rewards sameness, because what’s already selling feels safer to mimic.

This creates two problems:

Price Compression: As more players enter the same bracket, pricing wars begin. Brands introduce offers (Buy 2 Get 1, ₹299 samplers, etc.) that eat into margins. CAC remains high, especially on Instagram and influencer channels. And if everyone’s selling a ₹1,299 perfume with 18% oil concentration… where’s the room to grow?

Product Fatigue: For the consumer, it becomes harder to feel excitement. There’s a scent fatigue, not in how things smell, but in how they’re presented. Too many SKUs, too little distinction. What felt like experimentation in 2022 now feels like noise in 2025.

We’re also entering the “regret zone” problem. A ₹1,200 perfume bought online, blind, that turns out underwhelming is not a disaster, but it’s annoying. And enough of these annoyances add up to churn.

So what does this mean for massmium?

It means the playbook has to evolve. Because the ceiling isn’t just about price, it’s about imagination.

Smart brands will start:

Trimming SKUs and building core lines with strong repeatability.

Owning distinct scent profiles instead of chasing trends.

Designing with post-purchase in mind: giving samples, educating customers, creating discovery funnels that match scent to persona.

More importantly, they’ll need to figure out how to:

Build emotional equity (why does this brand matter beyond price?)

Justify premiumization (can you sell a ₹2,500 bottle and make people want it?)

Explore non-linear expansion: home scents, personal care, layering accessories, offline experience.

Because eventually, if you live in the middle too long, you get crushed between budget giants (like Fogg or Engage) and true premium players (like Naso, Maison Des Parfums, or even niche importers).

Massmium is a launchpad, not a moat. The ₹900–₹2,000 bracket buys you awareness, trial, and a seat in the cart, but it doesn’t protect you. As more players flood the tier, price compression will pull you toward either a race‑to‑the‑bottom in discounts or a slow, deliberate climb into true premium. Survival will depend on more than a pretty bottle and poetic copy. You’ll need recognisable olfactory IP, climate‑fit performance, and an ecosystem that keeps customers locked into your scent universe, candles, oils, hair mists, refills, so switching feels like starting over. In fragrance, storytelling opens the door; performance and ritual keep it from slamming shut.

The Real Moat: Brand as Scent, Scent as Brand

If early-stage fragrance success was about aesthetics, storytelling, and accessibility, the next phase will be about something deeper: olfactory IP.

In an increasingly crowded landscape, the only real moat is smell. Not just a pretty bottle. Not even a clever name. But a recognizable, memorable, signature scent that people associate with you, even before they know your logo.

Globally, cult brands like Le Labo’s Santal 33, Byredo’s Gypsy Water, and Maison Francis Kurkdjian’s Baccarat Rouge 540 didn’t just sell perfumes. They built scent cults. These perfumes act like olfactory passwords. You either get it, or you don’t. And if you do, you feel seen.

So far, very few Indian massmium brands have built scent IP with this kind of cultural gravity. Most launch multiple variants quickly. Many chase trend notes. Few invest in long-term olfactory brand-building. That’s a missed opportunity.

The next wave of winners will:

Invest in signature bases and unique accords they can use across formats bolstered by access to captiv ingredients in formulation.

Create repeatable scent patterns: so a candle, a mist, and a perfume all smell like the brand.

Build emotional and memory pathways through retail, storytelling, and sensory anchors.

It’s also why in-house perfumers and scent designers will become a differentiator. Just as fashion brands protect their cuts and tech brands protect their code, fragrance brands must learn to protect their noses. (Manan Gandhi of Bombay Perfumery does have a counterpoint: Outside of Chanel, Dior, LVMH, Hermes, very few other global brands (mass or niche) have in-house perfumery teams. It is more prudent to build stronger relationships with perfume houses who have access to the best global perfumers and ingredients. (Example: Byredo with Roberet, Fredric Malle with perfumers in IFF, Givaudan, Symrise))

And here’s where it gets interesting: scent is no longer just product. It’s media.

The story of a perfume, how it was made, who it was made for, how it makes you feel, travels faster than the perfume itself. Brands that treat scent as a storytelling channel, not just a chemical formula, will build deeper loyalty.

