Vision 20/26: Charting India

26 of India's most prescient investors reveal what they're seeing on the horizon

Hey folks👋

Welcome to the 383 new Tigerfeathers subscribers who’ve joined since our last essay, about the IPO of India’s most “Inevitable” e-commerce company - Meesho.

Given that today is our last piece of the year, we wanted to take this opportunity to share a small sample of the heartwarming reactions we’ve received to our work in 2025 -

Thank you for keeping it real. If you’re still on the fence about signing up, click here to uh get off👇

Tigerfeathers is presented by…Fuzz AI

Fuzz AI is the intelligence layer for modern investors, purpose-built for India’s financial landscape.

It’s the newest product out of the lab at Raise Financial Services, adding to a roster that includes Dhan, Upsurge and Filter Coffee - each designed to help Indian investors navigate the country’s public markets.

Unlike generic AI tools that are trained to summarise data, Fuzz is programmed to verify. Every answer is backed by visible, traceable public sources.

Built for serious investors, analysts, and finance professionals, Fuzz understands the intricacies of Indian regulations, policies, and market quirks that global tools miss.

It’s like having your own personal research analyst, one that understands the rhythms of India’s financial landscape.

What makes Fuzz different:

Verified insights with sources and citations

Deep research mode by default

India-centric financial datasets

Specialized agents for filings, sentiment, and quant data

50K+ investment professionals are already on the waitlist. Fuzz is currently in beta, but you can register for free access here👇

And if you’re interested in partnering with us on a future edition of Tigerfeathers, hit us up on Twitter/LinkedIn or by replying to this email. With that, let’s get to it.

“In the end, we will remember not the year itself, but the lists we made of it.”

- Plato

Friends, it’s that time of year again.

EOD has officially transitioned to ‘End of December’, and with that, comes the third edition of our Tigerfeathers Annual Crystal-ball & Oracle Survey (TACOS, for short 🌮).

Like last year and the year before, we asked some of India’s most thoughtful investors to weigh in on the same prompt to help us contextualise the year gone by. Because of the incredible response to our 2024 edition, we kept the question the same this time around - i.e. we asked:

“What is one chart, statistic, or piece of visual evidence that more people should pay attention to?”

And we’ve had some fantastic responses…

…but, as always, before we get there, please bear with us for a few paragraphs as we close shop for 2025 with some updates from behind the scenes (feel free to skip down a few sections if you want to get straight to it).

Tigerfeathers: Wrapped

We got off to a slow start this year.

That’s partly because Rahul got married in early January (🥳), and partly because we both came into the new year in the middle of two chunky, long term pieces of writing that took a while to come together.

It means we only got on the scoreboard for the first time on 30th May 2025 with the first of these essays, about the biotech pioneers from Hyderabad - PopVax.

Because we struggle with restraint, we followed this up the very next Friday with a book-length story on Hunger Inc, the hospitality wizards from Mumbai who’ve spent a decade teaching India to fall back in love with its own flavours. (Congratulations to the team for closing their milestone funding round a couple of months ago, and also partnering with us to host our first ever Tigerfeathers IRL event back in September).

We’ve kept a decent pace (for our standards) for the rest of the year. This was aided by shorter pieces and formats, including this historical tale on how Bangalore became India’s tech capital, this rumination on the art of the Forgotten Text, and this interview with Sushil Chaudhary, on his incredible journey of using inflatable movie theatres to bring the magic of cinema to the hinterlands of India.

For our last long read of the year, we partnered with Naman Pushp to tell the story of his startup Airbound—which is building a hyper-efficient new aircraft to make physical delivery as cheap and fast as the internet made information.

Random bit of trivia: our two longest pieces of 2025 were our stories on Hunger Inc (~42K words) and Airbound (~26K words). Our two most-read pieces of 2025 were #1 Hunger Inc and #2 Airbound. If there are any marketers or content creators reading this, make of this information what you will🤷♂️

Moving on, maybe the coolest thing to come of this year has been the rollout of the Tigerfeathers Spotlight Series, our programme to feature the best guest writers and guest writing from/on India. We’ve spent a bunch of time talking about why we launched this initiative so we won’t belabour those reasons again (but you can read more about the origin of the programme here).

In any case, we’ve been incredibly lucky to count on the talents of Paavan Gami, who masterfully dissected the IPOs of Urban Company and Meesho; we had Harnidh Kaur write a canonical essay on the cultural arbitrage taking place in India’s burgeoning fragrance market; and finally Khushi Mittal took us on a tour through the history of aviation in India, and made a compelling case for why India needs to build its own airplanes.

These essays are some of our all time favourites (and apparently some of yours too), so please join us in extending a hearty thank you to each of our guest writers for their efforts this year.

👏👏👏

We’re excited for the next group of authors to take the podium in 2026. If you know someone that might be a great fit for Tigerfeathers, do us both a solid and send them our way.

And if you’re in the mood for more great writing on India, consider checking out some of our favourite independent publications from Indian writers who consistently produce quality work, like *deep breath* Manish Singh (India Dispatch), Dharmesh Ba (The India Notes), Harnidh Kaur (hk’s newsletter), Tanvi Raut Dessai (Filter Coffee), Osborne Saldanha (Fintech Inside), Sajith Pai (Sajith Pai’s newsletter), Alysha Lobo (TechnicAly Speaking), Bhavishya Pandit (WTF In Tech), Shruti Rajagopalan (Get Down and Shruti), Pranay Kotasthane (Anticipating The Unintended), Priyadarshan Banjan (tal64), Palash Kulkarni (A Bigger Spalash), Rohit Kaul (Updating Your Priors), Debarun Karmakar (Field Notes), Daman Soni (D2C Surge), Manish Dsouza (The Hungry Pig), Manu Joseph (By Manu Joseph), Akshay Mehra (Amplify), Sarthak Ahuja (Sunday Snippet), Utsav Mamoria (Tumse Na Ho Paayega), Mumbai || Paused and Venkat Ananth (The State of Play). Props to The Daily Brief by Zerodha and everything else that came from the Zerodha-Substack ecosystem this year too; and also to the team at Alter Magazine, for upping the ante on intellectual discourse (and beautiful design) from India.

Lastly a quick shoutout to all our sponsors this year - including Finarkein Analytics, Bombay Locale, Fold.Money, Zoho One, and especially to Raise Finance (Dhan) for joining us as long term title partners. Feel free to give them some love.

Anyway, back to Tigerfeathers, and onto some ~numbers~.

How It Started / How It’s Going

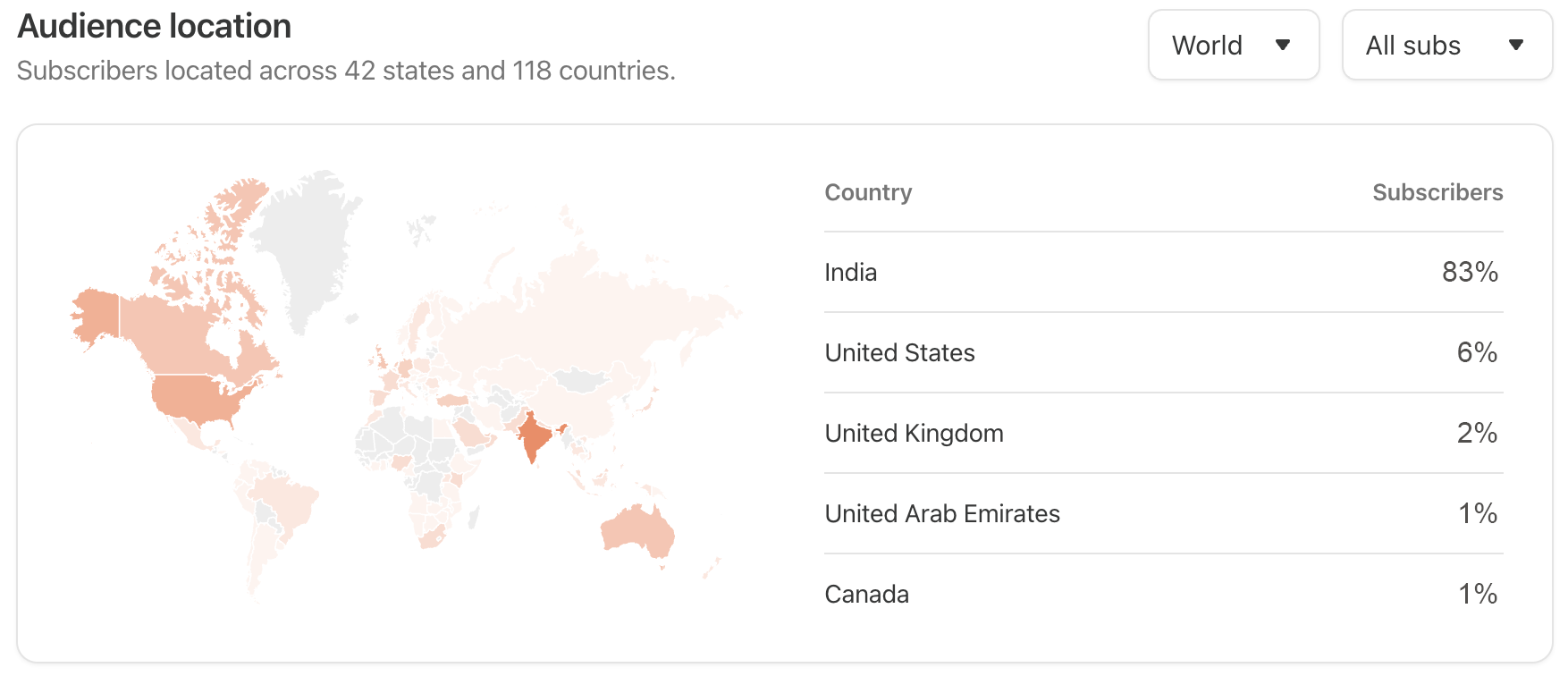

When we did our 2024 wrap up (almost a year to the day), we had 14,966 subscribers spread out over 96 countries.

As of this time of writing, there are 22,616 of us here today. This is what the global heat map looks like:

As always, whether you’ve been with us for five days or five years, all we can say is thank you. Thank you for being patient when you don’t hear from us for six months, and for humouring us when we emerge from hibernation by depositing a pair of novellas in your inbox. Thank you for indulging our dumb memes and accompanying us down an assortment of murky rabbit holes. Thank you for reading and sharing our stuff, and for sending over genuine feedback (good or bad) after every essay.

We’ve said it a hundred times already but the best part of Tigerfeathers is the people who read Tigerfeathers. We know there are a million better ways you could be spending your time in 2025 vs *reading* *a* *long form* *newsletter*. So if you’ve carved out even a few moments of your life to spend with us this year, please know that we appreciate you, and we don’t take that time or attention for granted.

Half a decade into this adventure, we’re now entering Phase 2 of the Tigerfeathers Cinematic Universe. So before we get to today’s piece, we have one last, quick update to share…

Runtime

You might recall that in last year’s edition, we had hinted at two upcoming initiatives. The first was the aforementioned Tigerfeathers Spotlight Series. The second was a new media project we were hoping to incubate in 2025.

That project has manifested in a new video-first IP called…Runtime (whose logo you might have spotted for the first time in our Meesho piece a couple of weeks ago).

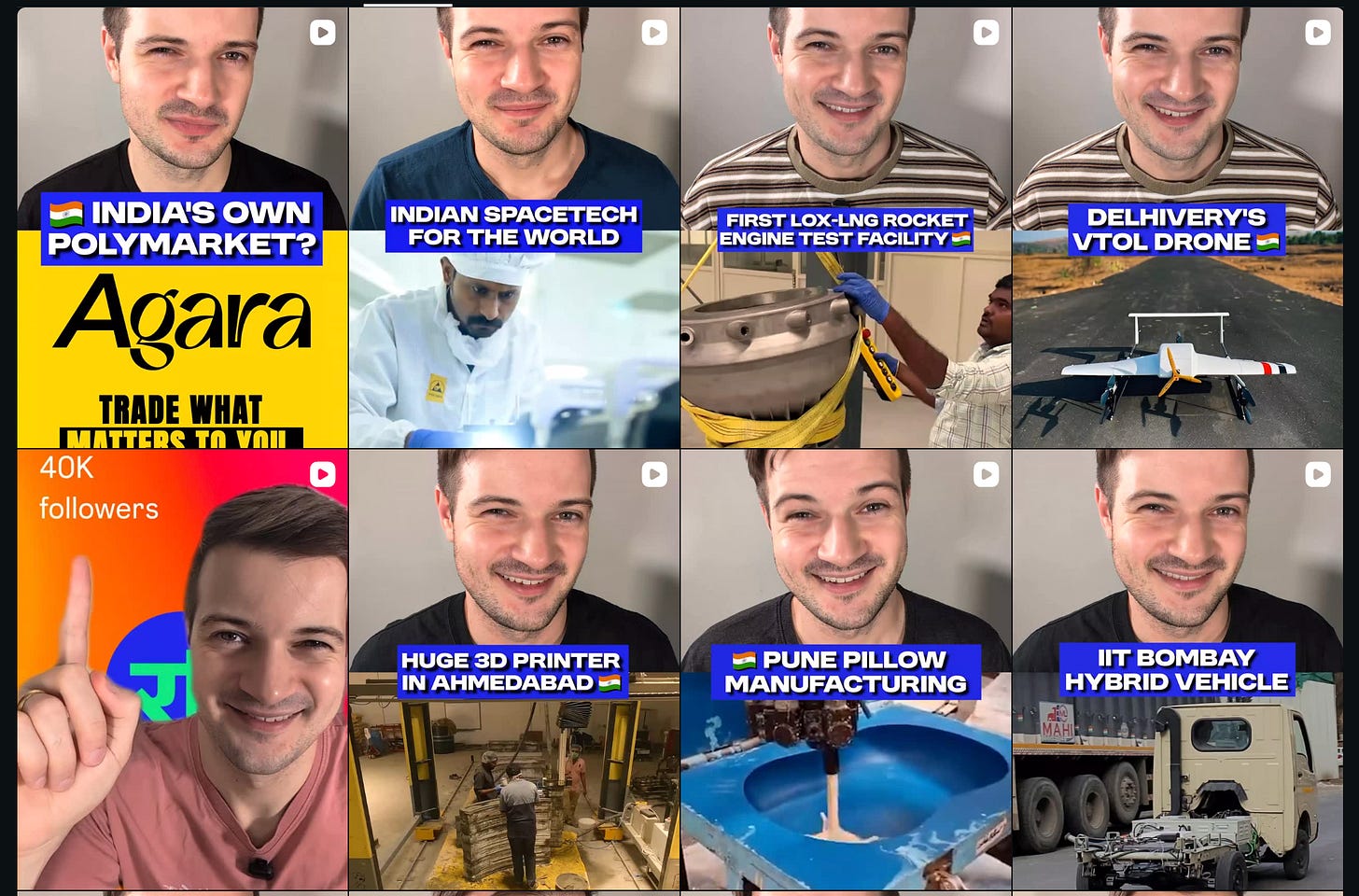

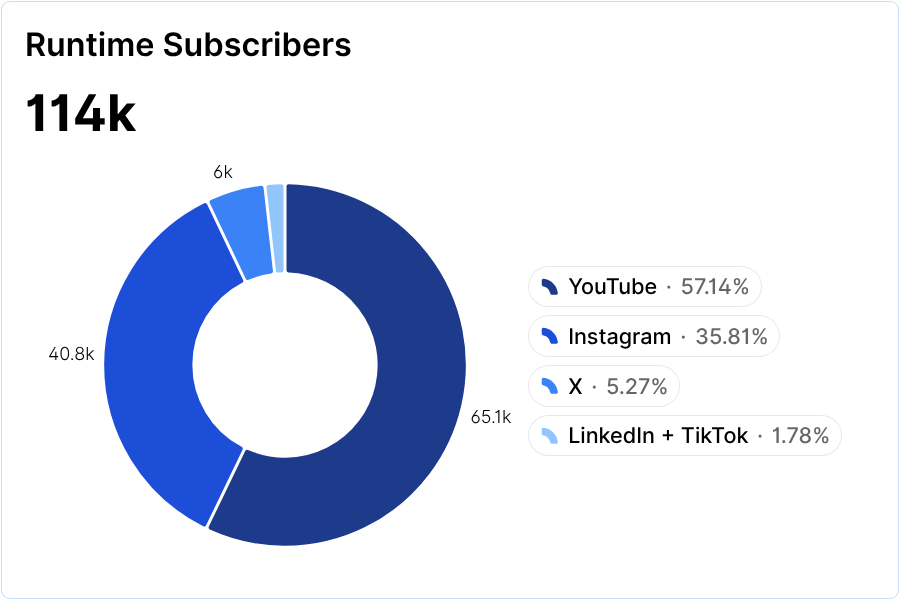

Some of you may have already come across this brand on YouTube, Instagram, or X, but for the uninitiated, Runtime is a property centred on ‘Fast, sharp, builder-first updates from India’s tech frontline.’