This is why I’m very very excited about:

Podcast-style audio guides to scents

Immersive retail formats (e.g. blind bars, interactive counters)

Playlists, moodboards, and fictional characters tied to scent launches

The future brand isn’t one that sells 40 SKUs. It’s one where people say: “Oh, that smells like them.”

But there’s a trap here too: the branding trap.

Some brands are chasing aesthetic polish over olfactory distinctiveness. They’ve nailed the look, the grid, the influencer partnerships, but the scent itself is forgettable. Or worse, derivative.

In this trap, the vibe overpowers the value. Customers might buy once, but they don’t come back. Because for all the marketing, the product doesn’t live on skin.

So the challenge ahead is fusion: brand and scent must collapse into one. You can’t fake this anymore. The bottle, the emotion, the performance, the aftersmell, all must say the same thing. Massmium’s next icons won’t be known for their packaging. They’ll be known for their trail.

Global Dreams, Indian Realities: Going Beyond Bharat

Indian fragrance brands aren’t starting from zero on the global stage, but they’re not exactly sprinting either.

On one side, you have MENA giants like Ajmal, Rasasi, and Swiss Arabian, brands that dominate the Gulf and Muslim-majority markets with heritage, in-house R&D, deep scent literacy, and massive export scale. These are powerhouses of projection, longevity, and cultural relevance. They understand ritual, loyalty, and layering. They win by owning every stage of the supply chain from raw material to retail shelf.

For Indian D2C players, especially massmium ones, this is not an opponent you beat head-on. You don’t out-Gulf the Gulf.

But that doesn’t mean India has no edge. In fact, it’s already proving one.

Indian brands like 11:11, Papa Don’t Preach, and Karthik Research are carving space in international luxury, showing up at Selfridges, Bergdorf Goodman, and Harrods, not as token brown inserts, but as aesthetic, values-led, premium products that blend Indian heritage with global taste. Their success shows that the world is open to an Indian story if it’s told with precision, ambition, and creative autonomy.

So what does this mean for Indian fragrance?

1. The India story sells, but only when it’s expensive, modern, and unapologetically specific.

This is the real lesson from 11:11 and Papa Don’t Preach. They aren’t selling ‘India’ in a tourist-trinket sense. They’re selling a version of India that’s bold, sensual, and deeply self-aware. When that story is layered into fragrance, not in a kitschy way, but through sourcing, storytelling, and scent memory, it becomes globally legible.

But to pull this off, brands need to climb the value ladder.

₹1,200 isn’t export-worthy unless it performs like a ₹5,000 EDP.

You’re not going to land in Paris by mimicking French minimalism.

If your bottle says “sacred sandalwood,” it better move like an invocation, not a Pinterest board.

2. MENA isn’t your enemy. It’s a masterclass.

The Gulf taught its population to layer scents, to buy perfumes for every hour of the day, to see fragrance as emotional armor. That didn’t happen overnight. It happened because their brands invested in retail, education, and deep cultural embeddedness.

Indian brands can learn from that.

Create fragrance rituals for Indian consumers, not just products.

Make discovery feel like belonging, not confusion.

Own the Indianity of smell from mitti attar to marigold to the wet green scent of banana leaf.

There is no reason Kannauj can’t rival Grasse.

3. SEA is still the true scale corridor, and it wants newness, not heritage cosplay.

The Southeast Asian market is where Indian brands can build quickly and intelligently. The climate is similar. The sensorial vocabulary overlaps. The price sensitivity is well-matched. And the Western brands here feel overplayed.

Here’s where Indian brands can win:

Smart pricing with luxury packaging

Climate-sensitive formulations (high oil, low projection)

Diaspora-fueled demand that goes beyond nostalgia

Pan-Asian influencer partnerships and visual systems that localize without flattening

This isn’t about exporting what sells here. It’s about exporting what only India can make — but in a language the world understands.

4. If you want to go global, your scent has to be a statement, not a safe bet.

The massmium bracket has gotten Indian brands attention. But attention isn’t reputation. Reputation is built bottle by bottle, trail by trail.