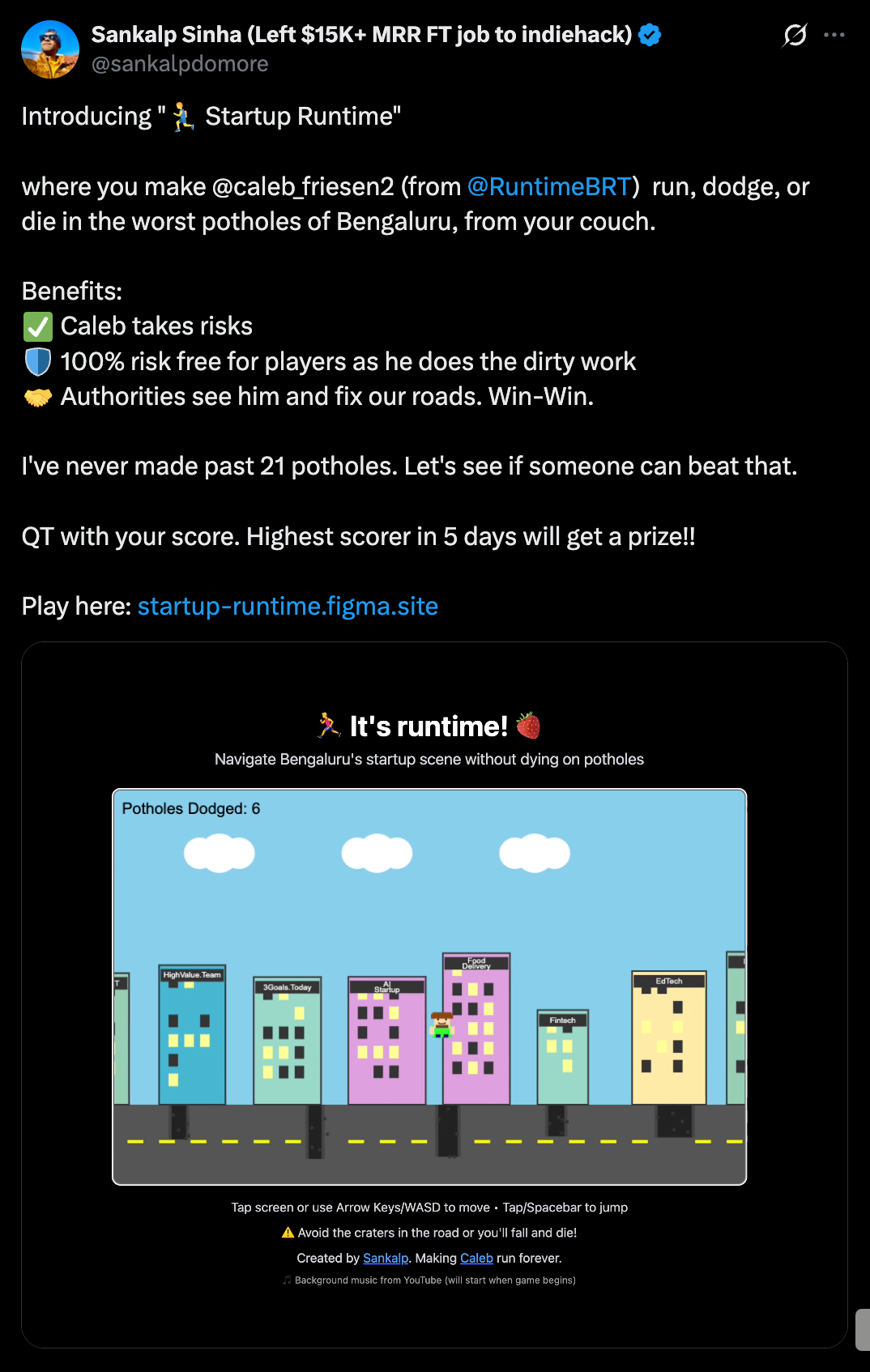

It was co-created and is hosted by Caleb Friesen, the erstwhile host of Backstage With Millionaires, India’s first startup-focused YouTube channel to cross one million subscribers. (When he’s not busy creating snackable tech videos, you can usually find Caleb focused on his one-man crusade to make Bangalore’s footpaths walkable again, a cause that was enshrined in a fully playable video game created by Sankalp Sinha earlier this year).

But what does Runtime do, you ask?

Although it is somewhat of a sister brand to Tigerfeathers, Runtime doesn’t have a lot in common with its older sibling. Whereas this newsletter produces deeply researched, long-form content that takes weeks (re: months) to churn out, Runtime produces short, snappy videos at a daily cadence, covering the coolest things happening in Indian tech over the past 24 hours. Every now and then it’ll also hit the road to cover what’s happening on location at Bangalore’s spirited hacker houses, and some of India’s most exciting companies like Pixxel and Aeos Games.

Runtime was born on the back of a survey we conducted earlier this year with ~150 Indian tech founders, 65% of whom responded saying they were looking for a way to ‘stay up to date with the latest developments in their field’. That turned into a brand focused on super-topical, bite-sized daily updates that could be consumed on the go.

This is what a typical update looks like👇🏽

And if you’re curious, this is how the first six months-ish of operations have panned out -

If you haven’t checked it out yet, please tune in (and subscribe) on your platform of choice. Feel free to share your feedback with us. And remember that our DMs will always be open for you to share stories that you think we should cover.

While Tigerfeathers and Runtime may sit at opposite ends of the media barbell, what they do have in common is the same mission: to faithfully document this incredible time in Indian history; to celebrate innovation from India’s tech ecosystem and tell the stories of its most ambitious practitioners. We’re excited to keep pushing in that direction in the year(s) to come.

If you ask us what would constitute a ‘successful’ 2026, it would look something like this -

pressing publish at least 12 times next year, with at least a couple of traditional long-form stories in the mix

do at least one ‘epic’ piece that adds to the canonical history of Indian tech, business or venture capital (if you have suggestions for these, we’re all ears)

create a flagship events IP (and maybe more) that allows us to take this show on the road and meet the Tigerfeathers community around India (and maybe the world?)

find a way to tie in investing into our media efforts in a structured, intentional way (which would also give us the ability to support founders with both capital and content)

But mostly it’s to keep learning, to keep leading with curiosity and optimism, to keep the quality bar high, and to do our part to support and amplify the story of India in the 21st century.

And now (belatedly) back to our regularly scheduled programming -

🌮TACOS #3

Okay, it’s time to (significantly) raise the intellectual bar for today’s newsletter. As a refresher for what’s on the menu - for the second year in a row, we presented some of India’s most thoughtful investors with the following question -

“What is one chart, statistic, or piece of visual evidence that more people should pay attention to?”

The idea was to have each respondent identify one thing that more people should be aware of. This ‘one thing’ could be extremely niche, very broad, aimed at founders, other investors, or just curious people at large. It could even be something embodied or tackled by a company in their portfolio (with total freedom to shout them out).

We kept the mandate flexible, with only one caveat - it needed to be something that could be represented as a piece of visual evidence - a chart, number, photo, screenshot, infographic - whatever.

Our goal was to assemble a portrait of India through the eyes of some of its sharpest capital allocators, to learn which signals are top of mind as the calendar turns to 2026. To get the most vivid picture possible, we sought not just a diversity of views, but also a diversity of vantage points, which is why this list includes individuals with different domain expertise, sectoral focus, operating stage, vintages of investing experience etc.

We owe a massive thank you to all our contributors for taking the time and making the effort to send in a submission. Ultimately each of these individuals is someone we enjoy hearing from and learning from. We’re confident our readers will come away with the same sentiment.

Let us know what you think in the comments, and if you have any feedback for us for next year.

With that said, let’s get to it.

Krishna Mehra - Elevation Capital

2026: The Year AI Has To Show Its Receipts

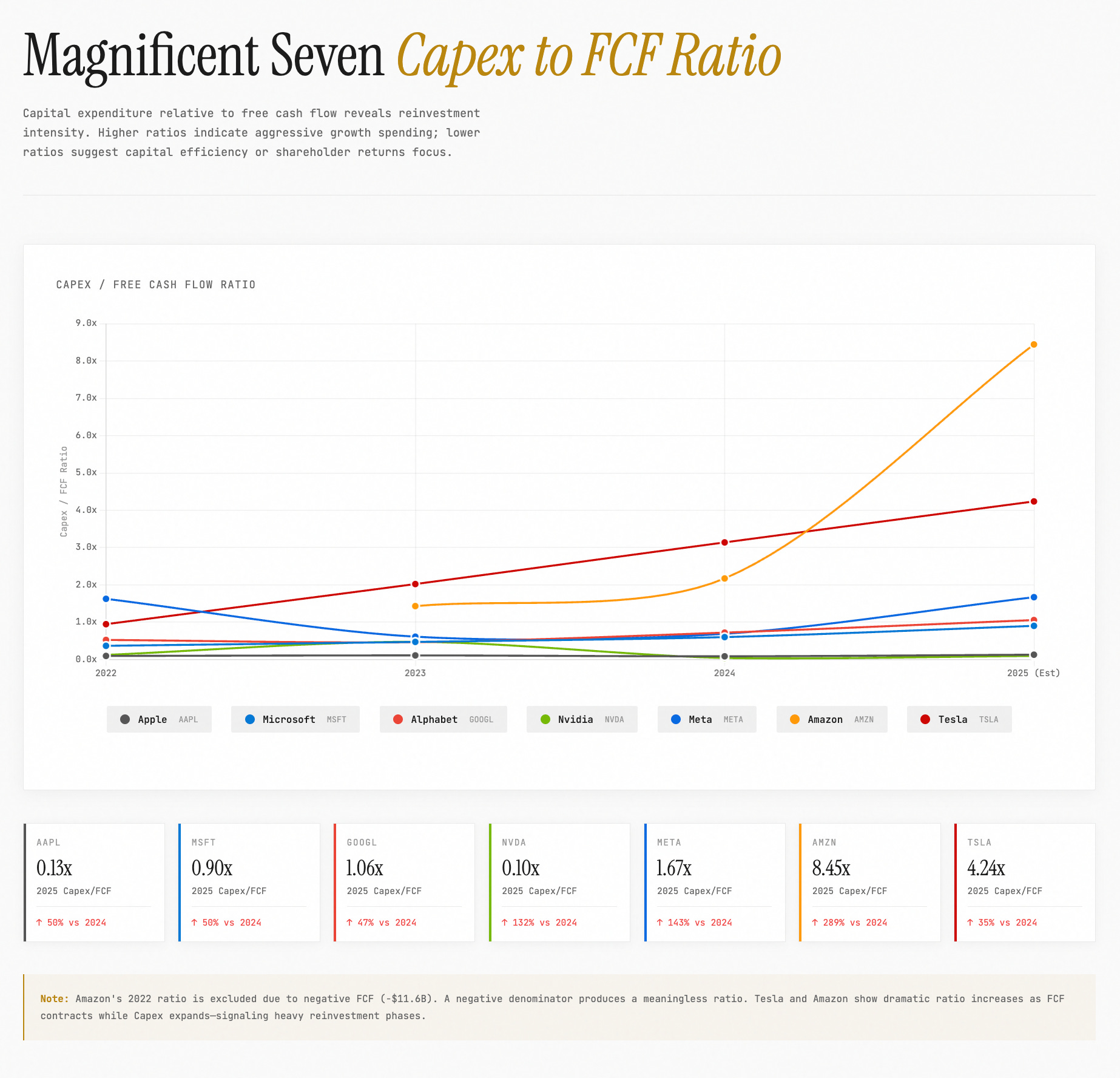

This chart shows the scale of the AI buildout over the past few years, measured by Free Cash Flow (FCF) and Capital Expenditure (Capex) for the Magnificent Seven. It illustrates the arms race we’re in, where companies are willing to spend many multiples of their FCF on chips and data centres. What’s a few hundred billion when it comes to dominating the future computing platform?

However, we strongly believe 2026 will be a decisive year for AI, when markets will reward results over promises - both for startups and the Mag7 alike. Startups will need to demonstrate real customer value (vibes necessary but not sufficient), and growth trajectories will need to be sticky and high-margin to sustain 100x multiples.

Pranav Pai - 3One4 Capital

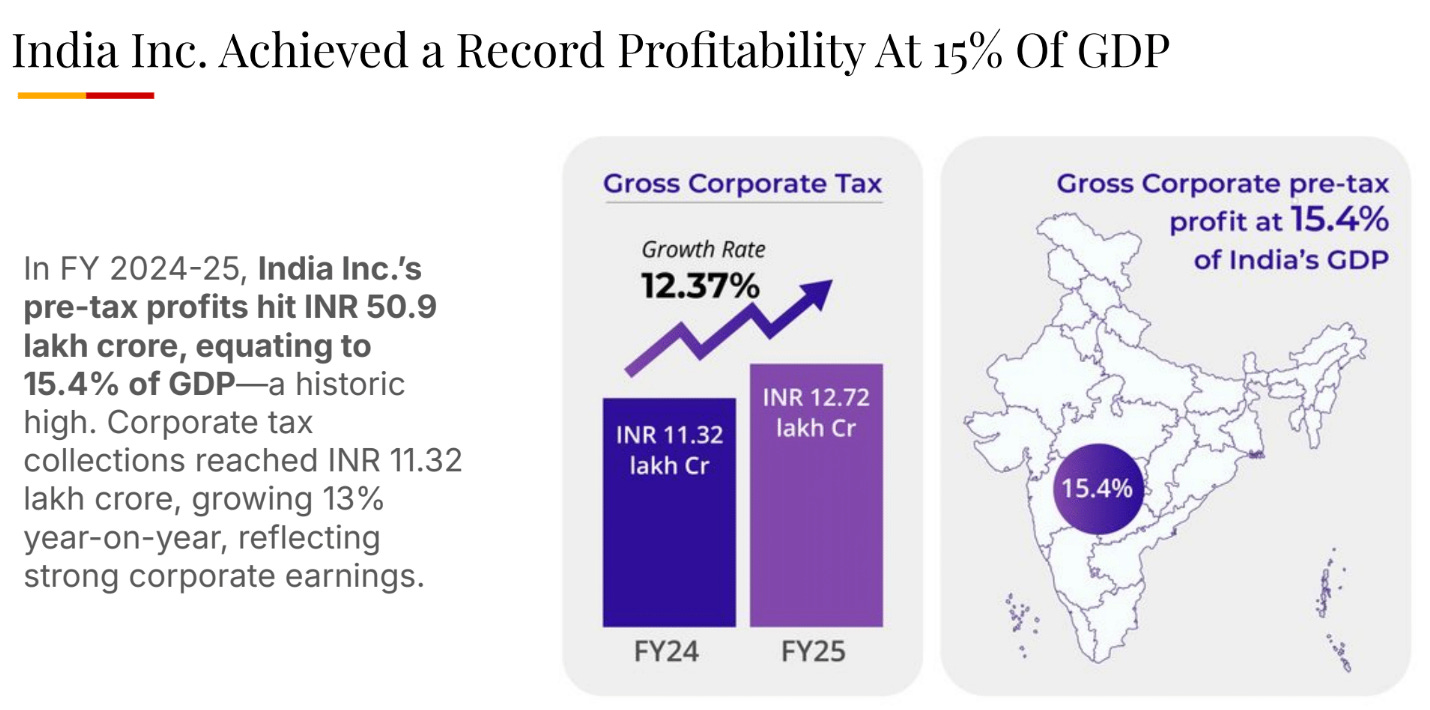

With India’s GDP breaching ₹331 lakh crore (~$4T) in CY25 and on track to cross $10T within the next 15 years, the country is poised to become the world’s third largest economy soon. Behind this ascent is a corporate sector that is now among the most profitable and efficient anywhere: FY25 gross corporate tax collections imply pre-tax profits of over ₹50 lakh crore or 15.4% of GDP, a ratio second only to the US. Balance sheets are clean, cash reserves exceed ₹13 lakh crore, and India Inc plans to nearly double capex through FY26–30, largely self-funded.

The question now is ambition.

India has mastered producing profitable national champions. The next era demands global challengers: firms willing to deploy surpluses into R&D, supply-chain depth, full stack technological competitiveness, and international market share. We must transition from playing it safe to building for the world. The window of opportunity to win global market share during the world’s supply chain reorganisation is finite, and the time is now.

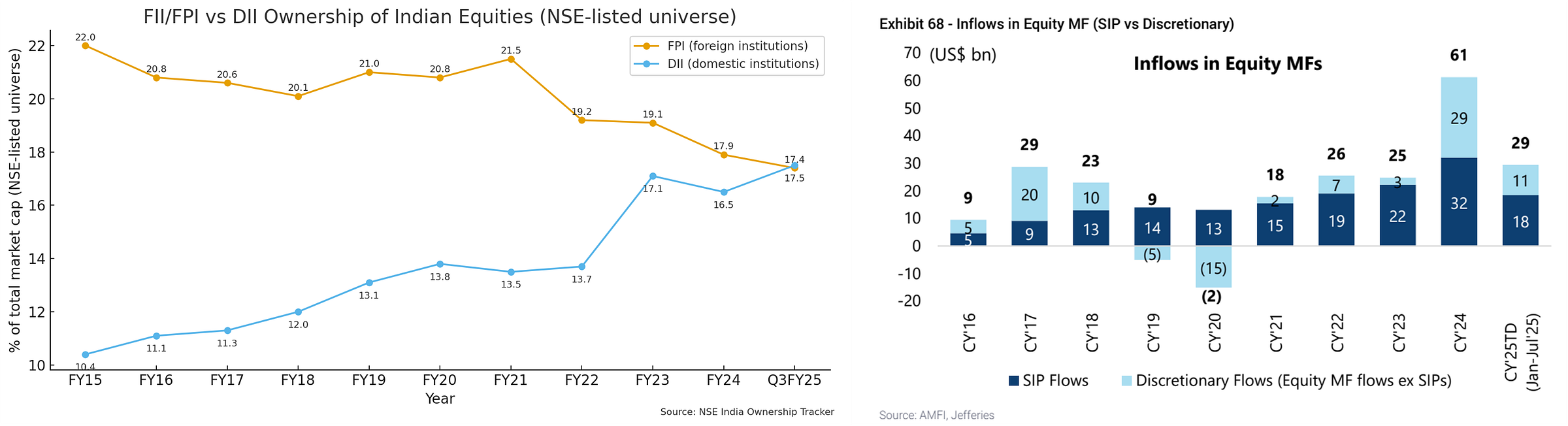

GV Ravishankar - Peak XV Partners

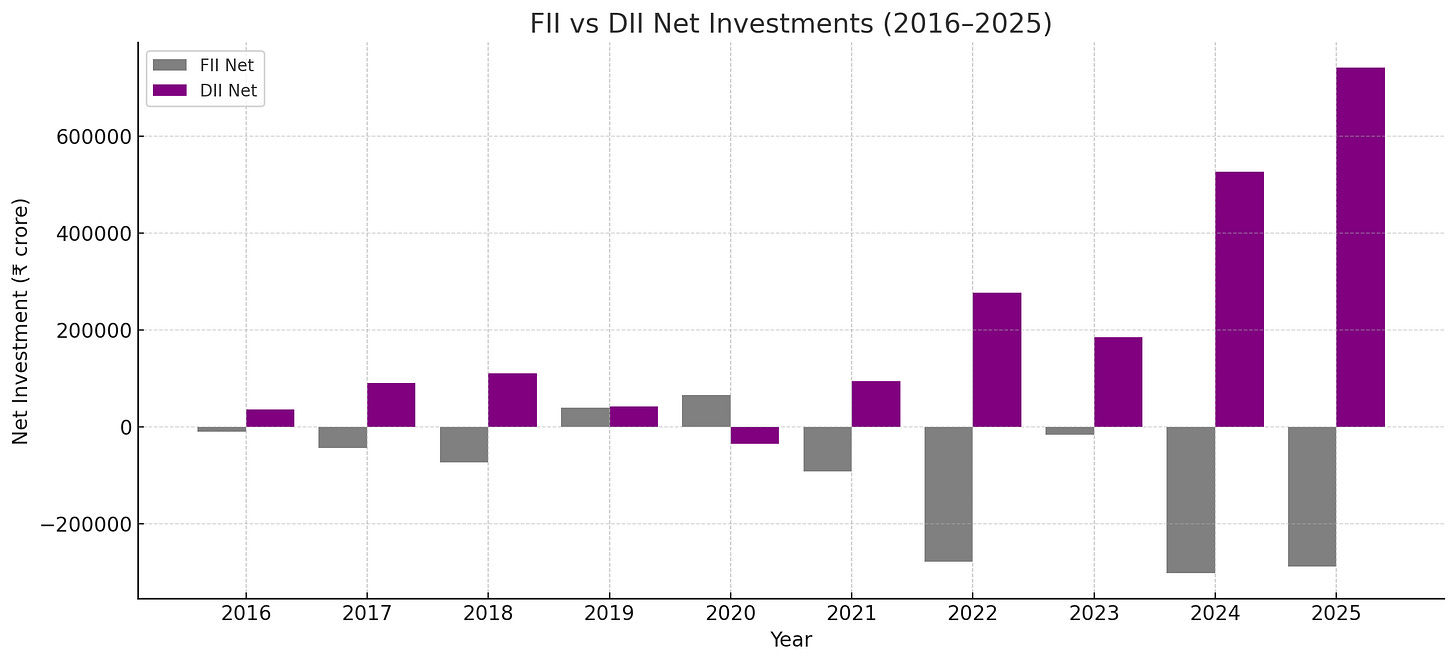

For me this is wasn’t as evident till earlier this year. How much our markets have changed in the last decade. While they have gone up 3x to almost $5 Trillion, the value creation has happened thanks to domestic mutual funds which is in turn thanks to India’s love for SIPs.