To win globally, Indian brands will need:

In-house noses or long-term perfumer partnerships

Export SKUs that translate local genius into global confidence

And frankly, better margins, because real perfume needs real investment

This isn’t a dream. It’s a runway. And it’s already being built.

Let the French sell fantasy. Let the Gulf sell ritual. Let India sell power, story, and skin memory. the kind that smells like the monsoon hitting hot sto ne, the kind that lingers on a silk sari, the kind you can’t quite name but never forget.

It’s time to stop asking whether India can build a global fragrance brand. And start asking: who will do it first and best?

VI. The Money Behind the Moodboard

The VC Problem: Prestige without Profits

There’s a paradox at the heart of Indian fragrance startups: they’re margin-rich and still capital-starved.

Fragrance, especially in the massmium zone, boasts gross margins of 65–80%. The CAC-to-AOV ratio is friendlier than skincare. Repeat rates are strong for hero SKUs. And returns? Almost negligible.

So why is VC money hesitant?

The answer lies in how venture capital reads “prestige.”

Perfume, unlike makeup or even serums, is still seen as indulgence-first. It doesn’t solve a visible “problem.” You can’t show “before and after.” It’s vibes and vanity. And that makes it harder for VCs, especially those trained on SaaS logic, to model growth with conviction.

Most fragrance startups don’t fail on product. They fail on perception.

Belora is a case in point. A Surge-backed brand that started with colour cosmetics and entered fragrance in 2022. Despite decent revenue numbers (~₹15 crore in FY22), it shut down in 2023. Why? Because it couldn’t raise a follow-on round. The story was “nice brand, not a venture scale play.”

That verdict has haunted other founders in the space. When you tell a VC you’re building a perfume company, they hear:

Low frequency category

High brand churn

Subjective product with no defensibility

But here’s the thing: that’s no longer true.

Consumer behavior has changed. Fragrance is now daily, not occasional. It’s replacing deo, not sitting beside it. And new brands are building loyalty not through “fine fragrance” positioning but habit loop: Monday scent, Friday scent, gym scent, cuddle scent.

That opens room for scale. But only if the funding lens updates too.

What’s also missing? Understanding of true contribution margin. Unlike serums or shampoos, perfumes don’t need external efficacy validation. If the customer likes how it smells and it lasts 4+ hours, it’s a win. That reduces friction in the funnel.

And unlike makeup, where shade matching can be a nightmare, perfume is more forgiving. Discovery sets and minis are cheaper to produce and test at scale.

There’s also a price-to-perception arbitrage. A ₹1200 perfume feels luxe. A ₹1200 face cream feels suspect. That creates better value elasticity.

So why aren’t more investors biting?

Part of the problem is that the success stories are too recent. They haven’t IPO’d. They haven’t shown ₹100 crore exits. But if you zoom out and apply the right lens, high-margin, low-return, emotionally sticky, increasing frequency, the signal is clear.

Fragrance may not be a “hypergrowth” story. But it’s a compounder story. One that VCs need to start underwriting with the right horizon and expectations.

The Fragrance Investment Scorecard: What Actually Matters

If you're going to bet on Indian fragrance startups, here's what my personal scorecard looks like, and now it’s yours:

1. Repeat Purchase Rate at 6 Months (The Loyalty Test)

Winner: >40% repeat rate

Danger Zone: <20%

Why it matters: Fragrance is emotional, not functional. If they don't come back, your brand is just expensive impulse shopping.

2. Organic Share of Voice (The Taste Test)

Winner: >30% of mentions are unpaid UGC

Danger Zone: Entirely paid promotion

Why it matters: Real fragrance brands generate conversations. Fake ones buy them.

3. AOV Growth Trajectory (The Ecosystem Test)

Winner: AOV increases 15%+ annually through bundling/upselling

Danger Zone: Flat or declining AOV

Why it matters: Single-SKU fragrance brands hit a ceiling. Winners build fragrance ecosystems.

4. Founder Aesthetic Authority (The Taste-Maker Test)

Winner: Founder's personal taste is clearly defined and followed

Danger Zone: Generic "luxury" positioning with no POV

Why it matters: In fragrance, you're not buying a product. You're buying into someone's nose.

5. Climate-Market Fit (The Reality Test)

Winner: Scents perform well in Indian heat/humidity with 4+ hour longevity

Danger Zone: Pretty bottles that disappear in 30 minutes

Why it matters: Performance > Packaging in a country where 40°C is normal.

Red Flags That Kill Deals For Me

The Dupe Trap: Brands that lead with "Inspired by Baccarat Rouge" will never build real equity

The Spray-and-Pray Launch: 15+ SKUs in year one signals no focus

The Founder-as-Face Problem: Celebrity attachment without taste authority

The Platform Dependence: >80% of sales from one channel (usually Instagram)

The Margin Mirage: Great gross margins hiding terrible retention economics

Green Flags Worth Paying For (For Me!)

The Scent Signature: A recognizable olfactory DNA across all products

The Community Engine: Customers who evangelize without being paid

The Ritual Integration: Products that become part of daily routines, not special occasions

The Supply Chain Ownership: Direct relationships with ingredient suppliers, not just white-labeling

The International Validation: Organic international demand, even if small scale

VII. Margin ≠ Moat: Why Scent Needs a Second Product

The ₹10–15 Cr Plateau: Why Perfume Alone Isn’t Enough

Here’s the dirty secret behind most Indian fragrance brands: they stall.

Even the best ones. Great packaging, cult SKUs, strong early traction, and then flat growth after ₹10–15 crore in revenue.

Why?

Because a single-scent SKU, no matter how good, is not enough to build a growth engine. Even if the margins are healthy. Even if the reviews are glowing. Perfume is a slow LTV category. Most users don’t buy five bottles a year. They buy one, maybe two. Even loyalists.

And because fragrance isn't a need, it’s a want, it’s highly susceptible to novelty churn. The customer doesn’t always repeat-buy. They browse. They experiment. They try something new. The competition is infinite, and the emotional stakes are low unless you build depth.

Which is why single-product brands stall unless they bundle, layer, or expand.

Why Minis, Candles, Oils = Revenue Armor

Successful brands don’t treat perfume as a product. They treat it as the anchor. And around that anchor, they build a library of forms, formats, and price points.

Miniatures (5–10ml): They increase trial, enable gifting, and boost cart size without increasing regret. They also let customers build “perfume wardrobes,” like lipsticks. Brands like Naso and Maison De Fouzdar use this brilliantly, making minis feel like collectibles, not compromises.

Oils and Solids: Especially in Indian humidity, perfume oils (ittars) or balm-based solids feel more grounded and longer-lasting. They’re culturally familiar, travel-friendly, and encourage layering, which increases usage rate and repeat purchase.

Candles & Diffusers: You don’t have to teach a customer how to use these. They’re “home scent” upgrades that increase sensory touchpoints. A ₹499 candle feels affordable luxury. A ₹2,000 candle feels giftable. And both increase brand recall every single evening.

Gifting Kits: Fragrance thrives in ritual. And rituals mean bundling. Birthday kits. Shaadi season trios. “First job, first perfume” boxes. These expand the margin, reduce CAC, and drive UGC.

The best fragrance brands in the world, from Jo Malone to Byredo, don’t just sell scent. They sell presence. That presence is multiplied across product categories.

From Scent to Ritual: Expanding Without Diluting

There’s a trap here too. When expansion feels like desperation, users smell it. (Pun very much intended.)

The moment a fragrance brand starts pushing face creams, shampoos, or lipsticks with no aesthetic consistency, they lose trust. The extension has to feel like the founder’s taste extended, not like an investor’s panic.

Done well? It creates a ritual ecosystem:

Morning mist → Rollerball for commute → Office-safe scent → Candle at night

Gym scent + Laundry drop → Uniform for routine

Couple kits → "Smell like love" bundles → Anniversary-specific drops

The ritual justifies re-purchase. It makes scent part of identity, not just an indulgence.

That’s how LTV grows. That’s how brands cross ₹20–₹50 crore MRR without burning the house down on ads.