Over the past decade, India’s equity flows show a striking divergence between FIIs and DIIs. FIIs have been inconsistent, with several years of large net outflows—especially 2022, 2024, and 2025—often driven by global risk cycles, interest-rate shifts, and EM volatility. In contrast, DIIs have emerged as the stabilising force of the market, recording strong and rising net inflows, particularly from 2021 onward, fuelled by domestic mutual fund SIPs and long-term household savings. The data highlights a structural shift: India’s markets are becoming less dependent on foreign capital, with domestic investors increasingly absorbing volatility and driving sustained equity demand.

Priya Shah - Theia Ventures

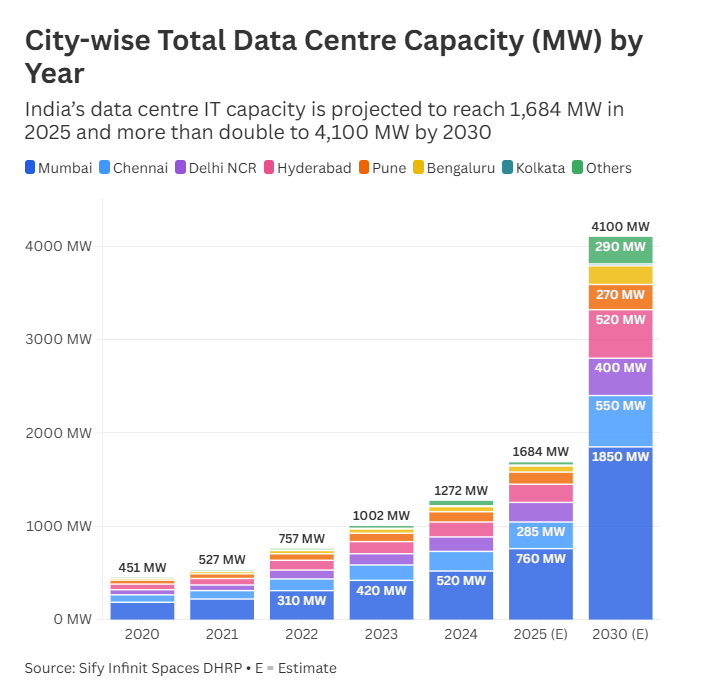

Data centres have evolved from hidden server farms to the backbone of cloud storage, streaming, enterprise systems, and generative AI. They come in several forms, each serving a different role in the digital ecosystem. Due to the high demands of India’s AI and other computing power requirements, there is a need for domestic data centres to ramp up.

As the chart above shows, as India’s AI ramps up, so does electricity use, leaving operators exposed to fossil fuel volatility, price spikes, and stricter emissions rules. Over 90% of data centre operators now cite power availability and energy costs (hence the demand for cooling) as their top concerns, and nearly half place upgrading grid infrastructure as the most important mitigation.

Yet the gap is stark: India generates nearly 20% of the world’s digital data but has only about 3% of global data centre capacity. The buildout is accelerating, but the distribution and the readiness of the grid to support it remain highly uneven. Interestingly, cities like Kochi, Vizag, and Jaipur are emerging data centre zones thanks to lower real estate costs and better access to localised renewables. Energy efficiency in data centres is not an add on; it is the backbone of a viable digital economy, and there need to be more technology companies solving for this in this space.

Suchet Kumar - WTFund

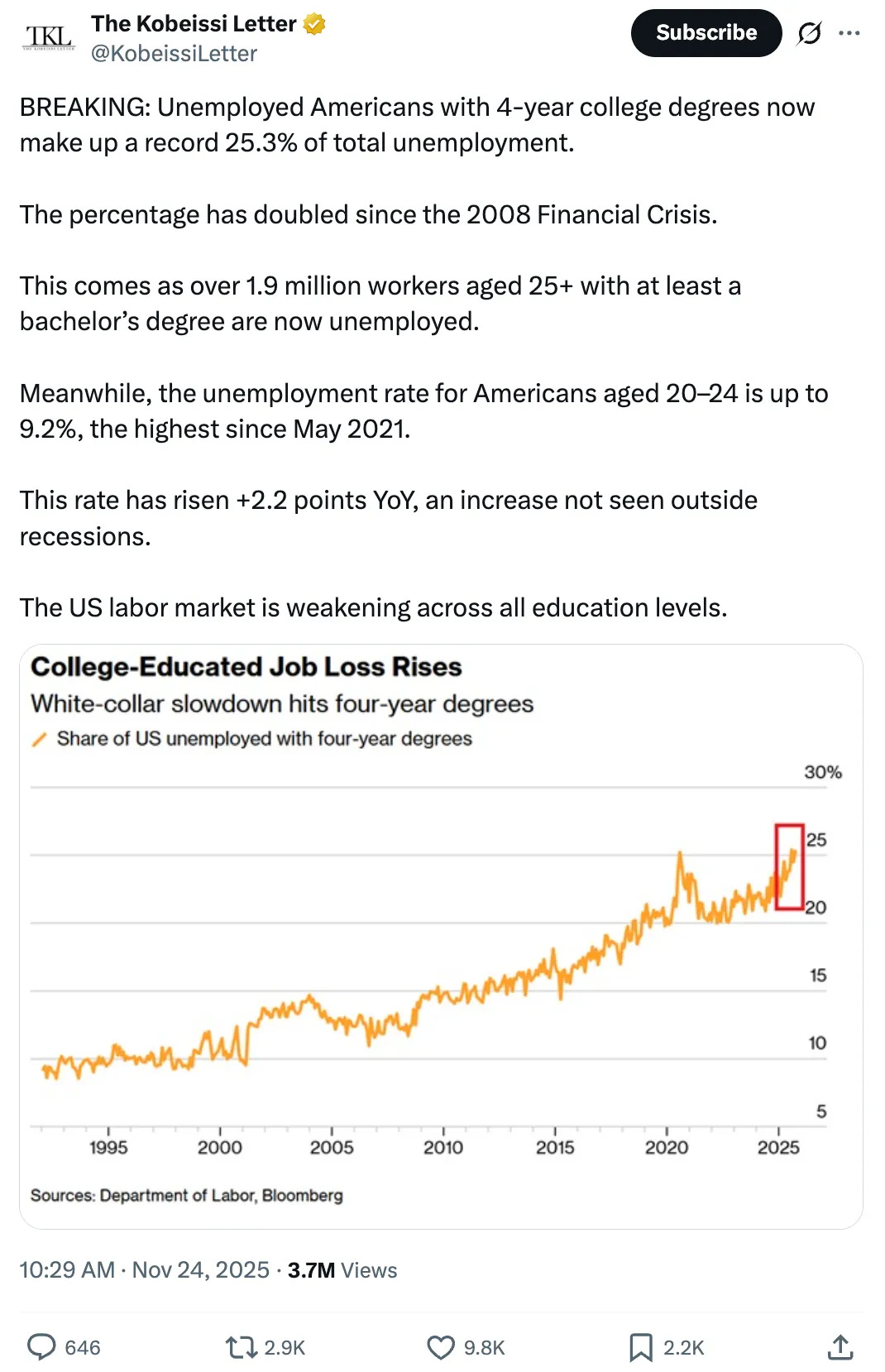

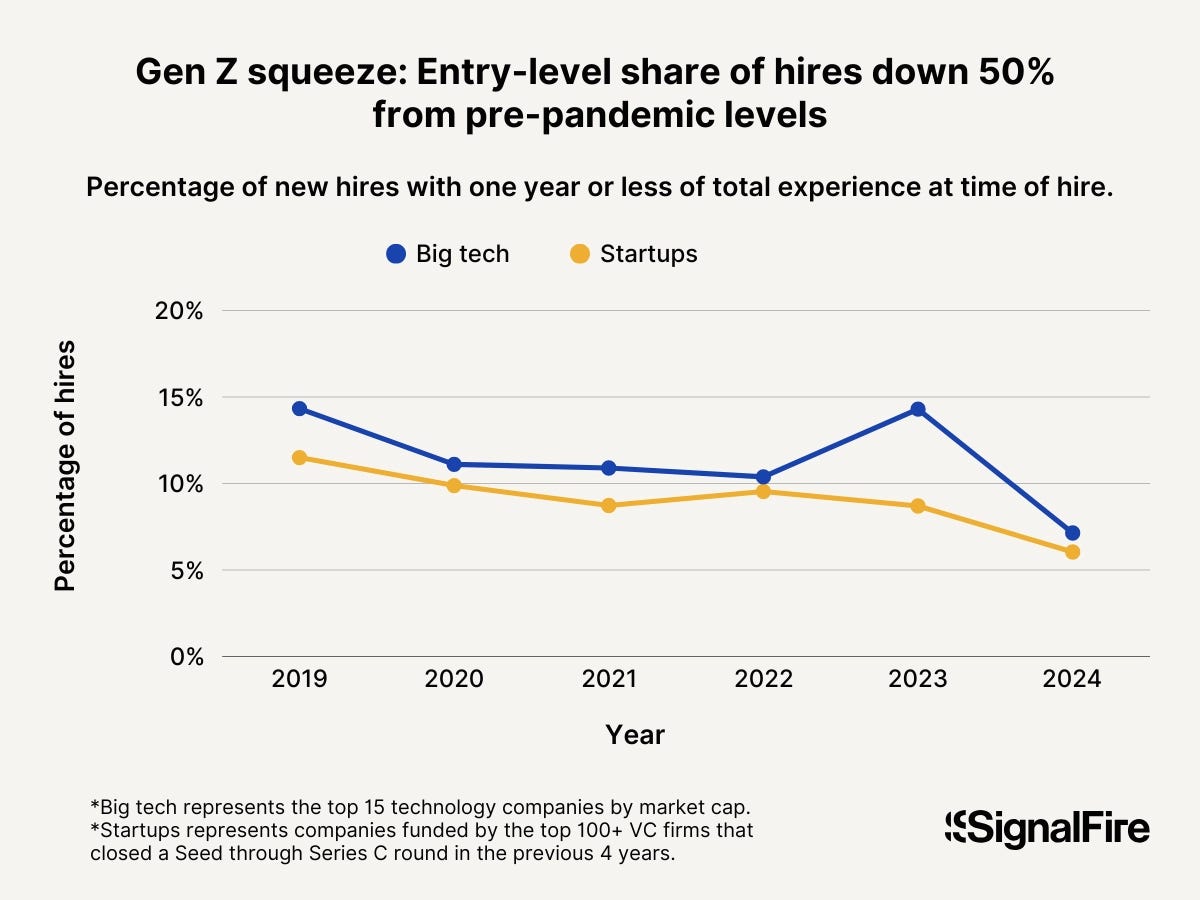

What more people should pay attention to: The traditional career ladder is breaking for Gen Z and beyond

College-educated Americans now make up 25.3% of total unemployment, double the rate from the 2008 Financial Crisis. Given the US has been the early adopter of AI, this is likely a trailing indicator for white-collar jobs worldwide.

The numbers globally back this up. Entry-level tech hiring has dropped 50% over three years. Indian IT companies have cut entry-level roles by 20-25%. The World Economic Forum’s Future of Jobs Report 2025 warned that 40% of employers expect to reduce staff where AI can automate tasks.

Most high-paying entry-level jobs involve making slide decks, building financial models, debugging software, and taking notes. These are exactly the tasks AI is already good at and improving rapidly. Seeing what NotebookLM and the latest models can do was a rude awakening. A team that needed 10 entry-level employees might now need just 3-5.

In India, where the median age is just 28, this threatens to squander our demographic dividend entirely. But there’s a flip side: if 90% of our generation remains paralysed by the false promise of stable employment, the 10% who start building might face dramatically less competition.

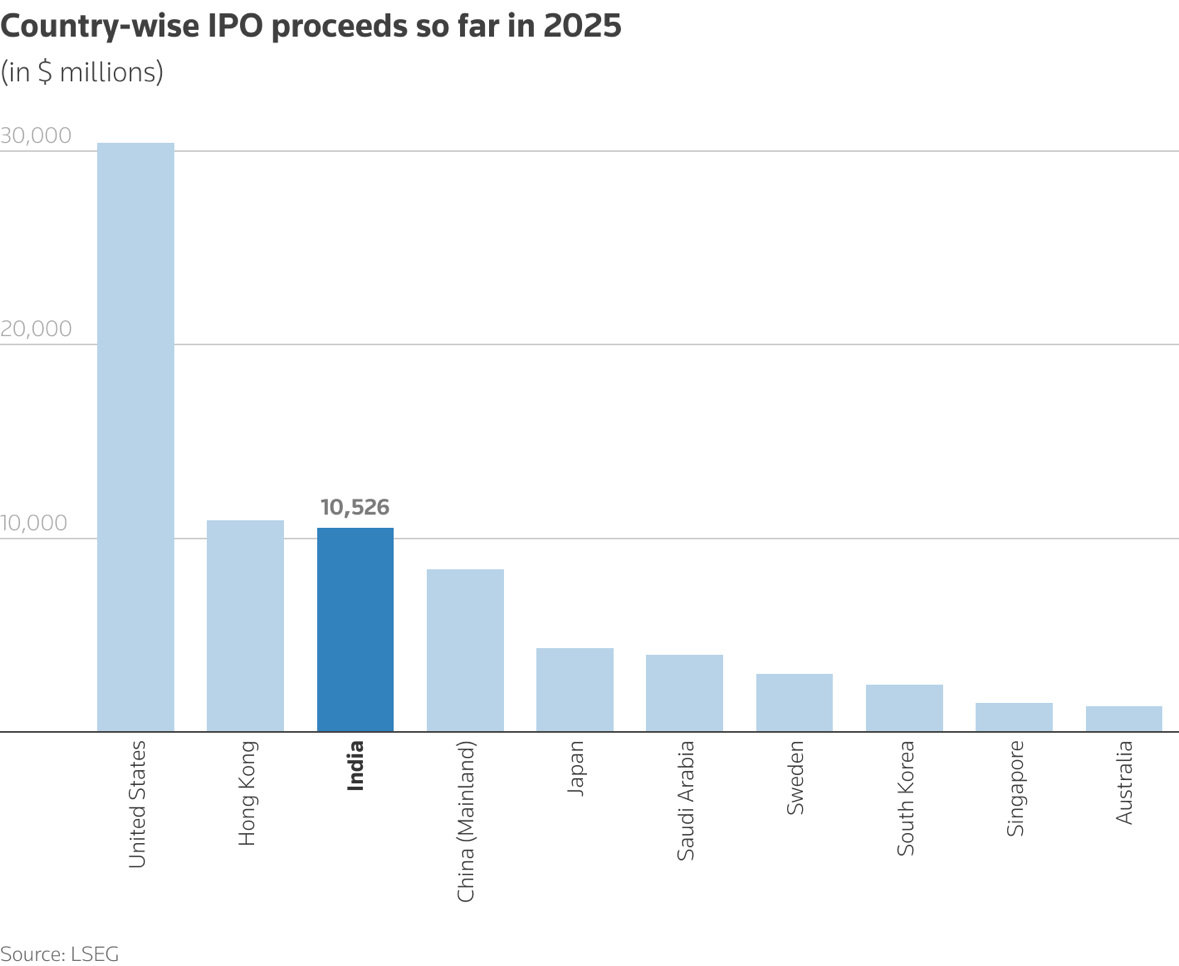

Rishabh Katiyar - Info Edge Ventures

India punched above its weight in IPO activity this year. While IPO activity is cyclical, it’s undeniable that India has become a favourable listing destination. What’s also not captured here is that the median IPO size was ₹750 crore, which implies a median market cap of ₹5,000 crore (assuming 15% dilution). This stands in stark contrast with the US, where the bar for listing is around $500 million in revenue.