The Global Playbook: What the West Gets Right

In international markets, the perfume-as-lifestyle play is mature. Look at:

Maison Margiela’s 'Replica' line — scents, candles, mini kits, shower gels, all with the same narrative frame.

Glossier You — one scent, one bottle, but multiple forms (solid, travel, ambient).

Le Labo — personalized labels on body wash, lotion, and even detergent. The scent becomes language.

Their expansions don’t dilute the brand. They amplify it.

TL;DR:

Perfume may be the heart of the brand. But expansion is its circulatory system.

If you want to scale fragrance in India and stay relevant, you need to offer more than just smell. You need to offer an experience people want to come back to, and a format they want to live with.

Margin alone isn’t a moat. But memory is. And the more places your scent shows up, body, home, ritual, the more unforgettable you become.

VIII. Closing Thoughts: On The Next Decade of Indian Fragrance

Let’s be clear: India has the ingredients. India has the people. India has the emotional firepower. What we’ve lacked, until now, is ambition married to execution.

The next 10 years are critical. They will determine whether Indian fragrance becomes a global creative superpower or remains stuck as a sourcing hub for Western brands. Here’s what needs to happen:

1. Build Brands, Not Just Bottles

India doesn’t have a fragrance brand problem. It has a fragrance commodity problem. Too many founders are focused on SKU expansion, dupe drops, or quick Instagram wins. Too few are building brands with longevity, distinctiveness, and emotional relevance.

We need:

Consistent visual language

Clear scent architecture

Emotional storytelling that travels across platforms

Look at how Maison Kurkidijan created cult by consistency. Or how Byredo went from niche to iconic with visual restraint and mood-rich names. India doesn’t need to imitate, but it needs to commit to identity. Not just aesthetics, but attitude.

2. Claim the Middle: Between Cheap Mass and Global Luxe

Right now, India’s fragrance economy is barbelled. On one end: ₹300 deodorants. On the other: ₹20,000+ imports.

The real win? Massmium. That sweet spot of ₹900–₹2,000, aspirational enough to feel premium, affordable enough to feel impulsive. This is where Indian brands can dominate, if they:

Invest in packaging and storytelling

Prioritize quality over quantity

Treat the consumer like an adult, not a conversion

The middle is not mediocrity. The middle is margin + meaning. Build for it.

3. Rewire the Funnel for Feel

Stop smell-splaining. Start meaning-making.

Sampling > Slideshows. Memory > Molecules. Emotion > Education.

Discovery sets, scent quizzes, kiosks, storytelling cards, personalized recommendations, these are funnel mechanics, not just “extras.” Build scent literacy without elitism. Create customer journeys that begin with recognition, not intimidation.

Because ultimately, we’re not selling perfume. We’re selling projections of identity, desire, memory, hope.

The next decade of Indian fragrance won’t be defined by who smells the best.

It’ll be defined by who tells the most unforgettable story and makes sure you can wear it.

To Harnidh: thank you for stepping up to the podium this week and bringing us up to speed on a space we would have never visited on our own. To our readers - please feel free to share your appreciation for Harnidh’s work either in the comments below or via her Twitter/LinkedIn.

The Tigerfeathers Spotlight Series continues next month. If you’re keen to throw your name in the hat or you have suggestions for future contributors, hit us up. Until then, keep your Tiger eyes sharp and your Tiger feathers sharp-er (or whatever).

And, as always, if you made it all the way here and you thought this was a good use of your time, it would mean a lot to us if you took a couple of seconds to share this post.

Wow - that was a thorough read. I'm now wondering if you think it's worth your while to comment on why Lush hasn't yet re-entered India!

Brilliant post. Thanks a lot.

On Brand building

It's one big missing piece. My experience over instagram post & reels led marketing by most such brands is that they all feel similar to each other and compete the mindspace with other personal care brands that are also trying the same imagery.

Some storytelling is visible, but there is a gap and lot more needs to be done.

One new 'trend' that I hoped to understand but found missing was the DIY perfume kiosks that are popping up everywhere. While it looked interesting earlier, now they have made the whole science/art of perfumery feel like a 'cheap' act.

What got them started and what role will they play according to you?