In an M&A-starved country with few financial sponsor-driven buyouts, the only way for VCs and PEs to realise returns is through IPOs. Therefore, a healthy IPO market accommodating companies of all sizes is essential for a thriving private market ecosystem. Blitzscaling is not the only path to returns—unlike in the US, where size matters for a company to eventually list. A balance between growth and profitability is equally (or perhaps more) rewarding in India for both founders and investors

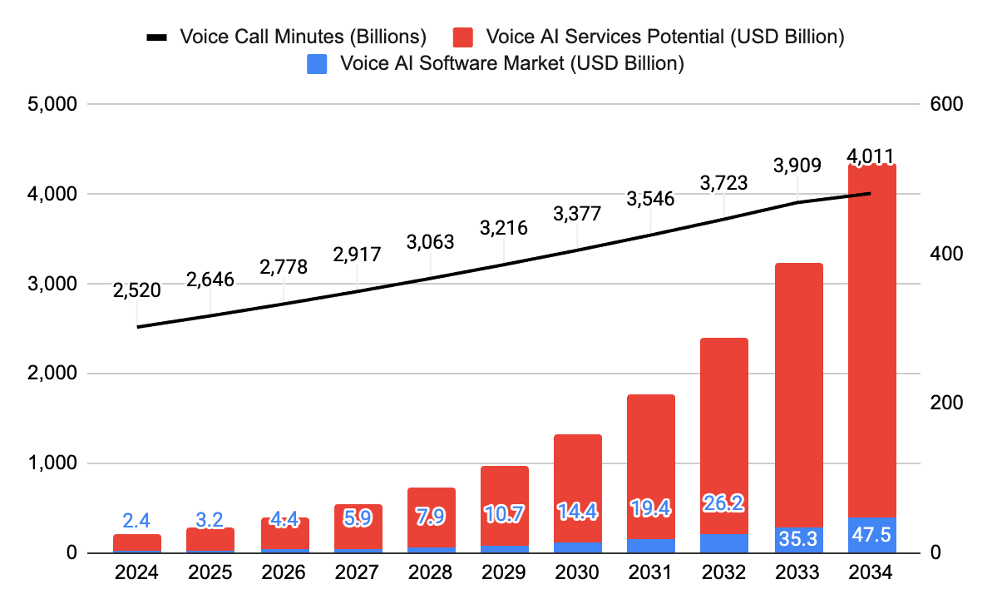

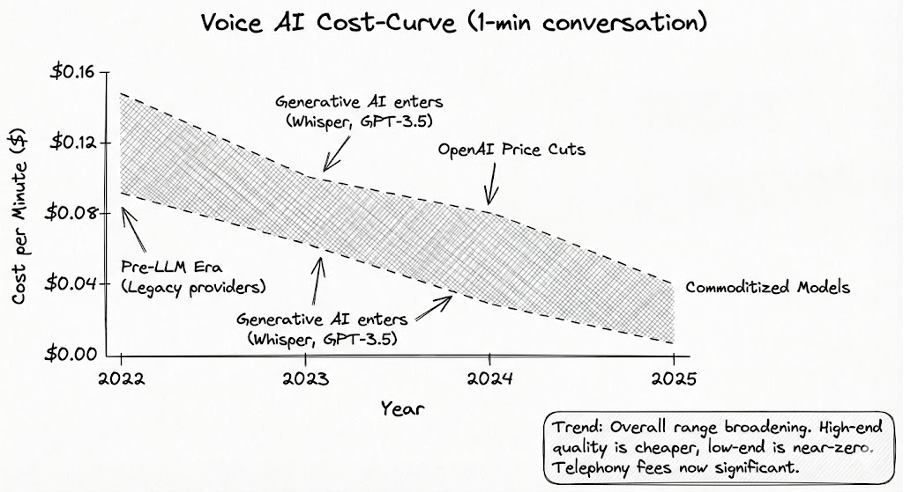

Rahul Chowdhri & Vardhan Dharnidharka - Stellaris Venture Partners

Voice has been the most natural way of human communication for more than 50,000 years. As is evident from the above chart, the use of voice is only going to go up as devices/ apps become native voice first. At Stellaris, we believe voice AI is one of the biggest opportunities in the AI supercycle.

1) Voice AI is having its own run of Moore’s Law

Both AI-led voice generation costs and latency have dropped by roughly 90% in 3 years. We have already crossed the uncanny valley where humans can figure out that they were talking with an AI-bot only after a 15-min call. Voice generation cost is now determined more by telephony (phone carrier fees) than the AI itself. All of this while there is still so much to happen with speech-to-speech models, embedded reasoning models, emotions, multilinguality, multimodality, etc.

2) Voice AI Opportunity

Just in the US, 1.4T call minutes gets consumed every year, of which ~600B was within business settings. On the foundational models, TTS upstarts such as ElevenLabs, Cartesia, Minimax are now major players and did not exist until a few years back. Some of the areas that will get disrupted are Customer Support/Contact Center, US Healthcare, BFSI, Logistics - each of these are spaces that spend hundreds of billions on personnel who spend the majority of their time coordinating over phones.

3) India & Voice AI

India’s “Do it for you” (DiFY) market presents a unique opportunity for Voice AI to drive top-line revenue growth and solve human scalability issues, unlike developed markets where it focuses on cost efficiency. Indian Voice AI opportunity is about solving unique problems across unit economics, multi-lingual support and scarcity of training data. Some interesting themes are Indic models (Sarvam and AI4Bharat), vertical outbound calling (Arrowhead), multimodal customer support (Limechat), recruiting for frontline workers (Hunar) etc.

4) TAM is unbounded

A senior BFSI leader stated human call centers reach only 5-10% of health insurance leads, and only during non-peak times. A QCom leader is limited by human capacity in successfully onboarding new gig workers. We believe Voice AI’s true TAM exceeds current bottom-up minute analysis, as human capacity currently constrains outreach and potential tasks. And all this is in the enterprise world - in addition, there is a massive opportunity to innovate on the consumer end - companions, coaches, dating, etc.

5) 2030 Prediction

As technology progresses, we will soon have an era of extremely proficient Voice AI twins (of humans/Enterprises) talking to other Voice AI twins to facilitate, coordinate and complete tasks. In fact, the communication between the Voice AI bots will be in a whole new machine-only language for efficiency and transcription back will only be for human readability.

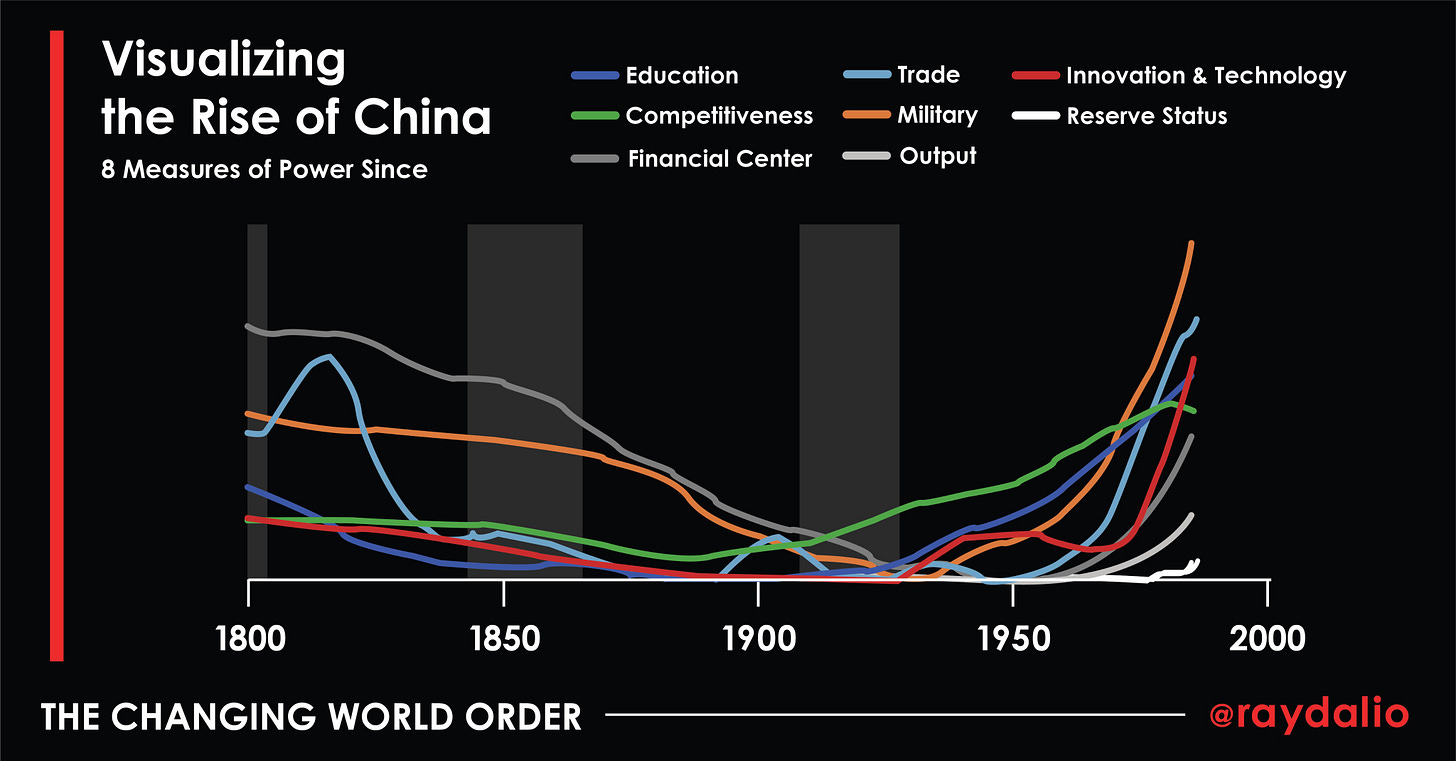

Utsav Somani - iSeed

For me, it’s a focus on changing world order and geo-politics. Specifically, the commentary and charts that Ray Dalio has been posting about and referencing in his book, The Changing World Order.

We’re due for a reset in many things. Covid accelerated a few things and delayed some. But change is definitely coming. And it will be fast, sudden, and something that we cannot predict.

Akshay Mehra - Hummingbird Ventures

Indian founders are rejecting the comfort of local maxima. In the early chapters of most startup ecosystems - whether due to confidence issues or extenuating circumstances - ambition tends to be capped at the ceiling of a country’s boundaries.

It’s now clear that India has pushed well beyond this, initially with software companies like Freshworks, and now with greater velocity as seen in AI companies like Invideo/Composio, fintech companies like Aspora, and even deep tech companies such as Airbound and Aspera. Even Indian students that travel overseas for their degree have amassed the self-belief to take the leap quickly by dropping out to build.

But this should come to no surprise for us in the ecosystem: the sheer depth of technical talent, lower cost of manufacturing for hardware, and nuanced forward-thinking product instincts have made this shift inevitable.

In my own time as an investor, I have noticed a subtle shift in how founders share their plans for their companies, how they think about attracting the best talent beyond borders, and how they articulate their dreams of building global companies. The ambition gap that once defined Indian startups is quietly disappearing, and that may be the most important trend in the ecosystem today.

Rahul Humayun - General Catalyst

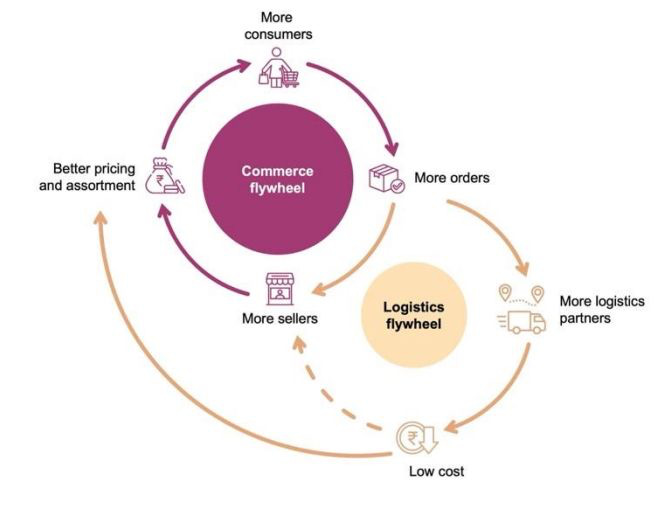

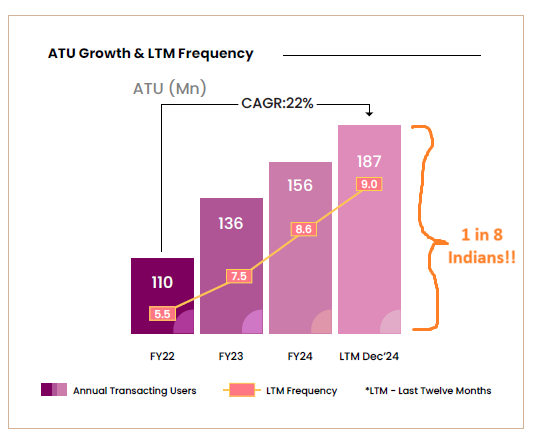

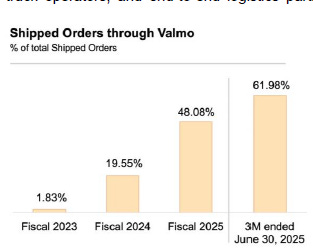

Take a look at the graphics below from Meesho’s DRHP that have been stuck in my mind:

Graph #1:

Graph #2:

Graph #3:

Meesho has built an N-of-1 horizontal e-commerce company (most capital efficient / cashflow profitable / low AOV - Rs 270 / $3) and the role of Valmo (its in-house logistics platform) has been critical in it. Valmo ensures a low cost delivery experience (0.5-1kg is 0.5-11% cheaper than scaled e-comm logistic providers) for supply that in turn incentivises them to keep prices low for consumers.

I’m super excited about founders using software to efficiently coordinate existing supply / infrastructure at scale to reimagine consumer markets and even create new ones (eg: concierge services, hyperlocal home services) at differentiated cost structures & lower capital outlay!

Rapido is another example of a no frills platform that coordinates existing supply around a radically different incentive structure. If you want to further go down the rabbit hole, check out Wander in luxury vacation rentals!

This is a pertinent opportunity even within enterprises. Given its ability to replicate human labour, AI is a massive multiplier in helping coordinate across humans + software tools (we see this playing out in our AI-enabled roll ups globally such as Dwelly in property management, Beacon Software in niche vertical SaaS, Accrual in accounting, amongst others).

Sajith Pai - Blume Ventures

These two charts really capture how the Indian equity market is being reshaped by domestic flows—particularly the relentless rise of SIP-led inflows. What stands out to me is how the surplus savings of India 1, or the more affluent Indians who account for the bulk of the country’s financial savings, are now showing up directly in the equity markets. As SIP flows have grown, these structural domestic surpluses have started to materially shift ownership patterns.

A decade ago, DIIs held barely 10% of the market—less than half of what FIIs held in FY15. Yet, within ten years, that picture has flipped, and DIIs have overtaken FIIs in ownership of Indian equities. And this isn’t because DIIs suddenly turned bullish or poured more money in. If anything, FIIs have been net sellers or have steadily reduced their ownership share over this period.

What’s protected the market through all of this, and what is now powering its growth, is domestic capital—especially SIPs. The discipline, predictability and sheer scale of these monthly flows are creating a structural backbone for Indian equities. To me, this is a genuinely fascinating and under-appreciated story: the Indian market is increasingly being owned, shaped and supported by Indians themselves.

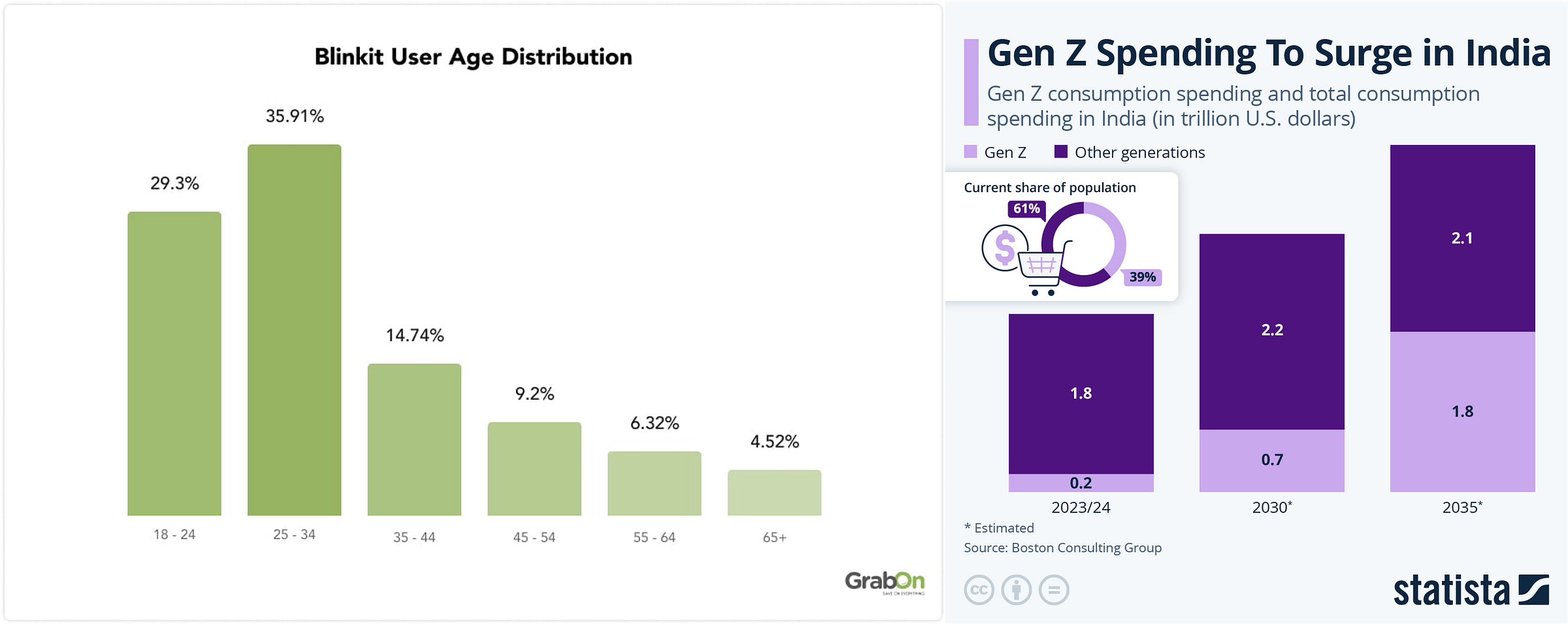

Sanil Sachar - Huddle Ventures

We’re bound to see massive tail-winds for newer brands in highly competitive segments to grow and rank as strong contenders, and in some cases, leaders as well. That means we’re likely to also see increased momentum of acquisitions from larger organisations who will look to integrate these brands and their customer base, as well as private equity outcomes resulting in favourable returns within the consumer ecosystem.

A few key indicators point towards these positive outcomes:

75% (and growing) of Indian online shoppers are aged 18–44, with a significant concentration in the age bracket of 18–35 years old. This user base is what we observe as digital-native and digitally empowered age groups. They are driving online buying across categories like fashion, beauty, wellness, personal care and FMCG, which are typically categories where challenger brands rapidly gain traction through digital engagement and a unique and favourable consumer experience.

Baby/kids and the ‘new-age parent’ wallet is a large segment I shared would be a winner in 2025, and a large reason for the above remains to be the first two points - age playing in favour of this trend as well as the buying behaviour aligning to a rise in new-age brands for kids. This was a key reason for us backing OZi as well, who are proving this hypothesis correct with their growth.

Younger cohorts are also adopting quick commerce and app-first shopping, with over 60% of consumers preferring mobile apps for shopping due to convenience, vernacular support, and UI/UX features that support exploration and personalisation (as reported by Economic Times as well).

Lastly, Tier-2/3 growth is extremely promising and a greenfield. Non-metro shoppers from younger age groups are rapidly adopting e-commerce at similar or higher rates. This is only expanding market size and lowering customer acquisition barriers for challengers relative to incumbents who remain retail-heavy.

In a nutshell, these consumer preferences create room for new brands to out-innovate traditional players and make 2026 a brilliant year for consumer brands to scale, build trust with a growing customer base, and flourish with an audience that is tech-savvy, has strong views on what they want, and is just a click away from becoming loyal customers.

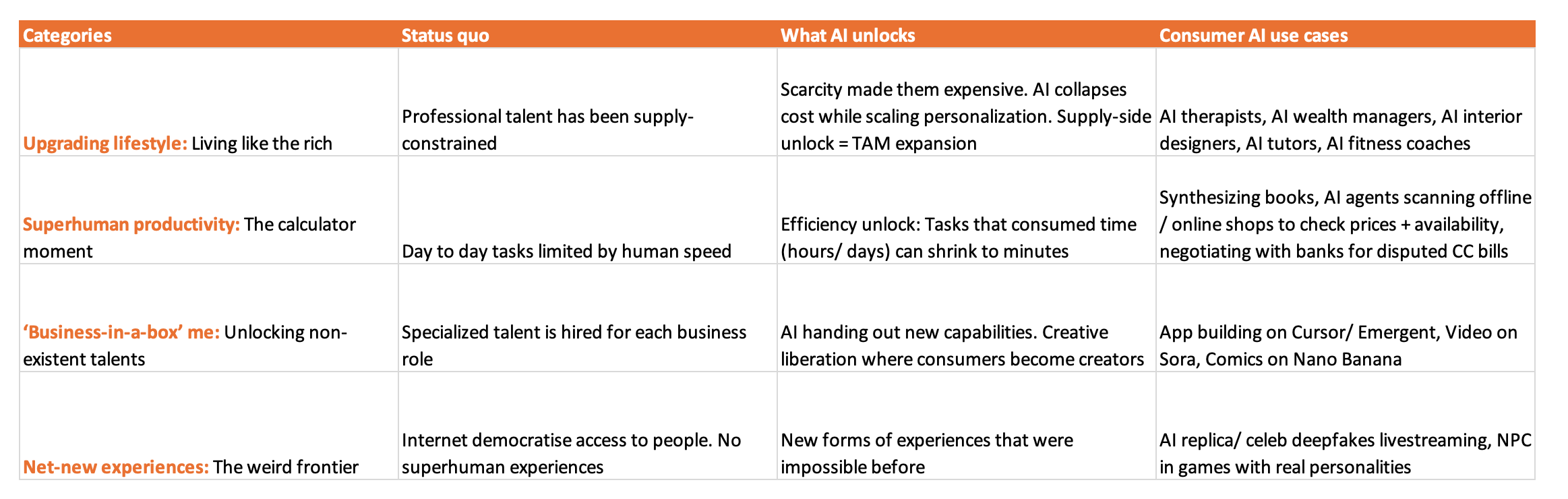

Priyal Motwani - Lightspeed India Partners

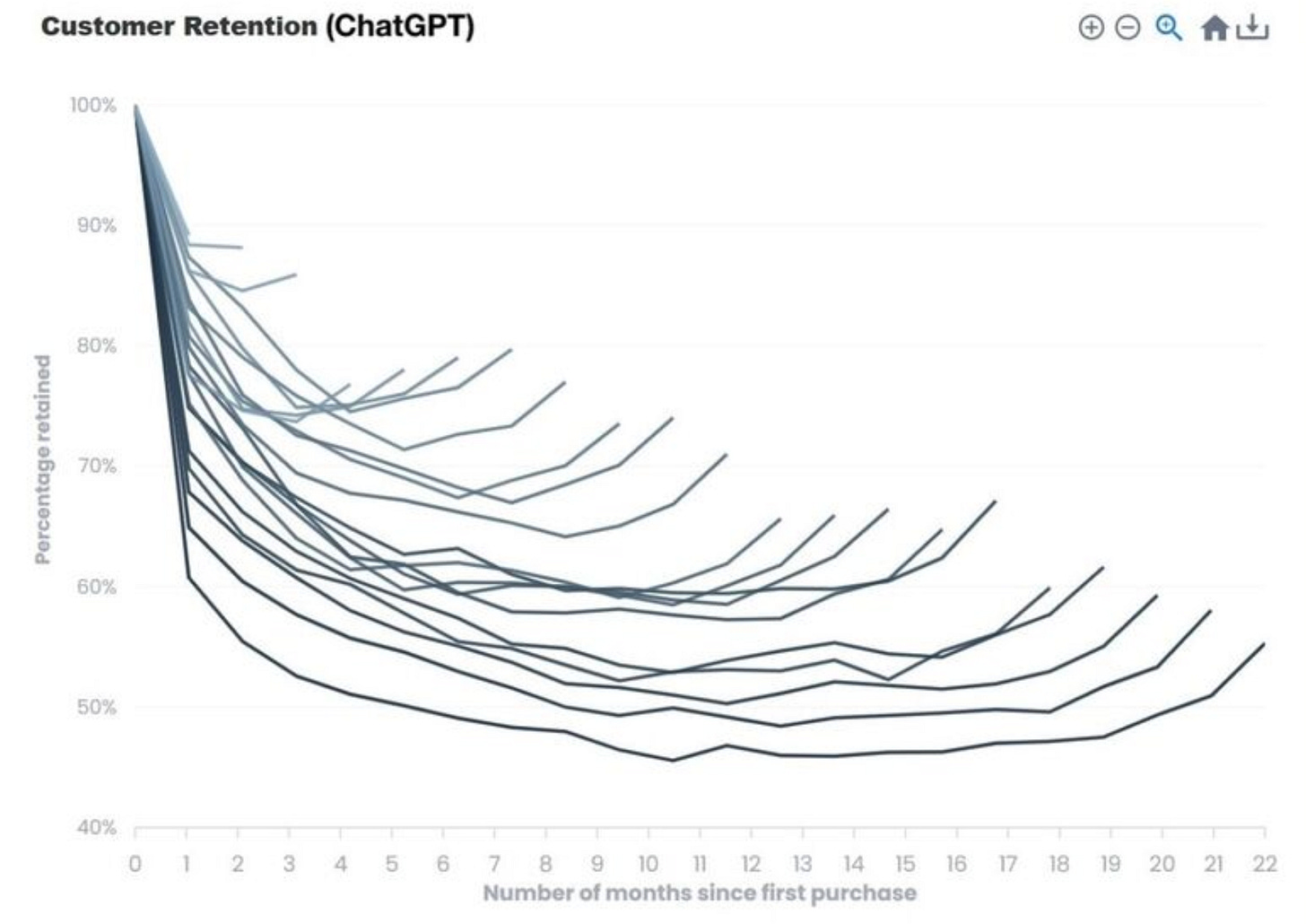

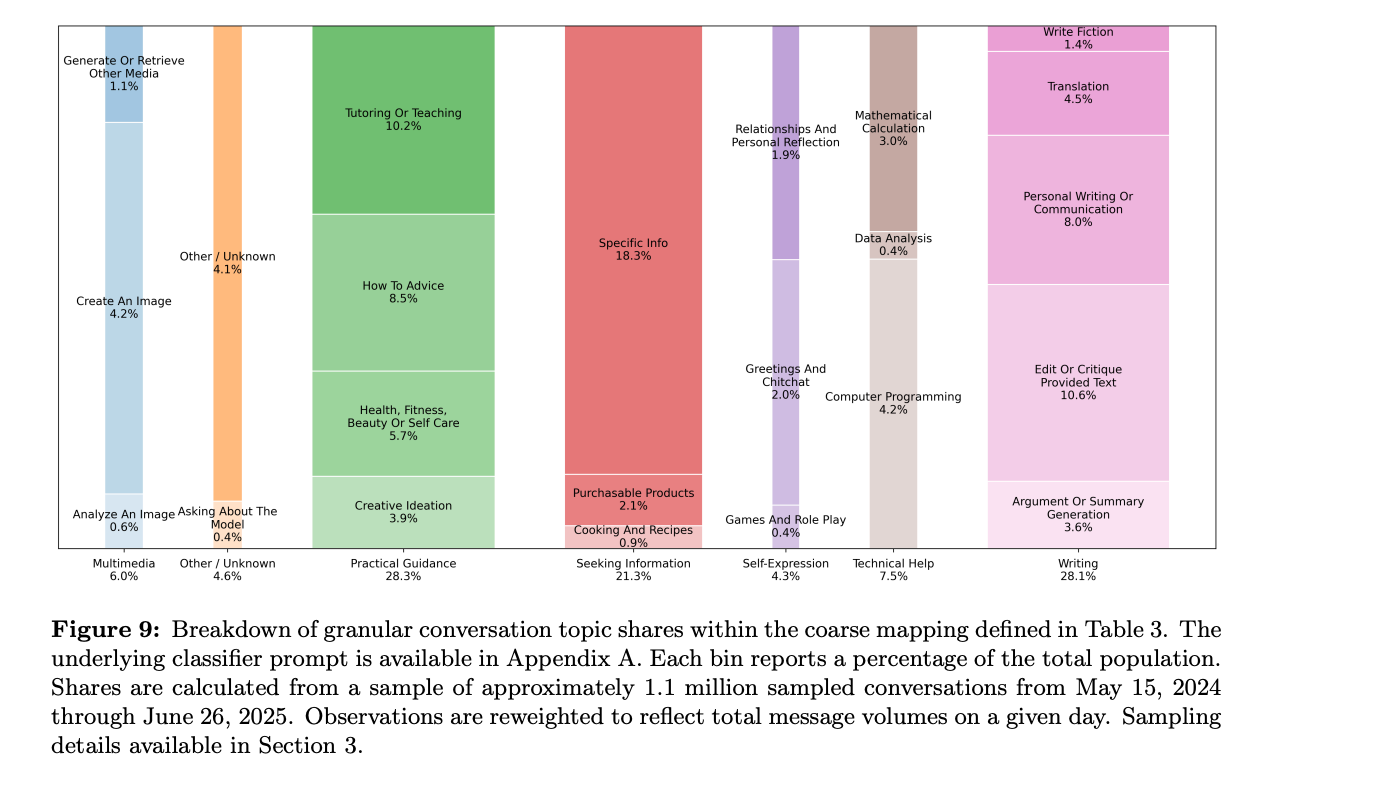

The Verticalisation of ChatGPT

ChatGPT is a generational consumer product. As the internet democratised access and distribution to the “talented”, ChatGPT democratised talent itself. Capabilities that were scarce, expensive, or impossible to access are now universally and instantly accessible.

This magic is clearly being appreciated by users too - the product boasts unbelievable retention (90% in M1) and rapidly growing smiling curves. Brilliant!

However, when we double click on how it’s being used, it’s clear we’re just scratching the surface.

Use cases are still mostly concentrated around ‘seeking information and guidance’, or ‘writing and synthesis’. So while we may have discovered fire, the next few years is when we will actually learn how to use it well.

What ChatGPT lacks is proactiveness, and the ability/willingness to take ownership of a task from end to end. Humans are inherently lazy thinkers. Every act of “what else can I do with this?” is friction. This is where the “verticalisation of ChatGPT” could come in.

The blocker to making ChatGPT my wealth manager or therapist is not my intent or its capability, it’s my imagination. I just don’t know all that’s possible, end-to-end. ChatGPT is a great ‘Jack of all trades, master of none’. Areas with high expertise and need for differentiated experience are most obvious candidates for verticalisation.

The next few years could see Consumer AI having its own large-scale winners. But what will it look like? Maybe something like this -

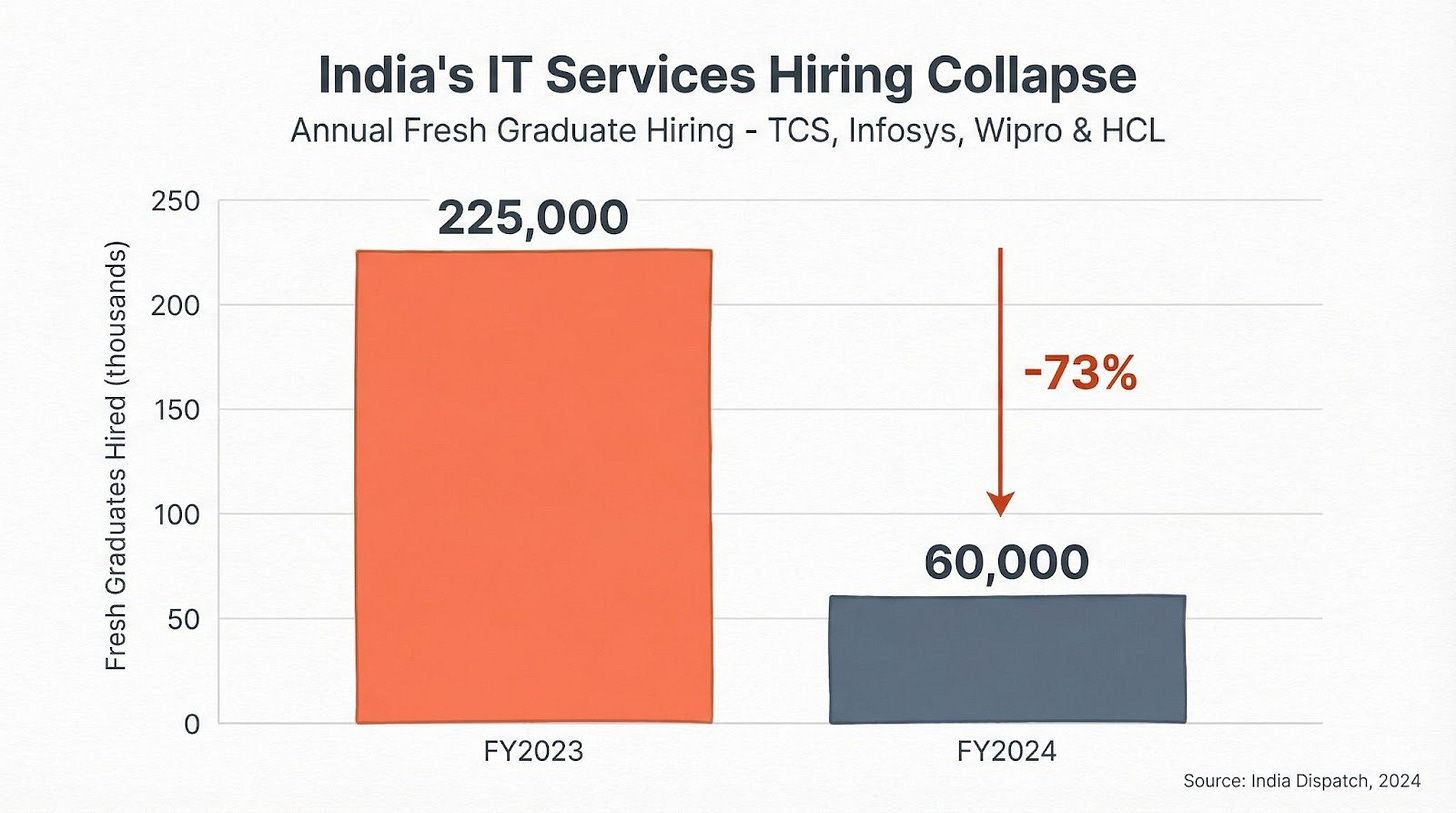

Arjun Malhotra - Good Capital

AI is cracking the foundation of India’s Services Exports

India’s IT services giants built their empires on hiring thousands of engineering graduates every year and exporting their work to developed markets. Here’s what’s happened to that hiring:

Even if part of this is cyclical, the structural shift is that AI is increasingly handling the repetitive execution work that armies of junior engineers once performed: data sanitation, migrations, testing.

Why this matters: The pyramid that employed millions is hollowing from the bottom up. AI will be an existential threat to jobs unless we find a way to harness it toward creating jobs in our economic structure.

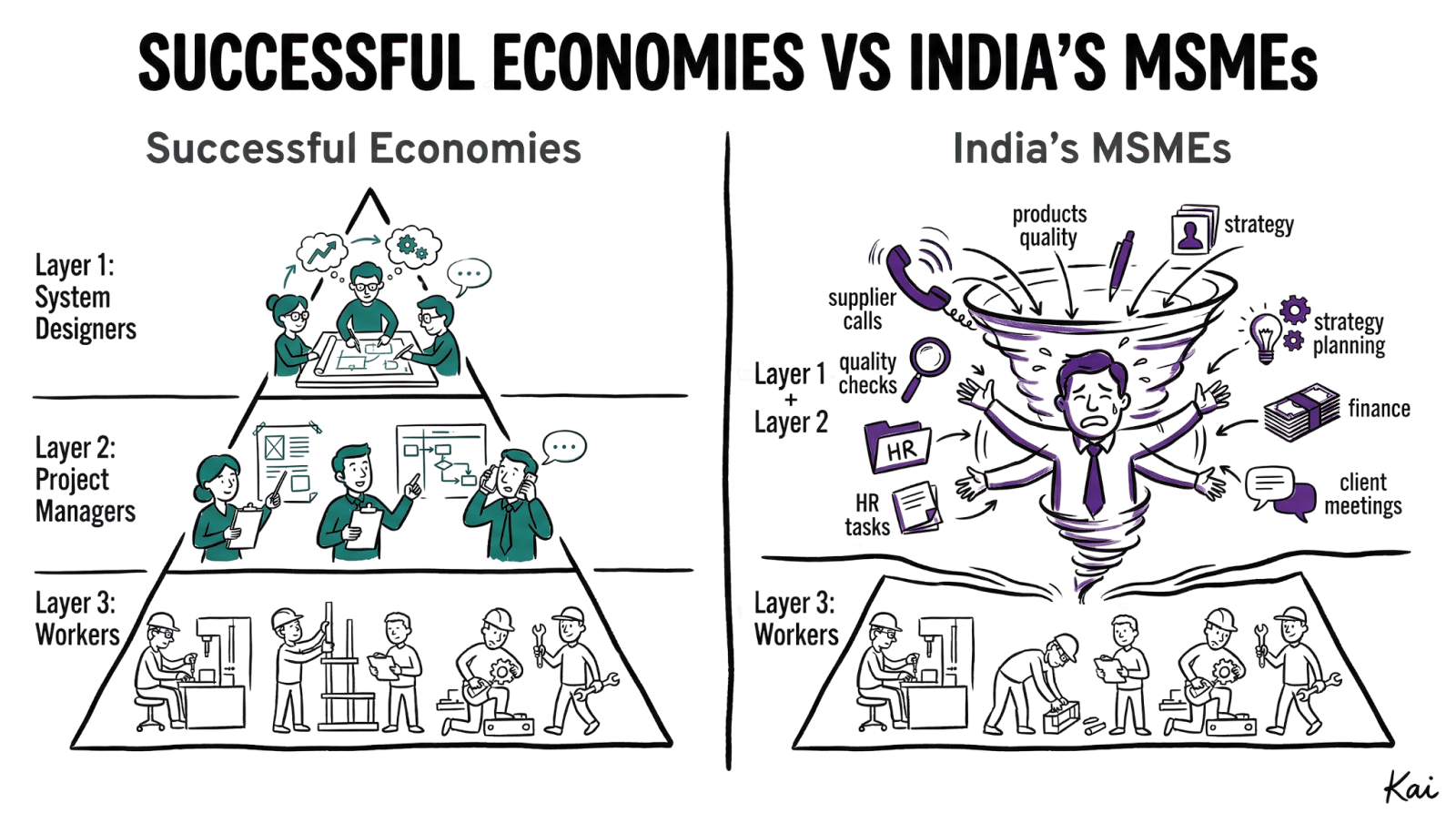

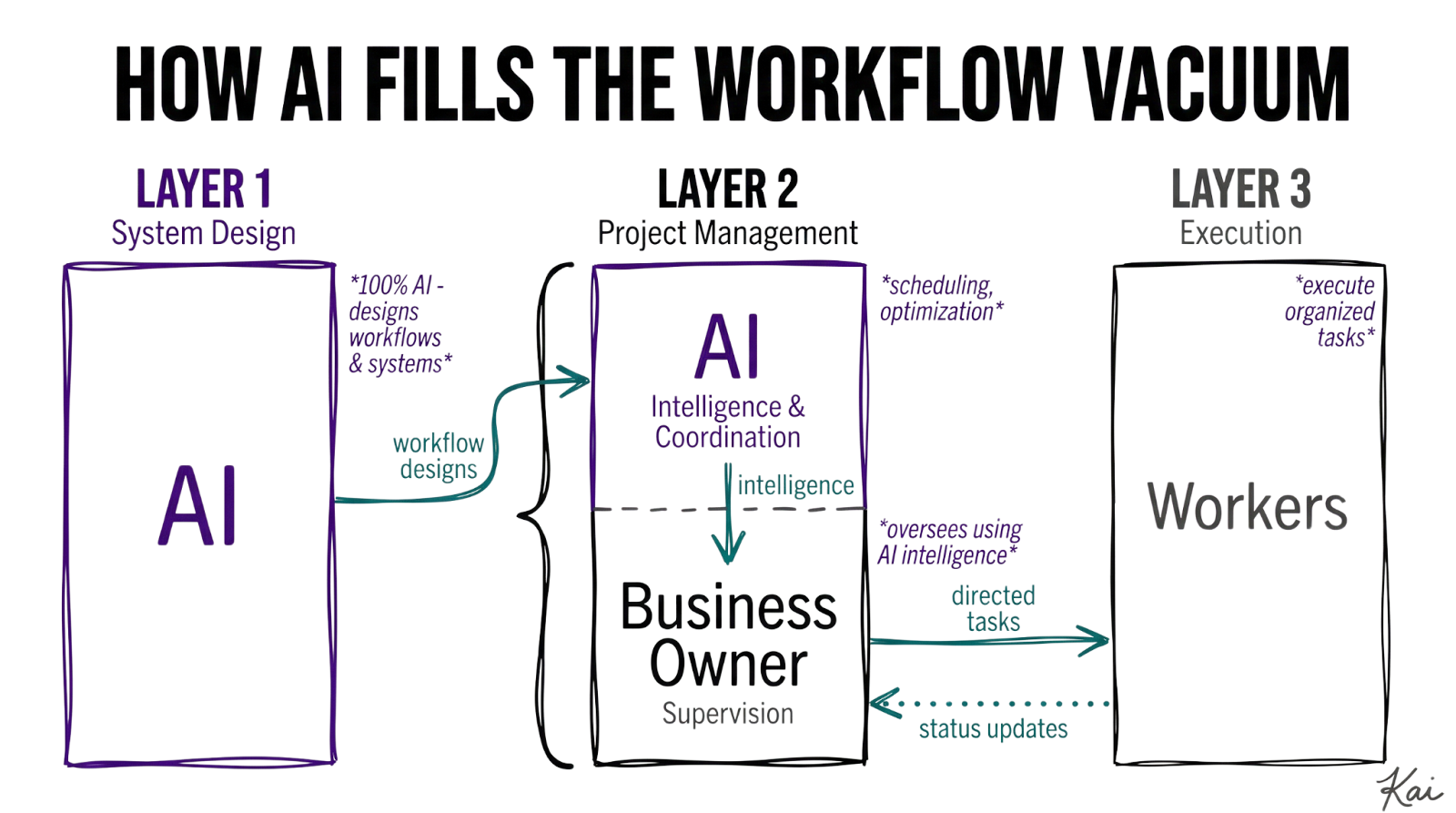

We believe the opportunity is in enabling India’s 63 million MSMEs and making them competitive with professionalised services. Today, Indian MSMEs operate through chaos. With a lack of organisational design (at Layer 1), these SMEs face a fundamental workflow vacuum:

System design (Layer 1): They have no one to design great systems: create structured workflows through which things get done, sequence and project manage work, optimise resource allocation.

Project management (Layer 2): The owner has no time to run high performance teams – simple things we take for granted can’t be done, e.g. weekly syncs, information capture via CRM, feedback loops via periodic checks of an inventory tracker – and the owner is left dealing with whatever comes at them.

Here’s where we believe startups can create value:

In Layer 1 (System Design): AI startups can create workflows and design systems through which SMEs can run like high-performing teams

In Layer 2 (Project Management): AI can assert the system design to effectively be a Project Manager, while supporting the business owner to work as a taskmaster.

In our portfolio, businesses like MyGenie (in construction) and Kookar (in home cooking management) are such examples building the scaffolding to wrangle AI to orchestrate the complex workflows of SMEs.

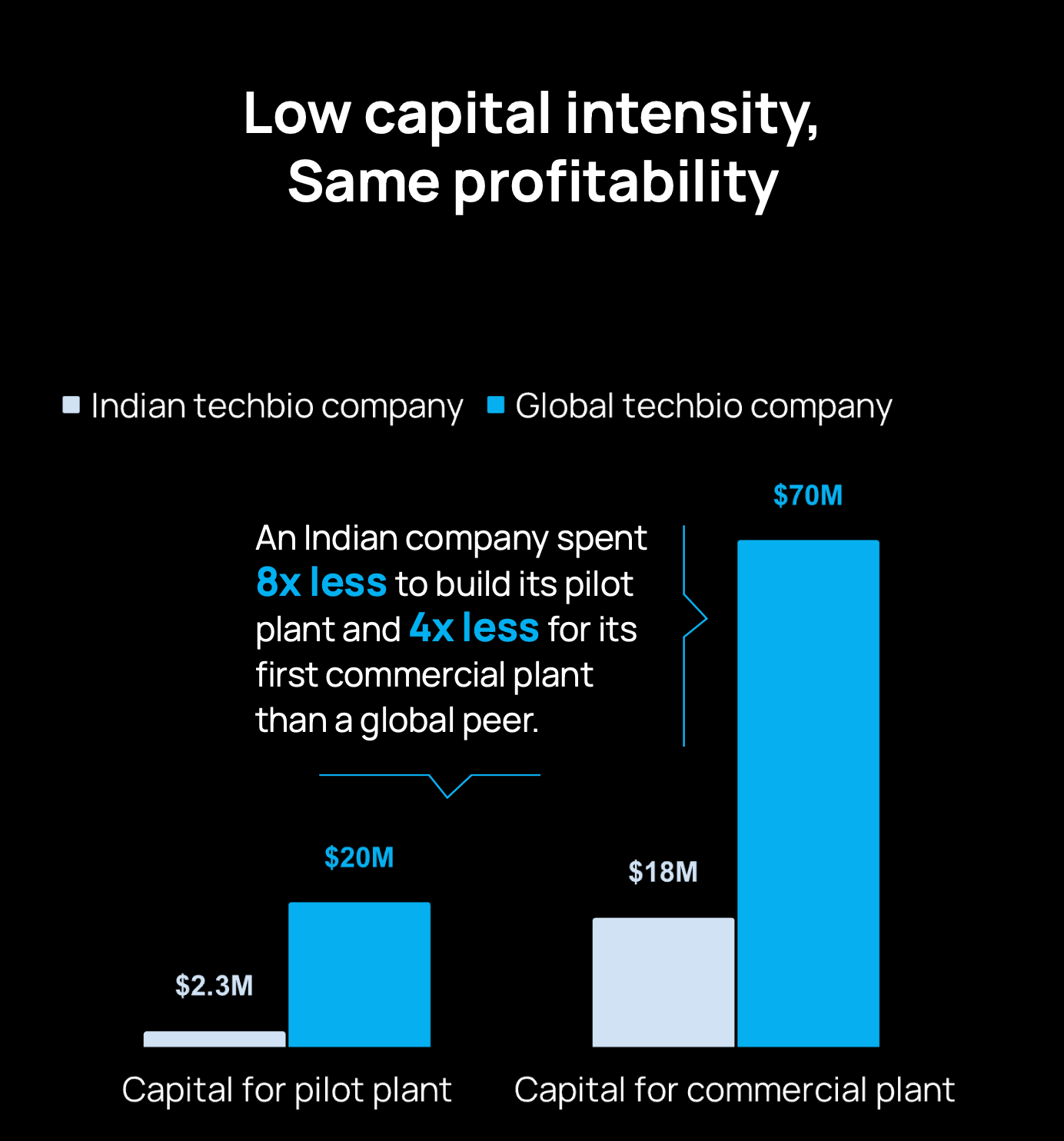

Ritu Verma & Vishal Katariya - Ankur Capital

The journey from lab to market is gaining real momentum in India. Technology acceleration, large markets built on new technologies, and India-specific tailwinds are converging to make India a global hotbed for deep science innovation.

India’s globally competitive R&D, highly-skilled talent base, and unique market landscape enables premium science commercialisation at compelling economics. What stands out for us is this graph:

India is building world-class companies with a fraction of the capital compared to global peers. As an investor, that’s what matters. Read our 2025 India Deep Science Tech Report where we unpack the India opportunity for science-based ventures.

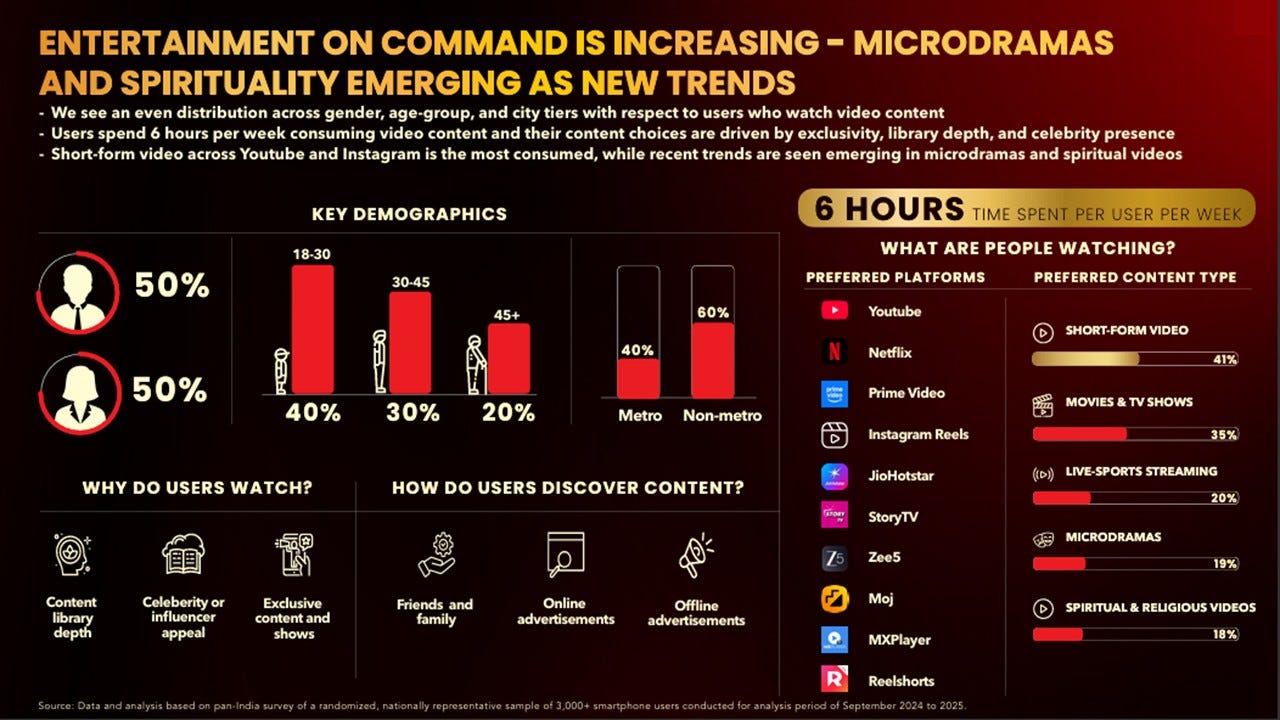

Salone Sehgal - Lumikai Fund

The rise of snackable content: Microdramas are India’s next big entertainment habit

For the last three years, we’ve been tracking the rise of micro-dramas - first in China, then across emerging entertainment ecosystems and this year, the format has clearly reached its inflection point in India. These 5–10 minute narrative episodes are built for fragmented attention, idle moments, and mobile-first consumption.

Our recent consumer study, Swipe Before Type: How Indians Watch. Listen. Play. Pay. released in November - captures this shift clearly: 1 in 5 video consumers in India already watch micro-dramas, placing them meaningfully close to OTT and short-form video.

What hyper-casual did to mobile gaming and TikTok did to social video, micro-dramas are now doing to storytelling: compressing format without compressing emotional payoff.

This data goes shows that India is doing something akin to inventing a new grammar for entertainment. And this goes beyond just consumption. There is real monetisation happening here as well. Apps like StoryTV, a Lumikai portfolio company and one of the top-trending consumer apps in India, now demonstrate not just heady consumption stats but also a real willingness-to-pay behaviour, a shift we’ve observed firsthand.

This is a “winner-takes-all” market where distribution moats, speed of content production, differentiated IP and gamified content delivery (e.g. cliffhangers) are critical to drive topline growth and generate healthy margins.

Natasha Malpani Oswal - Boundless Ventures

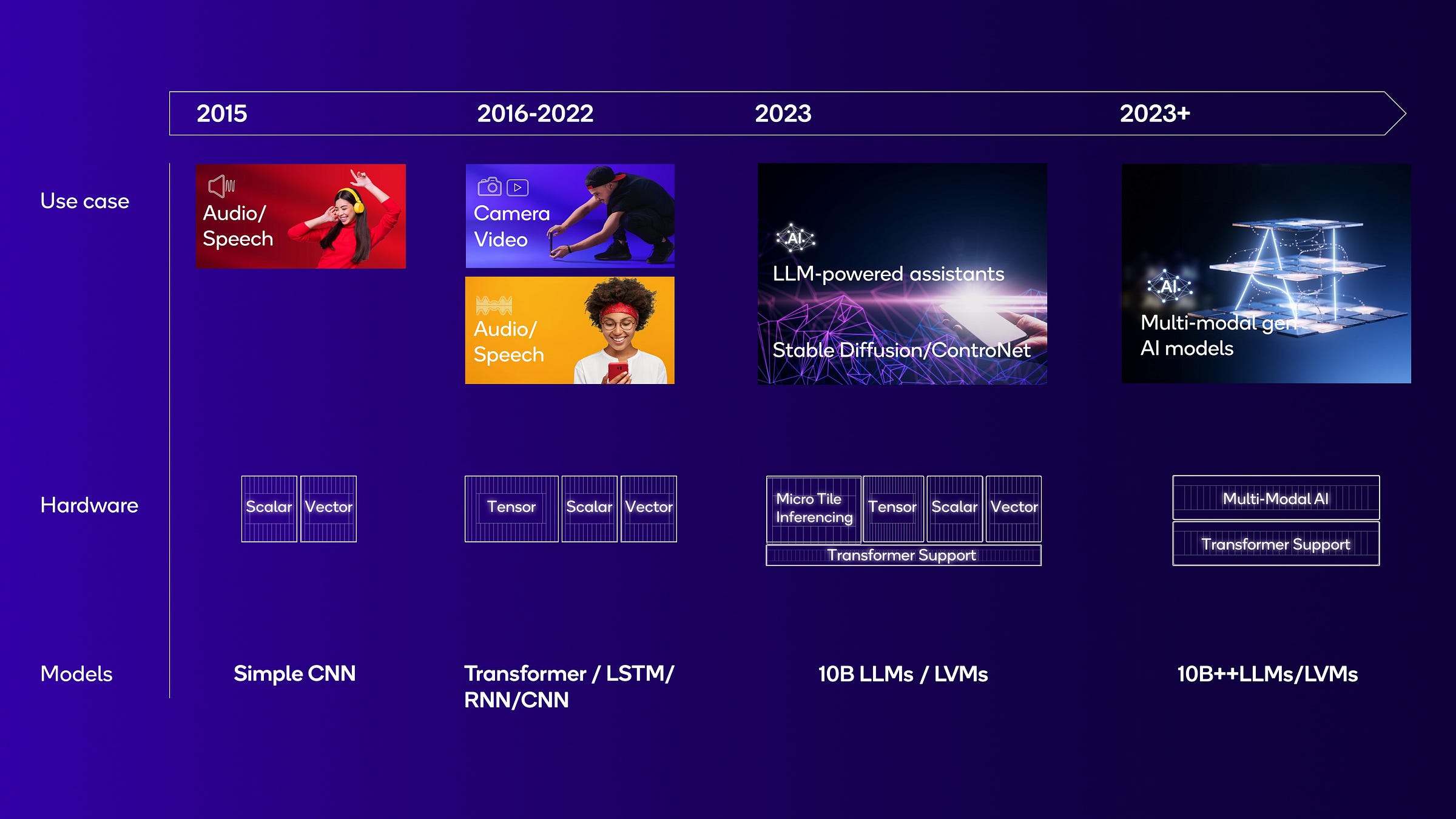

This timeline shows a quiet but decisive shift: AI inference workloads are moving out of the cloud and into the world. In 2015, devices could handle simple Convolutional Neural Networks (CNNs) for audio or speech. By 2016–2022, cameras, video and early transformers forced hardware to evolve toward tensors and specialised acceleration.

Then 2023 arrived, and the models changed shape: and became multimodal, generative, large, agentic. Instead of pushing everything back to datacentres, our devices adapted. Neural Processing Units (NPUs) learned to run transformers, diffusion, and multimodal inference locally. Silicon bent itself around new behaviour.

This is the platform shift we’re underestimating. Intelligence is becoming ambient. Private, immediate, contextual. AI isn’t just in the cloud anymore. It’s in our hands, pockets, homes, and streets. And that will redefine the next decade of products.

Dinesh Pai - Zerodha / Rainmatter

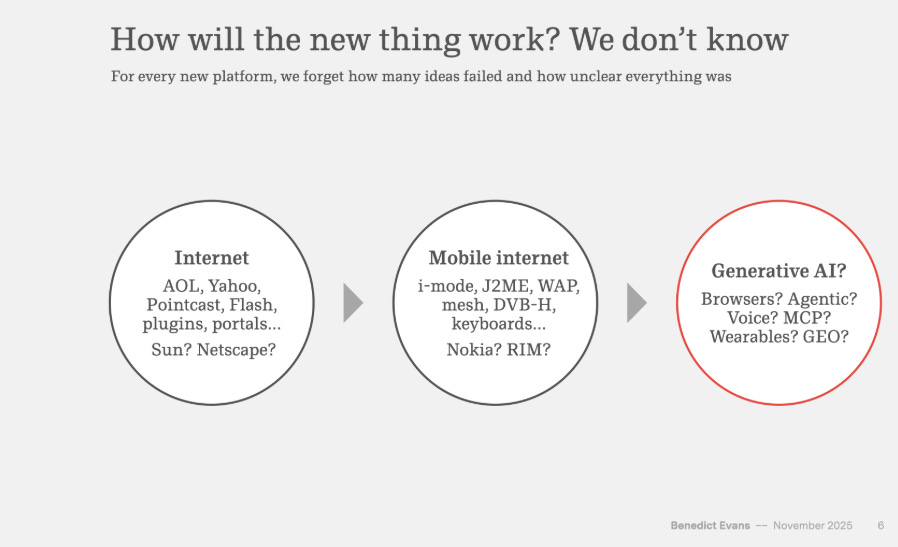

The tyranny of tiny decisions and how we are at the cusp of overcoming them.

The slide above from Benedict Evans asks a good question: ‘How will generative AI work? We don’t know’. But I think I know what to look for.

Right now, a huge amount of your cognitive load isn’t thinking - it’s deciding whether to think.

Should you respond to this email now or later? Does this message need a thoughtful reply or just an acknowledgment? Should you schedule this meeting before or after lunch? Does this notification matter? Should you remember this fact for later?

You make hundreds of these calls daily. Most are trivial individually. Collectively, they’re exhausting.

Worse, information slips through the cracks not because it’s unimportant, but because you can’t decide its importance in the moment. Someone mentions they’re hiring. You try and remember this. A few days later a friend asks if you know anyone hiring, and you’ve forgotten.

The system that wins won’t be the one with the most impressive reasoning. It’ll be the one that eliminates these micro-decisions entirely.

What this looks like?

Imagine a system that knows you well enough to handle the routine automatically. Not the important stuff - the routine stuff. The thank-you emails. The calendar shuffling. The “just checking in” messages.

More importantly: imagine a system that surfaces information exactly when you need it. Your friend asks about jobs, and before you can say “I don’t know,” your AI agent surfaces that conversation you had. Not because you asked it to search - because it knows what you need before you do.

Or consider health. Most of us don’t eat poorly or skip exercise because we don’t know better. We do it because the decision to be healthy happens at the moment we’re least equipped to make it - when we’re tired, hungry, stressed. What if there was a system that handled those decisions for you? Not by nagging, but by making the healthy option the default, the path of least resistance?

Or money. The reason most people don’t invest well isn’t lack of information - it’s decision paralysis. Too many choices, too much context needed, too easy to defer. A system that proposes a complete investment plan customised to your situation, ready to execute with one click, eliminates the inertia entirely.

This time it’s different?

LLMs are good enough to understand context, but more importantly, they’re good enough to represent you. To learn your patterns, your preferences, your decision-making framework.

The winning products won’t feel like AI. They’ll feel like a better version of you - one that doesn’t forget, doesn’t get tired, doesn’t get distracted. One that makes the obvious calls so you can focus on the non-obvious ones.

This is why all the capital is flowing here. Not because AI is impressive (though it is), but because it attacks the biggest constraint on human productivity: not our ability to think, but our capacity to decide.

The products that win will be the ones that realise most of our decisions shouldn’t require deciding at all.

Raiyaan Shingati & Priyanka Sahasrabudhe - Transition Venture Capital

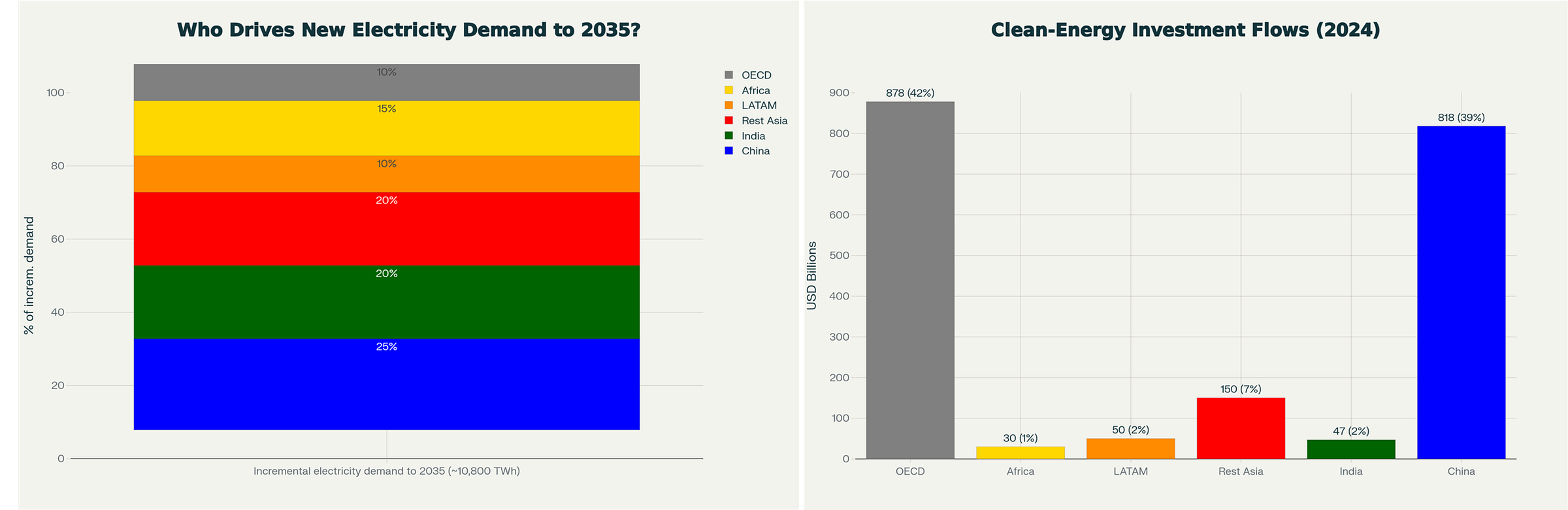

By 2035, Emerging Markets Will Drive 65% of New Global Energy Demand — but 80% of clean-tech investment still flows to rich, developed economies.

The chart on the left indicates where tomorrow’s energy demand lives: emerging markets drive ~90% of new electricity demand growth to 2035 (~10,800 TWh incremental). China (25%), India (20%), Rest of Emerging Asia (20%), Africa (15%) and Latin America (10%) lead, while OECD (10%) stalls below 2007 peaks. This reflects rapid electrification, industrialization and cooling needs in the Global South.

The chart on the right shows where today’s $2.1 trillion annual energy transition investment actually flows: advanced economies + China capture 81% [OECD - 42% and China - 39%]. Other EMs get just 19% ($277B total). Africa (1%) is starved despite 20% of world population and 15% of energy demand; India (2%) despite 17% of world population 20% of energy demand - LATAM (2%) is similarly underserved.

Rahul Mathur - DeVC

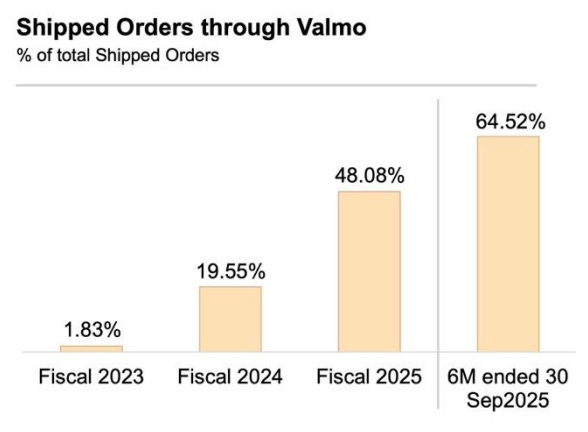

I actually have two images in mind, both of which concern Meesho.

(1) “History may not repeat but it sure does rhyme.”

- Flipkart was initially written off as an Amazon clone in India; today it’s a source of 1k+ startups

- Meesho, which was written off as a “sasta” Flipkart, filed its DRHP with incredible stats; 18.7 crore annual transacting users (albeit might include double counting given retailers buying wholesale from Meesho) with increasing LTM frequency from 5.5 to 9+ orders (per year!) || my notes from Meesho DRHP

(2) “Your margin is my opportunity” was said by Bezos but is brutally true in India

- Again, Meesho is a great case study here; look at how the company has taken logistics in-house over the years

- E-Comm Express suffered from the success of Meesho’s in-house logistics network - Valmo (more info on Valmo here)

- Put simply, given the zero commission model of Meesho - the only two revenue levers they could pull were Seller Ads and Logistics margins; the latter being quite attractive given some seller hub related characteristics.

In short: When you can’t rely on fat margins, you squeeze efficiency from every inch of the stack. Meesho turned necessity into advantage - what started as cost pressure became a moat.

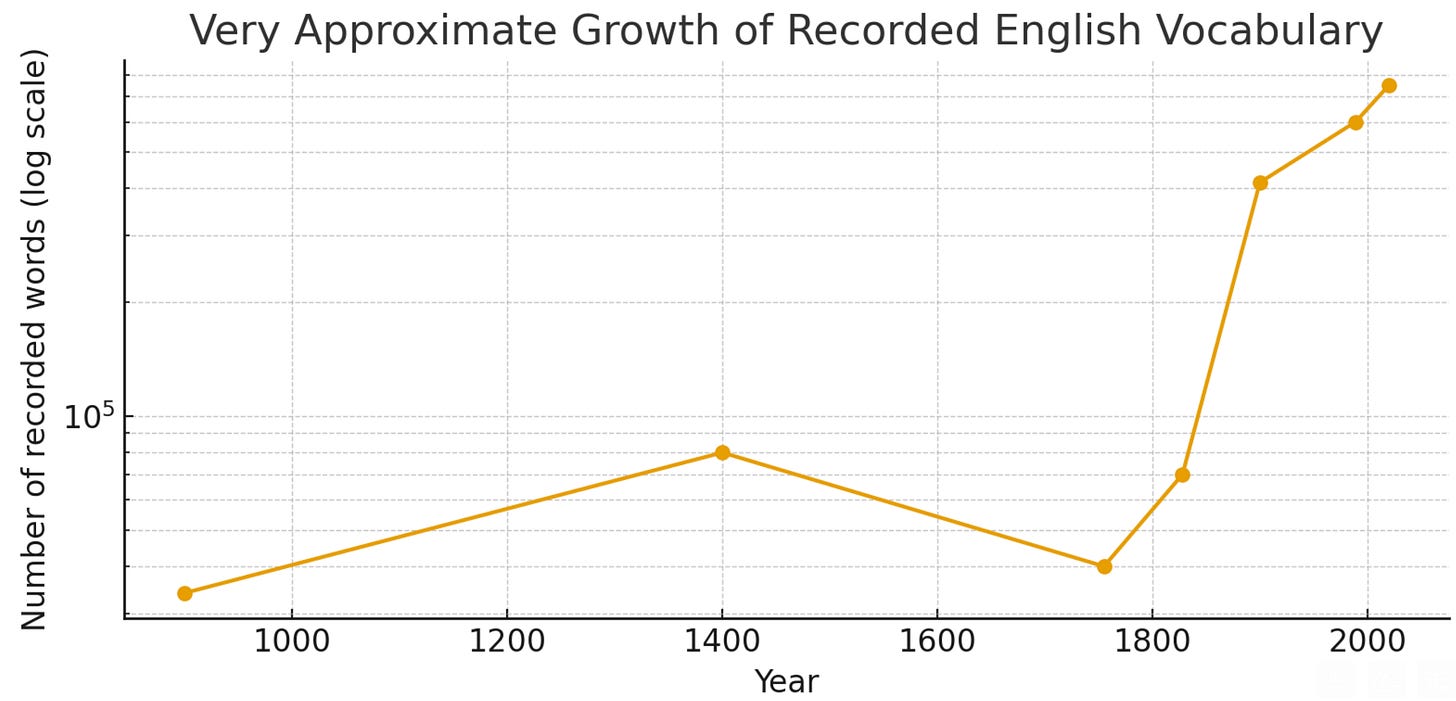

Prateek Behera - gradCapital

There are more English speakers today than there were before. Not just on an absolute scale but also proportionately (20% of the world speaks English today vs. 16% in 1990 vs. 2.5% in 1800). It is also directly correlated with the vocabulary size of English - which is close to 0.8M words. The closest second is Chinese with ~0.35M words and is also the second most spoken language in the world.

Interestingly, English probably adds more words to its vocabulary per unit time than any other language. Since 1980, it has added ~5k words per year - from other languages and new trends.

By 2100, we may have 40% of the world population speaking English - hard to ignore that vocabulary is the driving factor. Eg: its has 10x the vocabulary of Hindi or any other Indian language.

A fair assumption would be that, in general, English will be dominant in the future as well, which has some interesting implications. Eg: Any LLM or any AI product targeting the vernacular angle will naturally cap its market size by an order of magnitude - and generally won’t be very sophisticated as well.

Gautam Shewakramani and Raj Sheth - Inuka Capital

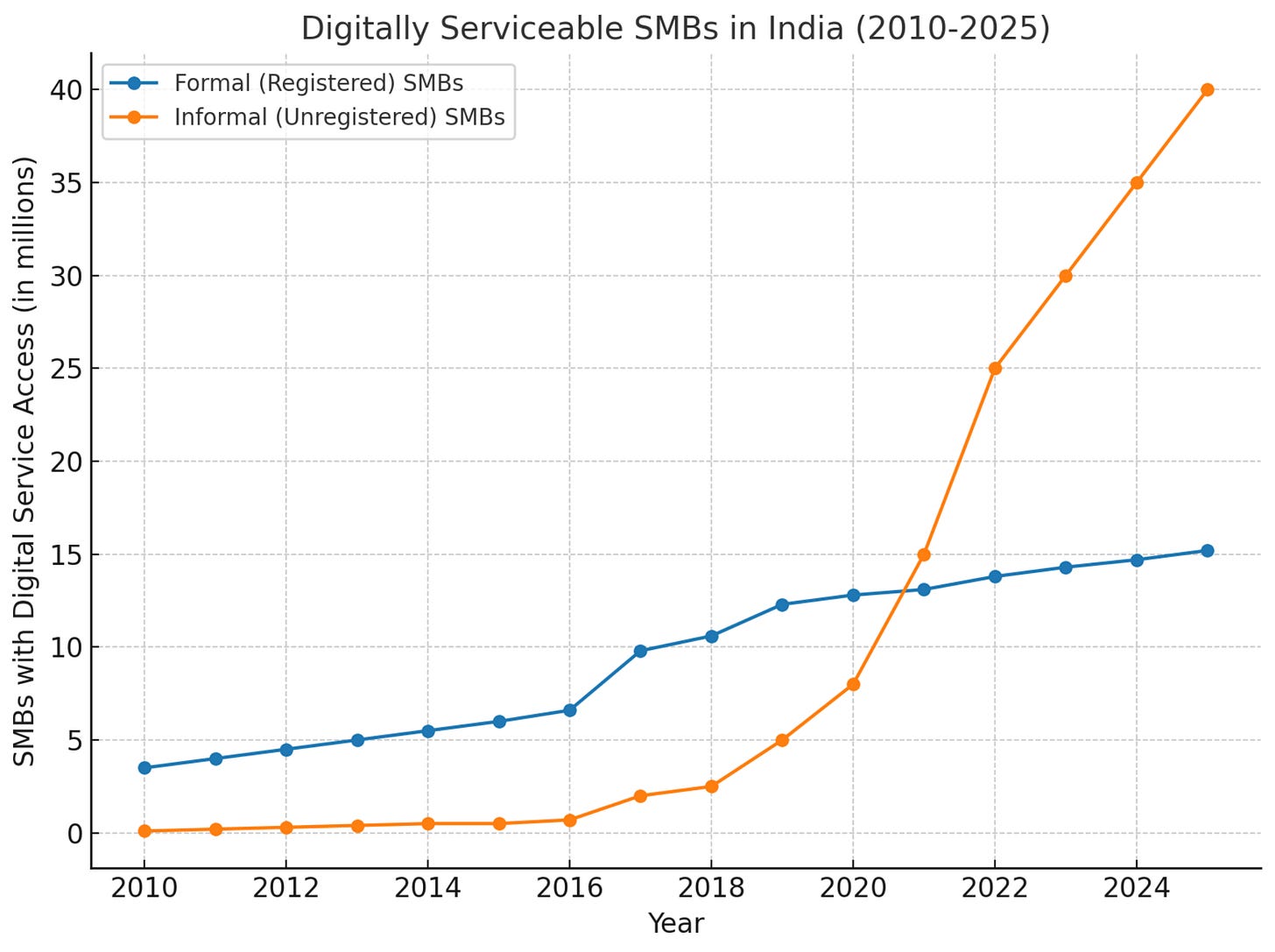

Number of digitally serviceable SMBs in India, 2010–2025 (registered/formal & unregistered/informal)

India’s small and medium businesses have quietly become one of the fastest‑digitising segments in the country. Over the past decade, India’s SMBs have embraced digital en masse, growing the serviceable market for purpose‑built SME software from just a few million to tens of millions of firms. “Digitally serviceable” SMBs are those on ERP, in the GST tax net, or transacting on platforms like ICEGATE. Formalisation after the GST rollout plus ubiquitous mobile payments didn’t just move paperwork to the cloud; they created a massive, addressable base of SMEs that can now buy, integrate & compound value through software.

That is why purpose‑built technology for SMBs is such a huge opportunity: vertical operating systems, middleware and workflow products can plug into this new digital plumbing and capture value across credit, logistics, procurement and customer experience.

Aviral Bhatnagar - ajvc

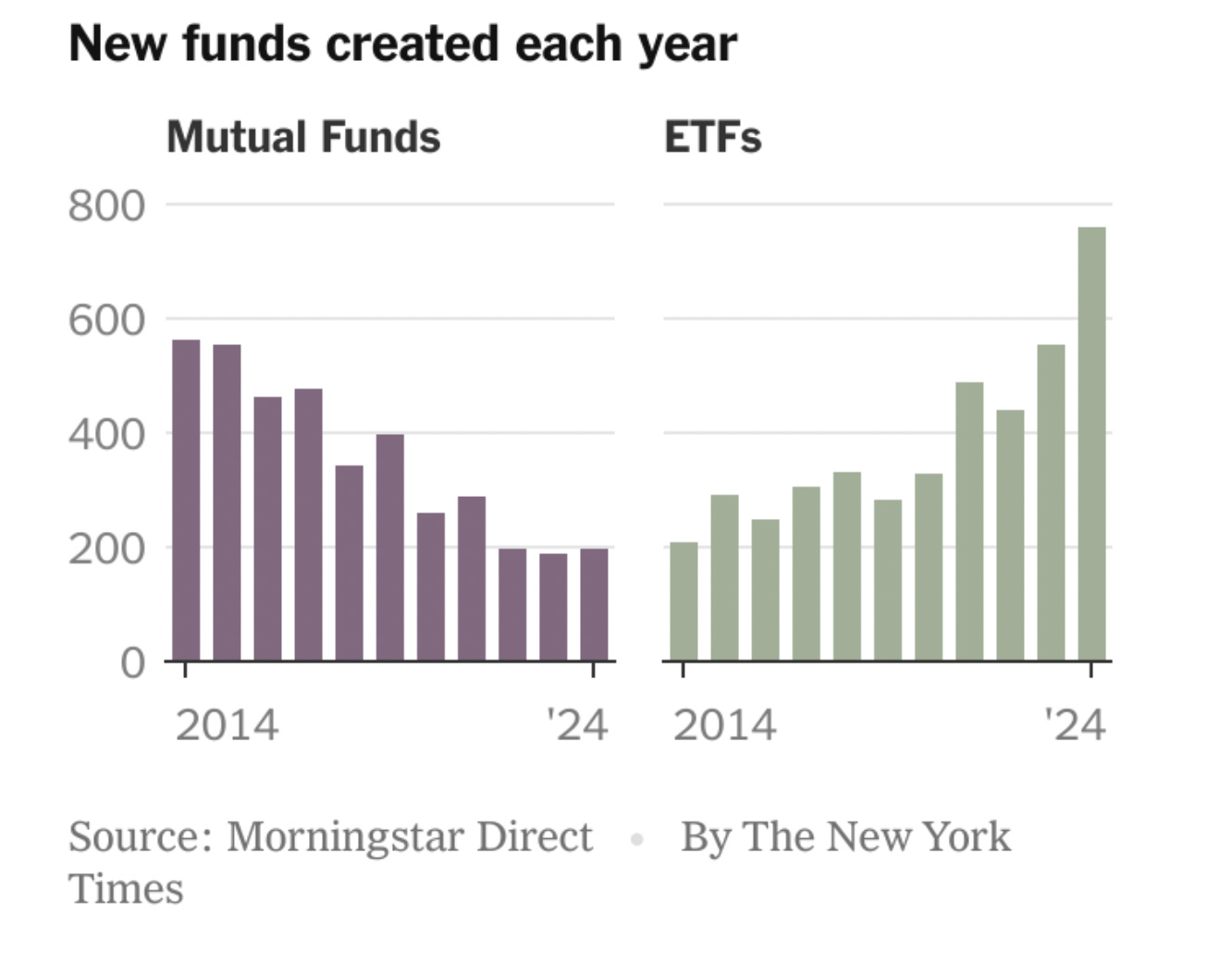

ETF launches are outpacing mutual fund launches in the US by more than 3x.

This shift reflects investor preference moving from brand-driven, ‘star manager’-centric funds to transparent, sector-specific investment vehicles.

A similar dynamic could emerge in private markets. Today’s private funds resemble 2000s-era mutual funds: brand-led, narrative-heavy, bundled by broad categories (sector/stage/geography), illiquid, and opaque. However, as companies stay private longer and operate at public-company scale, improved data availability and performance tracking will increase visibility into private market investments.

Over the next decade, we may see the rise of more specialised, data-driven private funds that offer targeted exposure to specific segments (e.g., seed-stage only, India-focused, consumer brands). LPs will increasingly seek modular portfolio access rather than bundled strategies - mirroring the broad trend shown in public markets - pushing fund managers toward more transparent, focused investment products.

Pearl Agarwal - Eximius Ventures

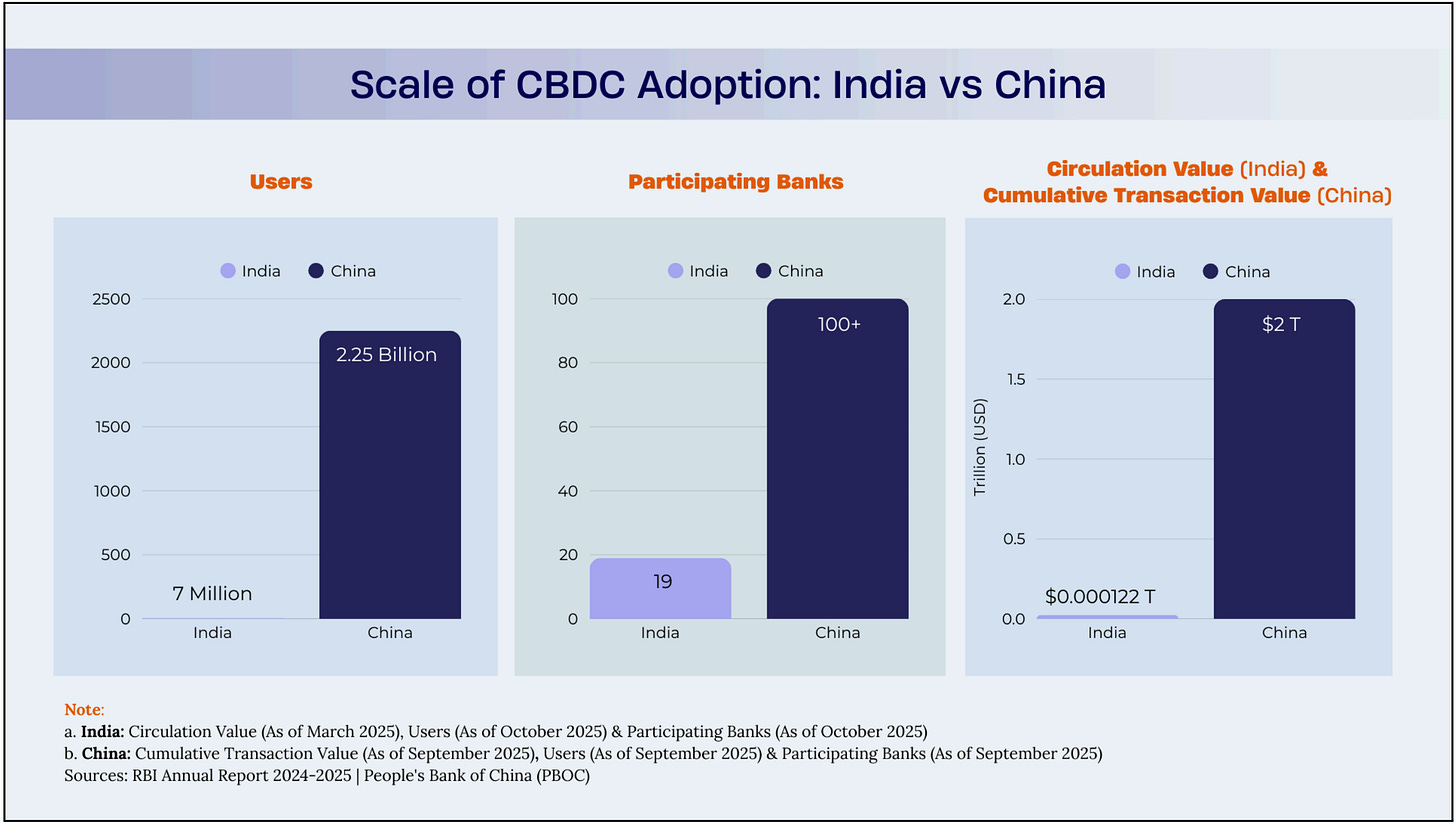

CBDC Adoption: India’s Rise, China’s Lead, and the Global Shift

India’s Central Bank Digital Currency (CBDC), the Digital Rupee (e₹), is moving rapidly from pilot to infrastructure. Since its launch in 2022, e₹ circulation has grown from roughly $0.65 million to a projected $115.4 million by March 2025, with 17 banks and over 6 million users already active. The focus is clear: reduce high cash-handling costs, enable programmable payments, and modernize public finance through more efficient, transparent settlement systems.

China remains the global benchmark. Its e-CNY surpassed RMB 14.2 trillion (~$2 Trillion USD) in cumulative transaction value through September 2025, deeply integrated into retail, public transport, and targeted fiscal stimulus. China’s advantage stems from state-backed infrastructure, tight regulatory alignment, and strategic goals such as reducing dollar dependency and strengthening monetary sovereignty.

India is now mirroring this trajectory through state-level programmable pilots, including welfare disbursements and vendor-restricted agricultural credit, signaling a shift toward “fit-for-purpose” money.

Globally, over 130 countries are exploring CBDCs, with cross-border settlement and tokenized finance rapidly emerging as the next frontier. The future of money is increasingly programmable, and India is positioning itself to be a serious contender, not a follower.

Rishaad Currimjee - Golden Sparrow

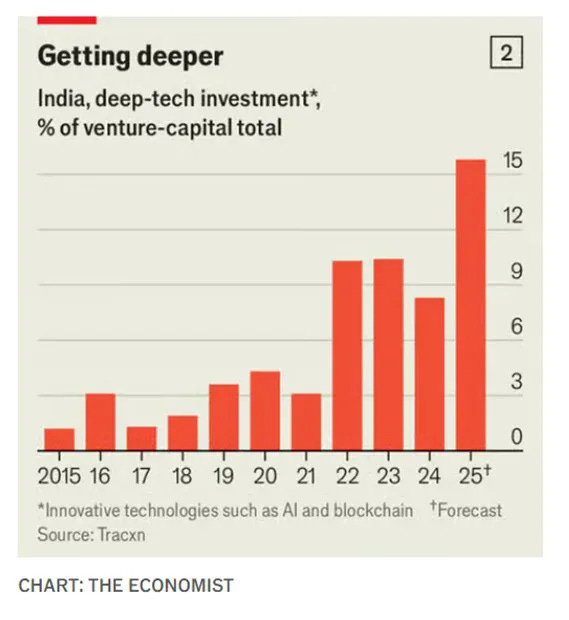

Is this India’s Deep Tech moment?

Ten years ago, Deep Tech represented 1% of India’s venture capital. By 2025, it hits 15%.

This is a structural shift happening amid a striking contradiction: India produces 8% of the world’s top AI researchers - and none work in India. The diaspora leads Google, Microsoft and IBM. Indian engineers design a fifth of global chips, yet India has no major chip firms. The country ranks third in scientific publications but spent just 0.7% of GDP on R&D—a tenth of what America or China deploy.

For decades, capital chased consumer apps. Talent fled abroad. India became the largest source of US graduate students, overtaking China.

What changed? Early movers like Speciale, Pi Ventures, and YourNest proved Indian technical talent could build deep tech companies. The space sector opened to private firms in 2020. Operation Sindoor exposed defense gaps, triggering local procurement from Deep Tech startups.

Local and global capital followed proof. Yali raised $100M+ funds. General Catalyst led Raphe’s $100M round. Speciale is raising $175M for later-stage companies. Celesta is launching a $250M fund. TDK is backing EtherealX and Ultraviolette.

The question was never capability. Capital is here. The talent is returning.

Aaryaman & Rahul - Tigerfeathers

Aaryaman Vir 🐅

I’ve chosen water security as my theme for this submission for the second year in a row because I don’t believe this topic gets enough coverage.

This is an image of a ship in Lake Urmia, northwestern Iran.

As the keen-eyed amongst you may have noticed, the lake is devoid of water. This is worrisome, given that Lake Urmia was once the largest lake in the Middle East and the second largest saltwater lake on Earth.

The sorry state of this water body is a striking visualisation of the water crisis that has gripped Iran today. Six years of unrelenting drought, coupled with poor water security policy, have given rise to a national emergency in the country.

Things have gotten so bad that Iranian President Masoud Pezeshkian warned citizens last month that if there was no rain soon, the national capital of Tehran would have to be evacuated.

Thankfully, there was some rainfall last week, but at this point it’s more of a temporary salve than a cure. Citizens still complain of taps that run empty and toilets that don’t flush for days, creating unbearable buildups.

Even on days that there is water, the pressure is often so low that it is impossible to bathe or properly wash dishes. Those who do not have the funds to install their own water tanks and pressure pumps are effectively living in the Iranian live-action Mad Max film.

India is not so far behind Iran. We, too, are in the midst of a severe water shortage.

Earlier this month, Karnataka Deputy CM DK Shivakumar launched the Sanchari Cauvery scheme, an initiative that allows Bangalore residents to order water from the government via mobile app (pictured above).

This scheme became necessary because access to water has been growing strained. As the city’s water infrastructure struggles to keep up with the inclement climatic conditions, poor policy, and growing demand, private tanker operators have begun to step in and sell water drawn from unregulated borewells. This has further exacerbated the water shortage and sent water prices skyrocketing.

While the introduction of Sanchari Cauvery is a welcome attempt at alleviating the symptoms of water scarcity, it does not address the cause. We need to pay more attention to our water. The government certainly will need to play a key role here in apportioning scarce resources, building infrastructure, and ensuring that we don’t permanently deplete our aquifers and groundwater reserves in a bid to grow water-hungry crops.

But the private sector needs to also pay attention to technological solutions. Building up domestic capability in cloud seeding, desalination, and water treatment is a key imperative.

Especially as water demand shoots up for the likes of semiconductor fabrication, data centre cooling, and manufacturing. We cannot afford to play around when it comes to the most vital resource of them all.

Rahul Sanghi 🐅

Last week, the Wall Street Journal published this article on how ‘storyteller’ had emerged as “Corporate America’s latest hot job”.

While I’m sure it turned heads in some Slack channels and Whatsapp chats around the world, to me all it did was anoint a trend that’s been brewing for much of the past 18 months.

Storytelling is not new. Humans have been telling stories since as long as humans have existed. Humans have been telling stories in a corporate setting for at least as long as marketing and comms teams have existed. The likes of Jobs and Musk have built empires by making their products feel inevitable, necessary, even sacred - not through features alone, but through the narratives they crafted about why those products had to exist.

So what’s new?

I think the current refashioning of ~storytelling~ as a potent business virtue is at least in some part due to the economic earthquake caused by AI. We are still relatively early into the LLM era, and like with any other epoch-defining tech transformation (the Internet, smartphones etc), it will take a while for us to sift through the rubble to identify which resources are scarce and which are abundant in a pre and post AI world.

To me, the current (and sudden?) re-interest in storytelling is a symptom of what that world will look like and where we’re headed.

‘Content’ is no longer scarce. ‘Content creation’ even less so.

As other contributors have pointed out, ‘average’ is now accessible at the click of a button. The average cool tweet, the average launch video, the average slop-coded personal-brand-building post on LinkedIn. You could easily feign expertise at audio engineering, graphic design, video editing and copywriting with the right tool.

But you can’t force people to care.

So, when our timelines are lathered with digital noise of all kinds, when we are inured to every species of content because of how often we encounter it, how do we know what’s worth paying attention to?

In other words, when the ability to create and spread media is abundant, what then becomes scarce, and where does value accrue?

I think it accrues to whoever can get people to care about their thing. And the way to do that - as it’s been since humans have been human-ing - is by telling a really great story.

Many of the victors in a post-AI world will be those who learn how to spin a compelling narrative; and how to shape information in a way that is legible and relatable to other people. The sharpest founders and their teams will have to become fluent in the language of causality that is hard coded in our psyches. They will need to get good at (pre-emptively) answering every ‘why’ that floats through the narrative brains of their target market - Why does this product exist? Why does this company need to exist? Why do you want to go to Mars? Why are you using this medium to reach me? Why is she the face of your brand? Why should I fund you and not them? Why should I hire you and not him? Why has this group of people come together as this company at this time to create this product?

As our newsfeeds get coated in a relentless assault of machine-churned manure, the risk of being buried under obscurity becomes a terminal issue, which puts the onus on people that can not only make media, but make it mean something, to cut through the noise to find the right customers, partners, investors, employers and allies.

In a world where making things is getting easier and easier, ‘making meaning’ is now the name of the game. What you’ll find, again and again, is that best story wins.

And that’s that🎉

A big thank you once again to all our contributors. And a big thank you to all our subscribers for taking the time to read our stuff this year. That’s it from us for 2025. We’ll be back in January (hopefully) with a special piece on India’s 1991 Liberalisation. Subscribe to make sure you don’t miss it -

And if you made it all the way here and you’re still keen to get more of that sweet chart action, feel free to check out our ‘Highlights from the Tigerfeathers Timeline (2025)’, a compilation of our working notes from this year that was published on our home page earlier this week.

With that - a very happy new year to you all, we’ll see you on the other side ⏩

Rahul's note on storyteling as the scarce resource post-AI really landed for me. There's an interesting paradox here though - as AI makes content creation trivial, the market's attention span seems to be contracting even faster. I've noticed teams focusing heavily on narrative now often fumble the basic distribution piece, which kinda defeats the purpose.

The Lake Urmia image from Aaryaman's piece is haunting though. It's a tangible reminder that some scarcities (water, arable land) won't be solved by better storytelling or AI infrastructure. Curious how many of these 26 investors are actualy paying attention to resource constraints versus the tech narrative.

Great assembly of perspectives - the depth here is refreshing given how surface-level most "annual predictions" tend to be

Gents, absolutely loved your work. My brain has been tickled and how. And I wish I had a fraction of the depth to fathom all the hard work you folks have poured in. If there's anything I can do to support you in your mission, I would love to. Specifically on the flagship event IP piece. Thanks!